How will Trump's negotiations with Russia affect Europe's security landscape?

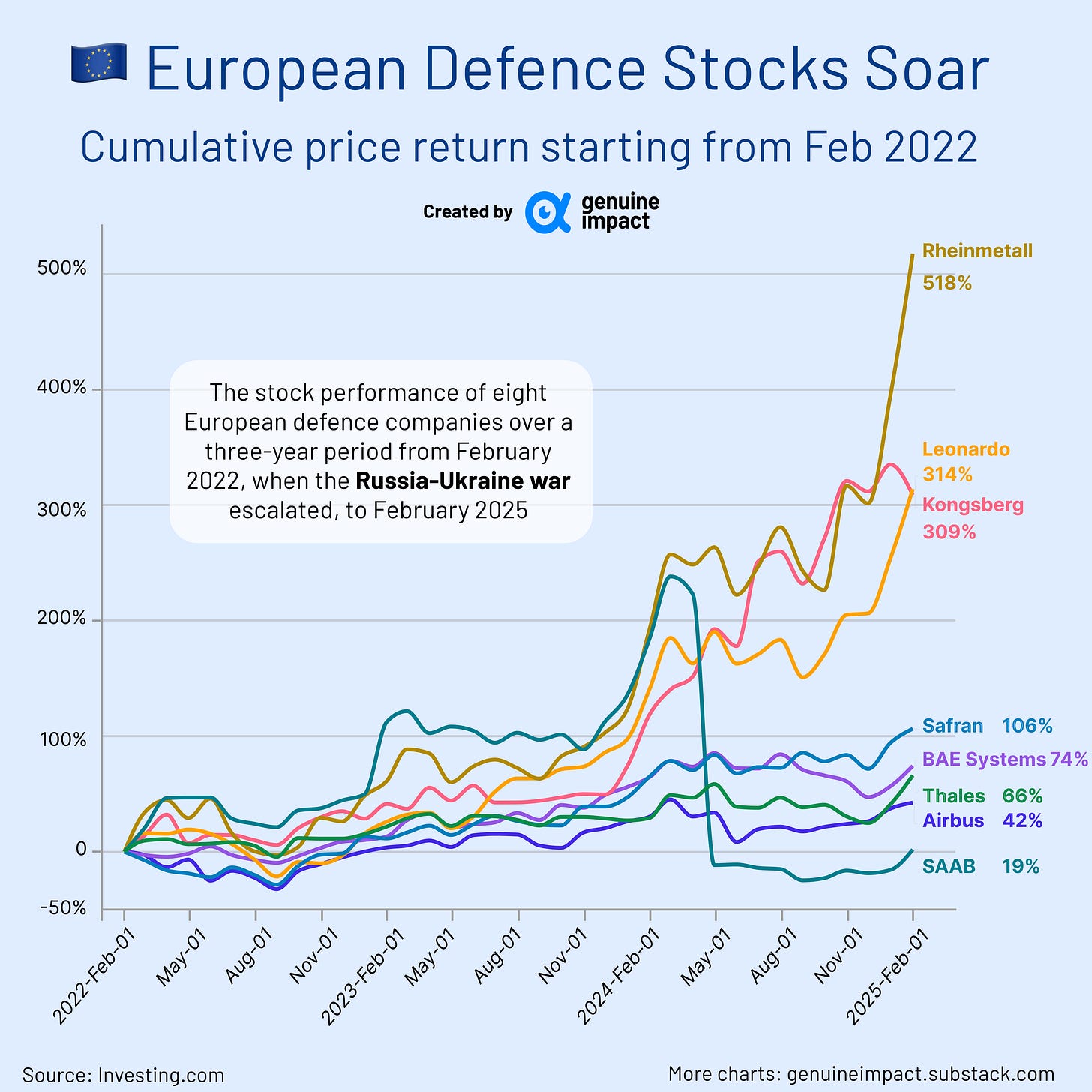

Why have European defence stocks surged?

How much did Chinese shares increase on DeepSeek fallout?

🇪🇺 Is Europe Left Defenceless as U.S. Foreign Policy Takes a Sharp Turn?

