🗓️ 2025 Mid-Year Review · Part II

— New Asset Allocation Themes in a Structurally Evolving Market

As H1 2025 wraps up, global markets remain caught between shifting momentum and lingering uncertainty.

At Genuine Impact, we’ve visualised key trends across major asset classes and regional equity indices—plus included our top investment takeaways to help you navigate the second half. Let’s dive in!

Macro Recap: Policy Crosscurrents and Structural Realignment

In H1 2025, global markets were shaped by an increasingly complex interplay of geopolitical dynamics and macro policy adjustments. Three defining features stood out:

1️⃣ Trade Friction Rises, Global Growth Slows

Tariff Shock: In February, the Trump administration launched a new wave of tariffs targeting China, the Middle East, and even Western allies. Reflecting the impact of these measures, the OECD revised its global GDP growth forecast for 2025 down to 2.9%, compared to 3.3% in 2024.

2️⃣ Geopolitics: Defence Race Reshapes Security Landscape

NATO Defense Spending to Rise Sharply: In May 2025, U.S. foreign military sales alone surpassed tens of billions of dollars. NATO member states have jointly committed to raising defence spending to 5% of GDP by 2035.

UK Follows Suit with Strategic Buildup: As outlined in the 2025 Strategic Defence Review, the UK will raise its defence budget to 2.5% of GDP by 2027, with a focus on strengthening cyber and space capabilities.

Regional Flashpoint: In June, a direct military clash between Iran and Israel—sometimes referred to as the “Twelfth War”—disrupted a decade-long fragile peace

3️⃣ Financial Conditions: Tight Liquidity in a High-Rate Environment

Fed Policy Remains Hawkish: The U.S. Federal Reserve’s “higher for longer” stance has pushed global risk-free real rates from a pre-pandemic range of 2%–3% up to above 4%, reigniting liquidity pressure across markets.

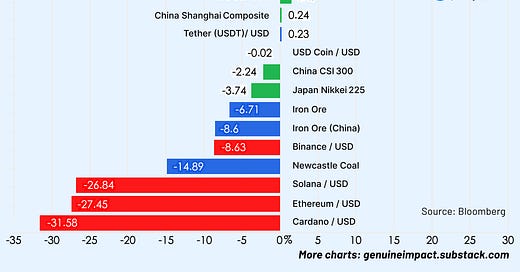

Cross-Asset Performance: Fragmentation Under Structural Forces

In the first half of 2025, asset performance diverged sharply, as macro regime shifts and risk aversion shaped positioning.

Early-year fundamentals were constructive, and broad commodities performed strongly. But in February, the onset of tariff escalations and rising geopolitical tension triggered a pullback in risk appetite. Gold and other safe-haven assets absorbed most of the inflows. By April, commodity funds saw $57 billion in net outflows, while gold ETFs saw inflows comparable to levels during major geopolitical crises, such as in 2022 or 2008. This reflects heightened investor demand for safe-haven assets amid policy and geopolitical uncertainty. In May, following a partial tariff easing between the U.S. and China, industrial metals and emerging market equities staged a rebound—signaling tentative market stabilization.

🇺🇸 United States: A Gradual Shift Toward Stability and Tech-Led Growth

In the first half of 2025, the U.S. economy maintained a trajectory of disinflation and moderate but resilient growth.

Headline CPI rose 2.4% year-on-year in May, with core CPI at 2.8%—both near their lowest levels since 2021—indicating that inflation pressures continued to ease. The labour market remained solid: unemployment edged up to 4.2%, while nonfarm payrolls grew by 130,000, largely driven by part-time and gig economy jobs. Wage growth held steady.

The Federal Reserve kept interest rates on hold at 4.25%–4.5%, reiterating its data-dependent stance. While concerns over services inflation and labour tightness lingered, markets began to price in the possibility of a rate cut as early as Q3, reflecting softer inflation expectations and slowing consumption.

According to revised figures, Q1 GDP grew 2.0% year-on-year—above the estimated potential rate of 1.8%—but contracted 0.5% quarter-on-quarter, as weak consumption, soft investment, and a drop in net exports weighed on momentum.

