Today's we’re taking a deeper look at the rise and fall of the British pound and the emergence of the US dollar as the world's dominant reserve currency, as well as the potential for the Chinese yuan to overtake the dollar's position as the world's major reserve currency.

The tale of currencies

It was the best of times, it was the worst of times;

The changing dominance of a currency is a tale of twists and turns, it was the epoch of dominance, it was the epoch of decline; it was the season of economic prosperity, it was the season of geopolitical upheaval; It’s a story of rise and fall, of triumph and defeat. A story that spanned centuries and shaped the fortunes of nations. It was the story of how the British pound concede its dominance to the US dollar, and now the same story is unfolding again in our time that rhymes with history.

In the beginning, the pound was the king of currencies. It was the currency of the world's most powerful empire, the British Empire, formed as a result of the Industrial Revolution. The pound was backed by the strength of the British economy, the power of its navy, and the might of its global influence. The pound was the currency of choice for international trade and finance, the benchmark against which all other currencies were measured.

However, like all things, the pound's dominance was not eternal. Its decline began in the aftermath of World War II, as the British Empire started to crumble under the weight of economic and political pressures. The war had left Britain devastated, with its economy in shambles and its resources depleted. The country was heavily indebted to the United States, which had provided much-needed aid during the war.

The US, on the other hand, emerged from the war as the world's dominant superpower, with a booming economy and unmatched military might. The dollar became the currency of choice for international trade and finance, backed by the strength of the US economy and the power of the American Dream.

As the US economy grew, the dollar's dominance only increased. The Bretton Woods Agreement of 1944, which established the dollar as the world's reserve currency, cemented the dollar's position as the king of currencies. Other countries pegged their currencies to the dollar, and the US was able to print money at will, safe in the knowledge that the world needed its currency. In the decades following the Bretton Woods agreement, the US dollar's dominance as a reserve currency continued to grow. This was due in part to the fact that the US was the world's largest economy and had a relatively stable political system. Additionally, the dollar was widely accepted in international trade and financial transactions, and the US had a well-developed financial system with deep and liquid markets.

The US dollar also benefited from the fact that the US was a major creditor nation, meaning that it was a net lender to the rest of the world. This meant that other countries needed to hold dollars in order to service their debts to the US, further reinforcing the dollar's position as the world's dominant reserve currency.

Meanwhile, the British economy struggled to keep up. Inflation was high, and the country was plagued by strikes and social unrest. Today, the pound is still a major currency, but it has lost much of its dominance to the dollar. The dollar remains the world's reserve currency, and the US economy continues to be the largest and most powerful in the world. The pound's decline was a slow and painful process, but it was inevitable given the changing fortunes of the two countries.

Elevate Your Branding Game with Canva Pro

Upgrade your designs to pro level with Canva Pro! Get access to thousands of premium templates, fonts, and graphics to make your emails, social media posts, and presentations stand out. Try Canva Pro for free today and elevate your creative game*.

*This is sponsored advertising content.

History does not repeat itself but it rhymes

Yet, the emergence of new economic powers, such as China and India, and the growing use of digital currencies, such as Bitcoin, have raised doubts about the dollar's continued dominance.

In particular, the Chinese yuan (or Renminbi), also known as the RMB, has been on a steady rise in recent years, both in terms of its use in global trade and its role as a reserve currency. While the US dollar has long been the world's dominant reserve currency, with over 60% of central bank foreign exchange reserves held in dollars, some experts believe that the RMB has the potential to overtake the dollar as the world's major reserve currency.

