🌐 Big Tech Under Pressure

🍎 Apple’s Supply Chain Strength Turns into a Strategic Weakness

🚗 Tesla Misses Q1 Expectations as Auto Revenue Drops 20% YoY

💼 Luxury Market Feels the Chill: Is the Boom Over?

💸 Behind the Trillions: Big Tech’s New Struggles

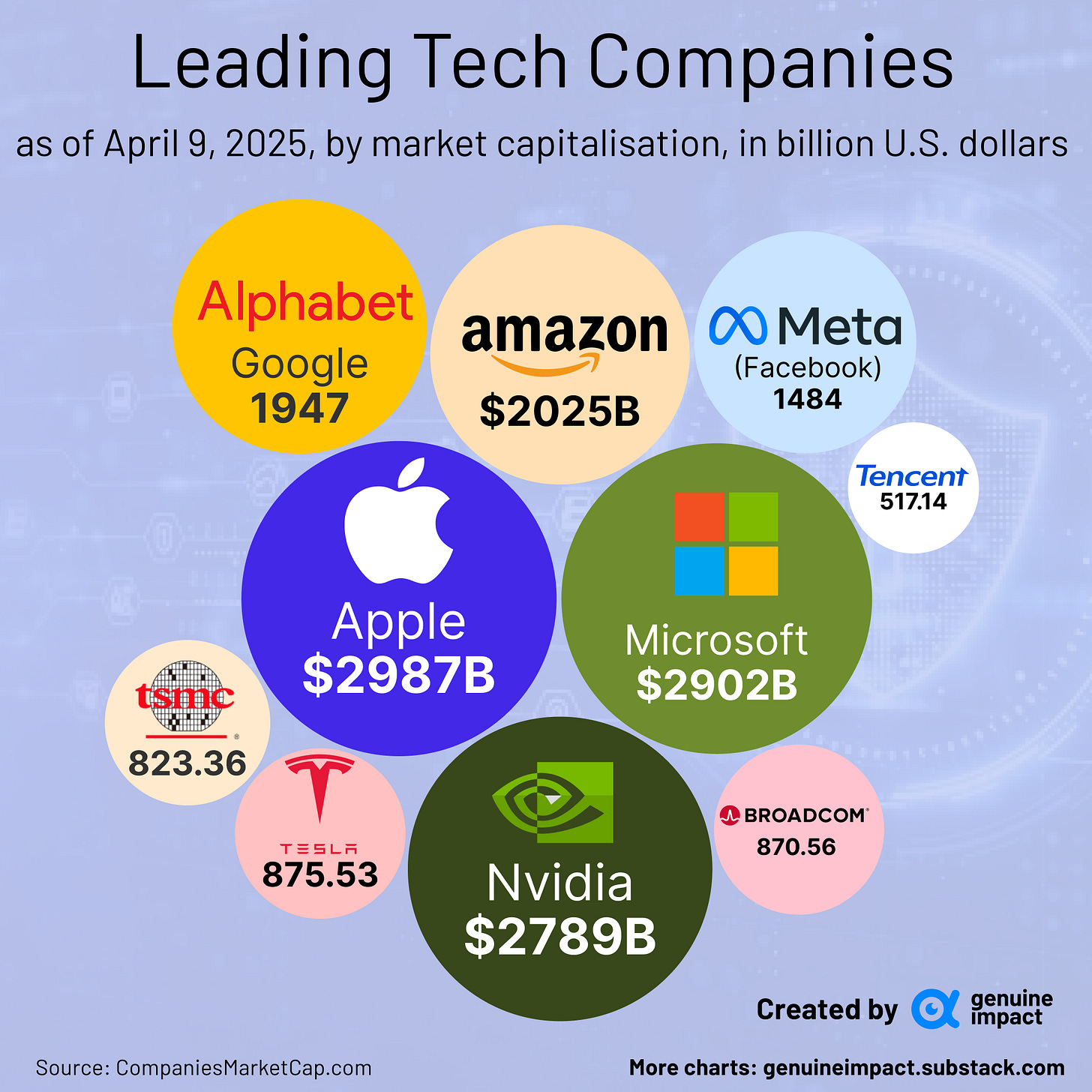

As of 9 April 2025, Apple still topped the leaderboard as the world’s most valuable tech company, with a market capitalisation of $2.99 trillion—just ahead of Microsoft at $2.9 trillion. But behind these eye-watering valuations, cracks are starting to show.