In a seismic shift in U.S. foreign policy, the Trump administration is reshaping America’s role in global security—leaving Europe on uncertain ground. At the Munich Security Conference on February 14, U.S. Vice President J.D. Vance openly questioned NATO’s role, while Defence Secretary Pete Hegseth announced that the U.S. would no longer act as Europe’s primary security guarantor. In an even more stunning development, Trump bypassed both Ukraine and European allies, opting for direct talks with Russia about the war in Ukraine. On February 18, U.S. and Russian officials met in Saudi Arabia for four hours—their first direct negotiations in three years. No Ukrainian official was invited.

For years, NATO’s united front and unwavering support for Ukraine were seen as non-negotiable. Now, Trump's engagement in unilateral diplomacy with Russia raises fears of a modern-day Yalta-style agreement, where great powers dictate Ukraine’s fate without its input.

💰 War Debt & Mineral Wealth

Due to the ongoing conflict, Ukraine’s national debt is projected to rise steadily over the next 5 years, surging by $118.7 billion (+68.05%) from 2024 to 2029. This marks the tenth consecutive year of increase, with the total debt expected to hit a record $293.09 billion by 2029.

Adding to the tension, U.S. Treasury Secretary reportedly pressured Ukraine to hand over $500 billion worth of mineral rights—critical resources such as lithium and titanium—in exchange for continued U.S. military aid. Kyiv refused, pushing the conversation to Munich, where American officials reinforced their demand. Control over Ukraine’s mineral wealth would help the U.S. reduce dependence on China and Russia, but it remains unclear whether Zelensky’s government will entertain such terms. Meanwhile, reports suggest Russia has made a backchannel proposal to the Trump administration regarding access to Ukraine’s occupied deposits.

The uncertainty surrounding NATO and U.S. involvement in European security is sending shockwaves through the defence industry. With Ukraine left out of the room and Europe scrambling for alternatives, the continent faces a critical question: Can it maintain its defence readiness without unwavering American support?

🚀 Europe’s Defence Industry: A Market on the Rise

Amid geopolitical turbulence, European defence firms are experiencing a surge in demand. The European aerospace and defence sectors have experienced steady growth in turnover over recent years. In 2023, the industry's revenue reached €290.4 billion, marking the highest figure recorded within the specified timeframe.

NATO members are reassessing their security strategies, which boosts the prospects of several major European defence contractors:

Airbus SE (Netherlands): A leading aerospace manufacturer producing commercial aircraft, helicopters, and defence equipment.

BAE Systems (UK): One of the world's largest defence contractors, specialising in aerospace, security, and military technology.

Thales (France): Known for tactical radios, space electronics, and defence security solutions.

Leonardo (Italy): A key player in producing helicopters, fighter jets, and defence electronics.

Rheinmetall (Germany): A major supplier of military vehicles and ammunition.

Safran (France): Focuses on aerospace engines and components for both military and civilian markets.

Saab (Sweden): Famous for fighter jets, air defence systems, and naval combat solutions.

Kongsberg Gruppen (Norway): A high-tech provider of defence, aerospace, and maritime systems.

According to stock data, Rheinmetall’s price has returned 518% over the past three years, making it the top-performing European defence stock. Leonardo and Kongsberg secured the second and third spots, delivering impressive returns of 314% and 309%, respectively.

Beyond geopolitics, factors such as government procurement contracts, international arms sales, and national defence budgets will continue shaping the market. Investors and policymakers alike should closely monitor NATO decisions, U.S. foreign policy shifts, and European military expenditures to gauge the trajectory of the defence sector.

Curious about how we picked these companies? Are European defense stocks a promising investment opportunity? How do these companies generate profits? Find out in our Friday premium edition for only USD $6/month (or GBP £5/month)!

Join over 32,000 subscribers who know that “Your money deserves better.”

In Case You Missed It 📬

📈 China’s AI Boom: Alibaba Surges as Investors Reassess the Market

Following the launch of DeepSeek, Chinese tech stocks have soared, with Alibaba leading the charge—its share price skyrocketing over 50% in just a month 🚀.

The AI revolution triggered by DeepSeek has prompted global investors to re-evaluate opportunities in China's tech and AI sectors, particularly the potential of previously undervalued Chinese internet giants. With Alibaba partnering with Apple to integrate AI features into the Chinese version of the iPhone, and Tencent’s WeChat adopting DeepSeek, demand for AI cloud computing services in China could soon resemble the supply constraints seen in the U.S. It’s evident that China’s AI development is accelerating rapidly—while costs continue to decline at an even faster pace.

Keep in touch with Genuine Impact!

Instagram | X/Twitter | LinkedIn

Created by Arya