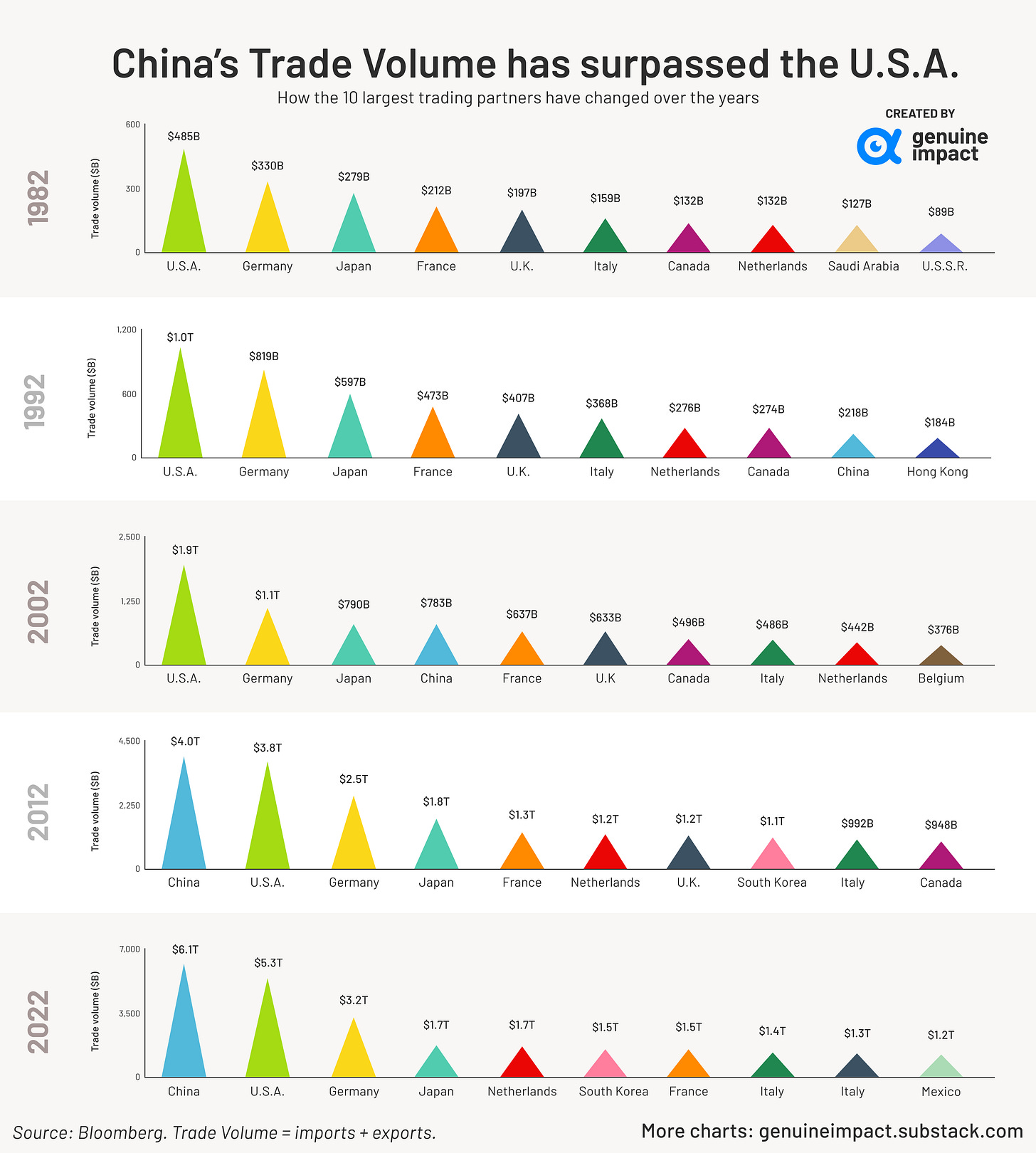

One of the main factors that could contribute to the RMB's rise as a reserve currency is China's economic growth and its increasing influence in global trade. China is now the world's second-largest economy, and its trade volume has surpassed that of the United States. In addition to its economic strength, China has also been taking steps to internationalize RMB and promote its use in global trade. For example, in 2016, the International Monetary Fund (IMF) added the RMB to its basket of reserve currencies, alongside the US dollar, Euro, Yen, and British pound. This move was seen as a major step forward for the RMB's internationalization and increased its attractiveness as a reserve currency.

As China continues to grow and open up its financial markets, it is likely that more countries will want to hold RMB-denominated assets as part of their foreign exchange reserves, further contributing to the significant rise of RMB’s participation and influence in the global monetary system.

Another factor that could contribute to the RMB's rise as a reserve currency is the increasing geopolitical tensions between the US and China. As the two countries continue to clash over issues such as trade, technology, and human rights, some countries may want to diversify away from the US dollar and reduce their dependence on the US financial system. Holding RMB-denominated assets could be seen as a way to achieve this diversification and reduce exposure to US political risk. Recently this trend becomes even more evident in the wake of the geological crisis in Europe, the Middle East and South America, as more emerging economics are starting to adopt RMB as a major settlement currencies for their international trades whilst reducing their reliance on the US dollar.

Despite these factors, there are several obstacles that could prevent the RMB from overtaking the US dollar as the world's major reserve currency. One of the main challenges is the lack of transparency and openness in China's financial system. Foreign investors are often restricted in their ability to invest in Chinese assets, and there are concerns about the government's control over the financial sector. This lack of transparency and control could make some countries hesitant to hold RMB-denominated assets.

Another challenge is the lack of depth and liquidity in China's financial markets. While the RMB has become increasingly popular in global trade, its use as a reserve currency is still relatively limited. The Chinese bond market, for example, is not as deep and liquid as the US bond market, making it more difficult for foreign investors to invest in RMB-denominated assets.

The emergence of a new dominant currency can have positive economic effects for countries that use it. For instance, if China’s RMB were to become the dominant currency, it could increase China's influence in international financial markets and reduce its dependence on the US dollar. Such a shift could tilt the balance of economic power towards China, away from the US.

When the dominance of a currency changes, it can have far-reaching economic and geopolitical implications. A decline in the dominance of the US dollar, for instance, could alter the balance of power between the US and other nations. Historically, the US has used the dollar's dominance to exert its influence through economic sanctions. But if the dollar's dominance fades, the US may be forced to find new ways to assert its power.

In addition to economic and geopolitical consequences, changes in currency dominance can also have cultural impacts. The US dollar's dominance has made English the language of international finance. If the dominance of the dollar declines, other languages, such as Mandarin or Spanish, may become more widely used in international financial transactions.

The changing dominance of a currency is a tale of hope and despair, of ups and downs, and ultimately a tale of how the fortunes of nations can rise and fall. As the world grows ever more interconnected, shifts in currency dominance are inevitable. Just like the rise of the dollar and the decline of the pound was a story that played out over many years, the ever changing landscape of the currency war will be a story that ultimately shape and reflect the course of history.

New to investing? Check out our handy video guides.

This newsletter started free, and we aim to keep it free for as long as we can. However, any support is always much appreciated - feel free to buy us a coffee using the link below <3

Want to advertise your brand on our newsletter? Click below and we’ll get back to you ASAP!