Recent tariff threats and geopolitical uncertainties have reignited market volatility, dragging down stock performance across the tech sector. In this shifting landscape, even the biggest names are feeling the strain—from Apple’s slowing momentum in China to Tesla’s global demand slump.

📉 Apple’s China Struggles: A Giant Under Pressure

Apple’s grip on the Chinese smartphone market is continuing to weaken. According to the latest data, iPhone shipments in China declined by 9% year-on-year in the most recent quarter—marking the seventh consecutive quarter of contraction. The company’s market share has dropped from 17.4% to 13.7%, pushing it down to fifth place in the rankings and making it the only non-Chinese brand among the top five vendors.

This trend reflects a broader shift in consumer sentiment. With China’s economy still struggling to regain momentum and AI innovations like ChatGPT banned domestically, Apple is finding it increasingly difficult to stay competitive in the world’s largest smartphone market. In January, the tech giant resorted to offering rare discounts on iPhones in an effort to stimulate demand—an unusual move for a brand long associated with premium pricing.

⚠️ Tariffs: A Short-Lived Relief

Adding to the pressure is the Trump administration’s unpredictable tariff policy. While smartphones and certain electronics were temporarily exempted from the latest wave of tariffs, President Trump was quick to warn that “NOBODY is getting off the hook”, suggesting more levies may be on the way. The White House is now scrutinising the entire electronics supply chain, including semiconductors—one of Apple’s most critical dependencies.

What was once Apple’s strength—its global supply chain—is now a glaring vulnerability. With production heavily concentrated in China and Southeast Asia, the company finds itself increasingly exposed to both geopolitical headwinds and trade disruptions. Its $500 billion investment pledge in the U.S. may win political favour in the short term, but analysts doubt it will shield Apple from future policy shocks.

📦 Global Rankings: Who’s Winning the Smartphone Race?

Despite these hurdles, Apple managed to lead global smartphone shipments by reaching a global market share of 23%—just ahead of Samsung. Across the full year, Apple shipped over 228 million iPhones globally, reflecting the company’s cyclical strength during the holiday season.

Samsung came in close behind with approximately 223.5 million units shipped in 2024, primarily driven by its flagship Galaxy series. However, it’s Xiaomi that’s proving to be the dark horse—capturing 13% of global market share in Q4 2024 and cementing its position in third place. Huawei, once a major contender, has been squeezed out of the top five entirely, hamstrung by U.S. trade restrictions and rising domestic competition.

