Global stock markets tank on Monday due to Trump’s sweeping tariff war

We're keeping our eyes on deglobalisation, safe-haven assets, and good hedges to weather the storm

Insider portfolio update: Another Week of Outperformance

📉 Black Monday Once Again

As if last Friday’s market mess wasn’t enough, Monday followed up with a full-blown global panic. Investor sentiment turned sharply negative as President Trump unveiled a fresh round of tariffs, sparking a major sell-off across Asia. Hong Kong’s Hang Seng Index suffered its steepest one-day drop since the 1997 Asian Financial Crisis—worse even than during the 2008 Global Financial Crisis.

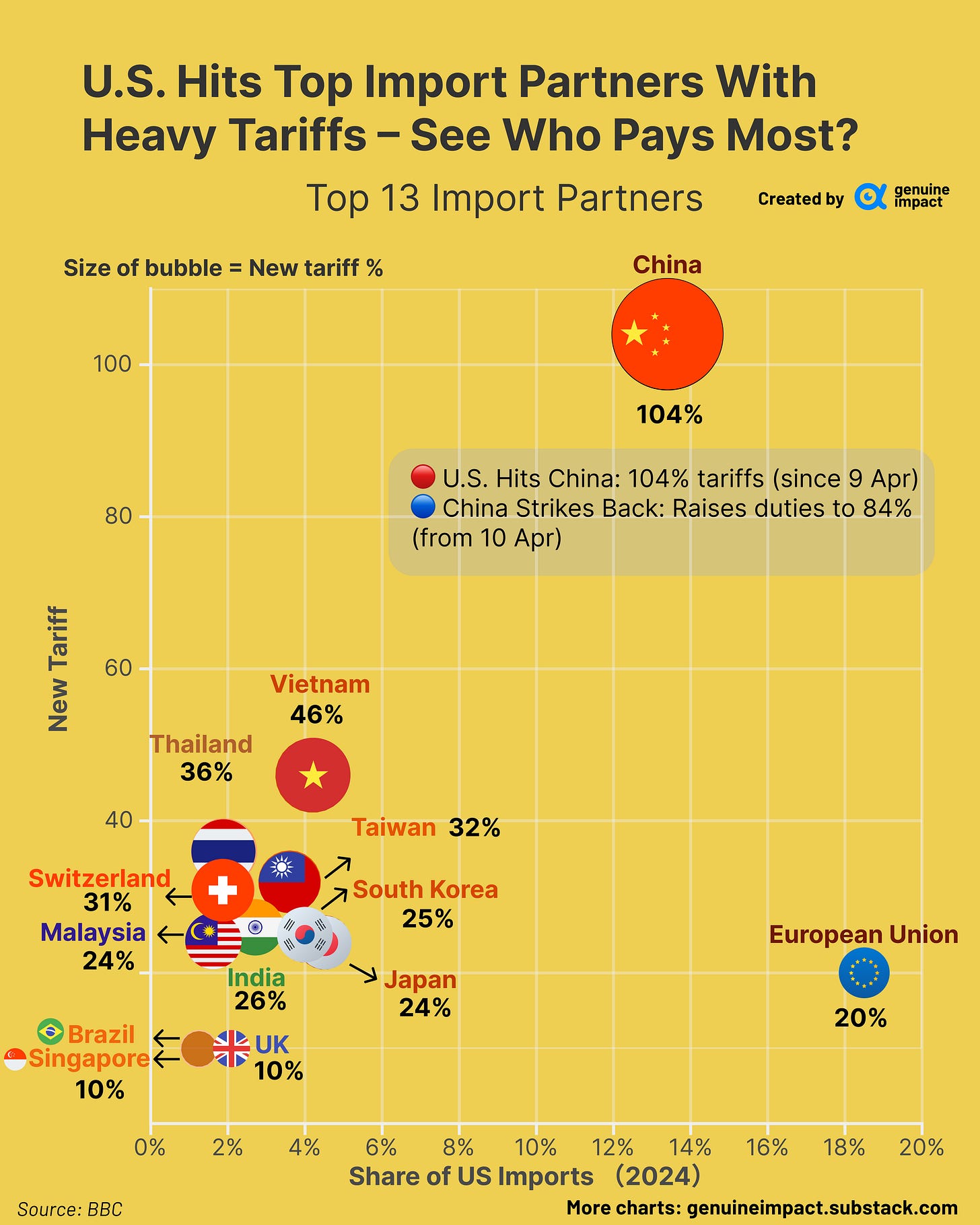

🇨🇳China fired back quickly, slapping a 34% tariff on U.S. goods and vowing to “fight to the end”. The result? Major Chinese indices dropped over 7% in a day, the worst single-day performance since the early days of the COVID-19 outbreak in 2020.💸

In the U.S., equities initially rebounded on rumours of a tariff delay, only to tumble again when the White House said, “nah.” While trade talks with the EU, Japan, Vietnam, and others are ongoing, the U.S. administration insists the tariffs will go into effect regardless.

And just in case anyone thought trade talks with the EU, Japan, and Vietnam might soften things—Trump says tariffs are coming no matter what. Buckle up. This could mark the end of the free trade era as we know it—and could send the global economy (and the U.S. in particular) into a nasty downturn. Multinational tech stocks got whacked hardest. 🍎Apple alone lost a jaw-dropping $640 billion in market cap in just three days. Ouch!

On April 9th, the “reciprocal” tariffs kick in, and the pain could go from Wall Street to your local high street. Picture this: you stroll into a shop for your usual bottle of French wine on Thursday and find it’s 30% more expensive.

🍷Cheers, make America expensive again!

🚨 The Trade War Storm Is Here—What Should You Hold?

Our Key Focuses Now— Deglobalisation, Safe-haven, and Hedging

Markets may be shaky, but we’re keeping our eyes on the road ahead. Our strategies have held up well through the noise, and here’s what we’re focusing on next: