Fallout from Russia's Gas Cutoff to the EU

Has the end of Russian gas deliveries via Ukraine marked a strategic shift in Europe's energy landscape?

How much have natural gas prices soared in Europe?

What opportunities and challenges does Africa face?

The End of an Era (okay, just 5 years) 🇪🇺

Russian gas deliveries to EU countries via Ukraine ceased with the expiration of a five-year deal, ending a long-standing arrangement in place since 1991. The Ukrainian President stated that Ukraine would not allow Russia to profit from their situation, marking a firm stance against Russian economic benefits from ongoing conflicts.

The European Commission noted that the EU had seen this coming from miles away and that most member states were ready for the transition, although Moldova, which is not an EU member, is already facing gas shortages. Meanwhile, Russia, not one to put all its eggs in one basket, still has the capacity to send gas to Hungary, Turkey, and Serbia through the TurkStream pipeline across the Black Sea.

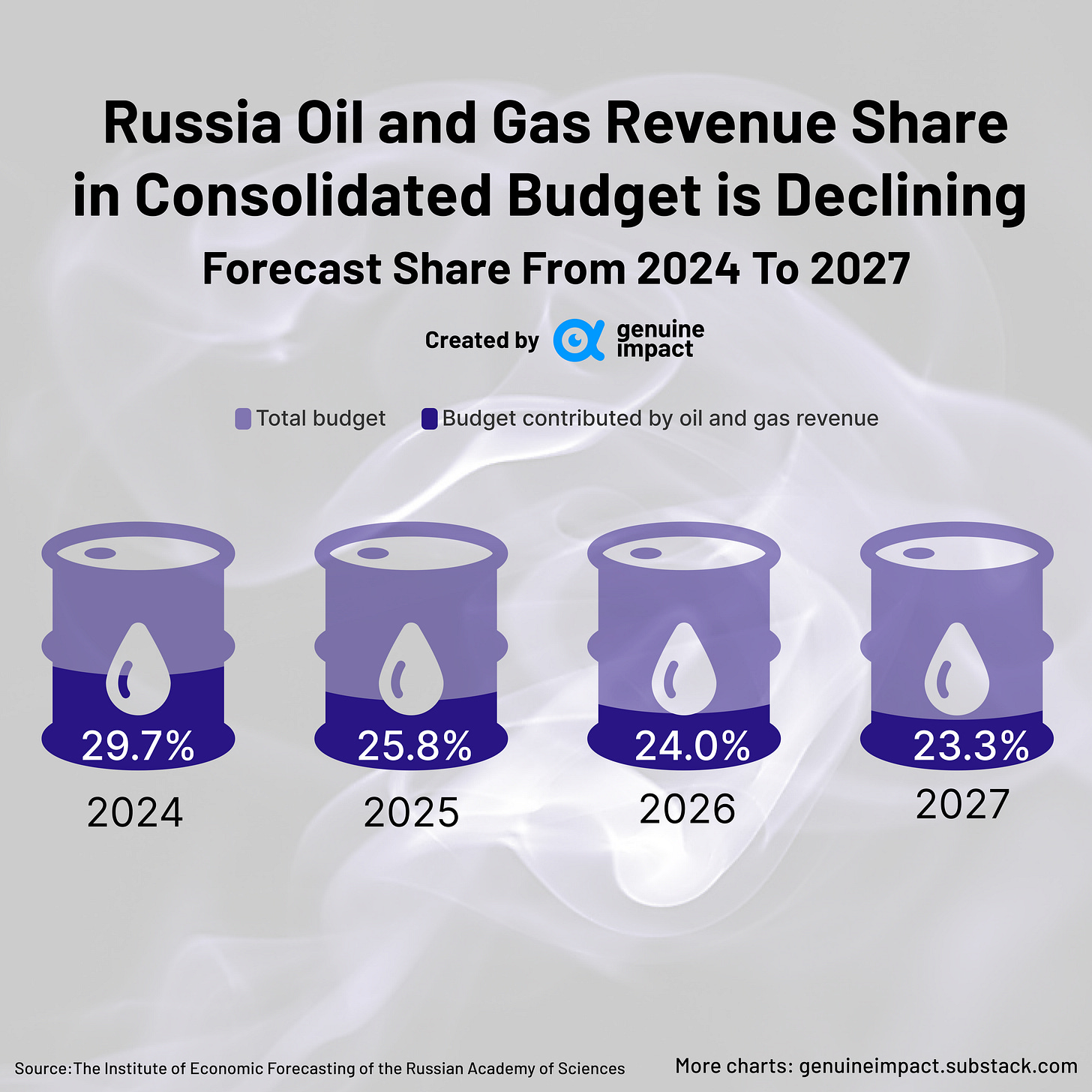

While politicians might downplay the immediate effects as minimal, the broader strategic and symbolic implications are considerable. Russia faces a significant reduction in its market influence, with projections from The Institute of Economic Forecasting suggesting a decrease in the share of oil and gas revenues in Russia's consolidated federal budget from 29.70% in 2024 to 23.30% by 2027.