🚗 Tesla: From Hype to Headwinds

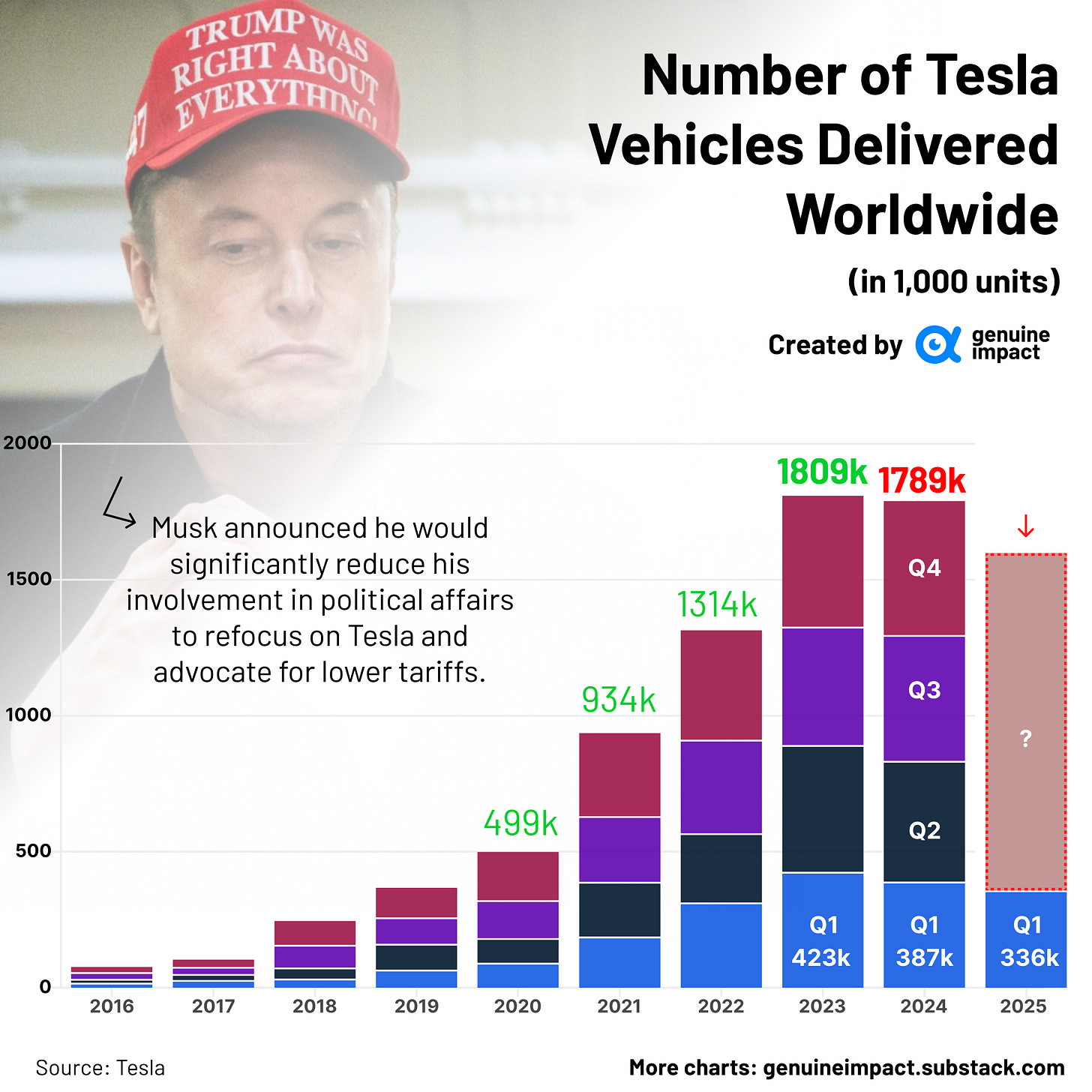

Tesla is entering earnings season with mounting pressure. In Q1 2025, the company’s production and deliveries declined 16% and 13% year-on-year, respectively. Its Q1 2025 results also painted a bleak picture, with adjusted net income down 39% and revenue dropping 9.2%. The Economist attributes the downturn to cooling global EV demand—amplified by two major setbacks: losing its market lead in China to BYD, and a steep sales decline in Europe, partly fuelled by Elon Musk’s vocal support for Donald Trump.

The highly anticipated Cybertruck has fallen short of expectations, selling fewer than 40,000 units in 2024—well below Musk’s initial projection of 250,000. While Tesla’s energy storage segment grew 67% last year, it still contributes just 10% of total revenue—far from enough to offset shrinking car sales.

Tesla shares have plunged over 40% year-to-date. In response, Musk announced he would significantly reduce his involvement in political affairs to refocus on Tesla and advocate for lower tariffs. The move briefly lifted investor sentiment, pushing the stock up nearly 8% intraday. On 22 April, Tesla ultimately closed up 5.39%.

📩 In these volatile times, curious how we’re positioning across assets and equities? 👉 Don’t miss this Friday’s premium edition, where we’ll break down our stock picks, portfolio allocations, and trade ideas — all for just $6/month (or £5/month).

Join 36,000+ savvy investors who believe: “Your money deserves better.”

In Case You Missed It 📬

✨ Luxury’s Luster Faces New Pressures

Last week, European luxury giants felt the heat after underwhelming Q1 updates—sending ripples through the sector.

LVMH reported lower-than-expected sales

Moncler, Kering, and Hermès also saw investor caution creep in

For a brief moment, Hermès even surpassed LVMH in market cap, becoming the most valuable luxury brand in the world—though LVMH has since reclaimed the crown 👑. What’s behind the wobble?

👜 High-end shoppers—particularly in the U.S. and China—are showing signs of slowing down.

📉 Analysts now forecast 2025 luxury sector revenues to shrink by 2%, down from a previous +5% estimate.

⚠️ Add in Trump’s tariff threats, and the industry’s vulnerability becomes clearer—luxury depends heavily on global demand and cross-border supply chains.

Even though luxury brands typically have pricing power, the mood is shifting. Wealthy consumers aren’t immune to macro uncertainty—and that’s starting to show.

Keep in touch with Genuine Impact!

Instagram | X/Twitter | LinkedIn

Created by Arya and Peggy