Equity markets saw diverging trends in the tech sector. Unlike the broad-based tech rally of 2024, 2025 saw leadership consolidate around a few names.

Microsoft (+13.7%), Meta (+16.7%), Broadcom (+8.4%), and Nvidia (+7.14%) emerged as standout performers, driving the current rotation.

In contrast, Apple (–19.6%) and Tesla (–20.2%) faced sharp valuation compressions, signalling investor caution toward high-premium growth names.

Looking ahead to the second half, market focus is expected to shift from valuation expectations to earnings delivery. Sectors such as semiconductors, cloud computing, and AI software still exhibit long-term growth potential, but after a rapid rally, the alignment between valuation and earnings will become a key concern for investors.

Structural divergence is likely to remain a defining feature of the tech sector. Investor interest in new technologies remains intact, but sensitivity to policy signals and fundamental execution has clearly increased.

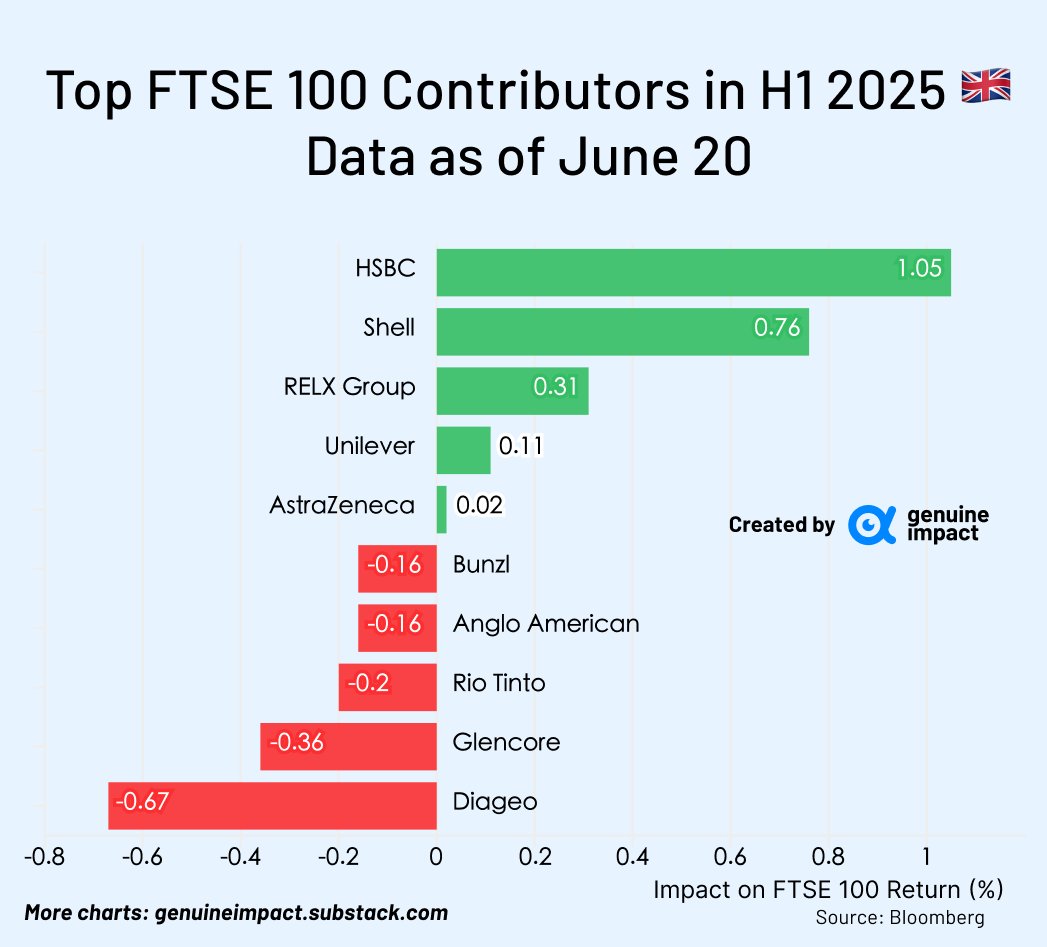

🇬🇧 United Kingdom: Stable Recovery Backed by Structural Blue-Chips

In the first half of 2025, UK equities rebounded amid disinflation (May CPI at 3.4%), stable exchange rates, and improving corporate earnings, the FTSE 100 index rose 7.36%, and its total return after dividend adjustment reached 9.51%, making it one of the strongest performers among major global indices. Despite ongoing political uncertainty and weak economic momentum, investors favored high-dividend, low-volatility blue-chip names as a source of stable returns.

Benefiting from the escalation of the Russia-Ukraine conflict, geopolitical tensions in Northern Ireland, and increased government military procurement expectations, the FTSE 100 industrials sector recorded a gain of +20.09% in the first half.

Within the industrials sector, Rolls-Royce rose 57.45% (contributing +1.35%) and BAE Systems rose 6.72% (contributing +1.15%). These were the top contributors to the FTSE 100 index in H1.

The financials sector rose 19.30% benefited from narrowing interest rate spreads and lower market volatility, with HSBC up 14.90% (contributing +1.05%) as representative names.

In contrast, the consumer staples sector underperformed, due to concerns over taxation policy uncertainty, Diageo dropped 24.76%, heavily impacted by regulatory risks in the U.S. and Europe, becoming the largest negative contributor to the FTSE 100 index in H1 (contribution: -0.67%).

Although May inflation came in at 3.4%, above the Bank of England’s 2% target, expectations for a rate cut later this year have moderated. Under the leadership of heavyweight stocks, the FTSE 100 is expected to retain its structural resilience.