Just a few years back, Russia was responsible for supplying around 41% of the EU's energy needs. Now, that figure has drastically fallen to about 8%. While Russia has shifted some of its energy focus towards Asia, it is predominantly for oil, as reconfiguring gas exports to Asia proves too slow and costly, especially amid its ongoing conflict with Ukraine. Consequently, much of its gas infrastructure remains underutilised.

The changes in Russia’s natural gas supply to the EU since the onset of the Russo-Ukrainian War in 2022 are stark. In May 2021, the EU imported approximately 7,973 million cubic meters of natural gas from Russia, a number that remained relatively stable until the war began in early 2022. Post-conflict, the imports saw a significant drop. By July 2022, imports had decreased to 3,657 million cubic meters, and despite minor fluctuations, the downward trend continued into 2024, with imports consistently falling below 3,000 million cubic meters per month, a reduction of more than half compared to pre-war levels.

📈 Consumers Bear the Brunt

While the EU has long claimed preparedness for shifts in energy supply, household natural gas prices in the EU from 2013 to 2023 reflect a significant trend. For a typical EU gas consumer, prices remained relatively stable from 2013 to 2021, averaging around 7 cents per kilowatt-hour, with minor fluctuations. However, following the onset of the Russo-Ukrainian War, prices surged dramatically by about 60%, jumping from 7.1 cents in 2021 to 11.6 cents in 2023. The surge in prices not only affects household budgets but also raises broader concerns about energy affordability and economic stability across the EU.

🔄 Shifting Energy Tides: Who's Gaining the Benefits?

In response, the EU has to reduce its dependence on Russian gas, turning to alternative suppliers such as the US and Norway, particularly for liquified natural gas (LNG). This shift positions the United States to potentially benefit significantly from the situation.

A look at the natural gas production shares from 2010 to 2023 underscores these shifts. The United States increased its share from 19.3% to 25.5%, reflecting a growth of 32.1%. In contrast, Russia's share declined from 18.40% to 14.40%, a drop of 21.7%. Other countries like Iran and Canada also saw changes in their production shares, with Iran increasing from 4.3% to 6.2% and Canada from 3% to 4.7%, while traditional gas producers like Norway and Qatar adjusted to the new global energy dynamics.

How Does This Impact Your Wallet?

Curious about the ripple effects of the EU's strategic energy shift away from Russian gas? Here’s what it means for your pocketbook:

In Europe, natural gas prices have jumped by 60% since the onset of the conflict, directly impacting household budgets and being reflected in monthly utility bills. For investors, the increasing demand for alternative energy sources might open up new avenues for growth, particularly in sectors involved in energy production and infrastructure. Moreover, as Europe adapts to new energy realities, job markets may evolve, with new skills in demand for emerging energy technologies and infrastructures.

So, as you adjust your thermostat or budget this winter, remember that these shifts in the energy sector might just dictate whether your wallet feels lighter or heavier in the coming years.

In Case You Missed It 📬

Africa's Dynamic Growth Amid Economic Challenges

Africa is experiencing unprecedented growth: life expectancy has increased from 41 years in 1960 to 64 today, child mortality rates have plummeted, and university attendance has surged ninefold since 1970. Culturally, African authors are gaining international acclaim, winning major literary awards in the 2020s, and this year South Africa hosts the first G20 summit on the continent.

However, while Africa's population has doubled over the past 30 years to 1.5 billion and is expected to do so again by 2070, its economies have not kept pace. GDP per capita in Africa was about half the world average in 1960; now it's only a quarter, with East Asian incomes seven times higher than those in sub-Saharan Africa. The growing economic disparity poses significant challenges, with Africans expected to account for over 80% of the world's poor by 2030, up from 14% in 1990. This juxtaposition of vibrant social progress against economic stagnation underscores the complex narrative of a continent at a crossroads.

Keep in touch with Genuine Impact!

Instagram | X/Twitter | LinkedIn

Created by Arya and Wendy