Happy Wednesday! Today, we are diving into the intricate world of credit ratings. These assessments wield tremendous influence over financial markets and the global economy. Let’s explore who is driving the show, which companies in the S&P 500 shine brightly, and how nations stack up on the creditworthiness scale.

Credit Rating Agencies: The “Big Three” Domination

Credit rating agencies are the gatekeepers of financial credibility. They provide an impartial assessment of a company's or government entity's creditworthiness in general terms or with regard to specific financial obligations. In essence, these assessments offer a glimpse into an entity's ability to fulfill its fiscal responsibilities, be they in the form of broad financial commitments or specific debt obligations.

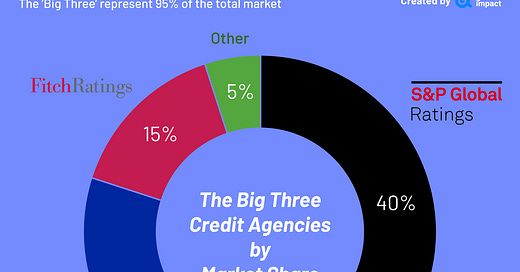

The "Big Three" credit rating agencies, as depicted in the donut chart below, hold an extraordinary sway over the market, capturing a whopping 95% of the market share.

This chart visually illustrates the market dominance of these key players, with S&P Global Ratings and Moody's commanding 40% each, followed by Fitch Ratings at 15%, and the remaining 5% held by other agencies. Their influence is far-reaching, shaping global investment strategies and ensuring financial stability.

S&P 500 by Credit Rating: Top 10 Companies📈

Here's the cream of the crop from the S&P 500: the top 10 companies with stellar credit ratings. These giants, spanning from healthcare to technology and consumer products, reflect top-notch fiscal responsibility. Take a look at their names, credit ratings, and sectors in the table below.

These companies signify financial fortitude and the trust they inspire in meeting financial obligations. Their strong credit ratings underscore their fiscal reliability, making them pivotal players in the S&P 500.

AI Tool Report

Learn AI in 5 Minutes a Day We'll teach you how to save time and earn more with AI. Join 70,000+ free daily readers for trending tools, productivity-boosting prompts, the latest news, and more.

*This is sponsored advertising content.

Global Credit Ratings: Mapping the World🌍

Beyond the corporate world, credit ratings play a pivotal role in assessing the financial stability of entire nations. Our global map offers a captivating visualization of worldwide economic well-being. Countries are colour-coded based on their credit ratings, offering a unique lens through which to view the intricacies of global finance.

As you explore this map, you'll witness how credit ratings influence a nation's borrowing costs, economic policies, and global standing. The colors on the map aren't just random shades; they represent a nation's fiscal reputation on the international stage.

Green might symbolize stability, indicating countries with strong creditworthiness, while shades of red signal potential challenges. Understanding these ratings is like having a roadmap to global financial resilience.

That wraps up our dive into the fascinating realm of credit ratings. These assessments hold the keys to financial opportunities and risks, shaping the way businesses and countries navigate the economic landscape.

See you on Friday for a deepdive on retailers!

This is good content, to be frank, so in order words a country's credit worthiness, might also serve as one tool to consider, in case one want to make an investment in that country?

So if I have a little asset in such country, I can borrow against it.. even if my asset might not be AAA but its value is worth more than same asset in countries shaded in red or orange right?