🇨🇳 China: Clear Industry-Level Divergence

With more Chinese companies gaining U.S. and Hong Kong listings, H1 2025 saw growing signs of sector divergence among China ADRs in global markets.

Driven by a steady stream of new IPOs from sectors such as AI, clean energy, and cross-border e-commerce, the overall listing momentum remained healthy.

According to data, by the end of June, more than 21 Chinese companies had completed U.S. IPOs in 2025 alone, half of which were in science and technology or advanced manufacturing, reflecting continued overseas capital interest in China's "new economy" sectors.

As of June 20, the Hang Seng Index recorded a 19.85% return (including dividends) in the first half.

In the first half of 2025, the rise of the Deepseek ecosystem, along with a rebound in internet and blockchain platforms, restored growth momentum and reignited investor interest. Mainland southbound capital and global hedge funds significantly increased their allocations to Hong Kong-listed equities, helping drive a notable revaluation across the market.

Previously pressured by regulatory concerns, Alibaba surged 37.8% (contributing +3.63%), while Tencent rose 22.30% (contributing +1.78%). Together, they accounted for the bulk of the Hang Seng Index’s H1 gains.

In contrast, Meituan fell 15.23% (contributing -0.94%) due to intensifying competition and ongoing regulatory uncertainty, becoming the largest drag on both the Hang Seng Index and China ADR-linked ETFs.

🧭 2025 Outlook: From Trend Betting to Structural Selection

As we move into the second half of 2025, macro conditions echo a transitional phase akin to 2006–07: the U.S. labour market remains resilient, core inflation stays mild, and the Federal Reserve holds rates steady while quietly shifting its stance. With forward-looking expectations now largely priced in, market focus is pivoting toward real-time fundamentals—earnings strength and valuation support.

Notably, the current softness in the U.S. dollar isn't being driven by interest rate differentials, but rather by capital flows and external shocks. Repatriation pressure and financial tightening abroad are reshaping currency dynamics. Meanwhile, housing prices and shelter CPI are expected to reflect delayed disinflationary effects in H2, potentially clearing space for a more accommodative Fed.

In this macro backdrop, we shift from chasing themes to selecting structure—focusing on directional clarity and long-cycle positioning across key asset classes: