Everything about ETFs

Are you invested? 📈

*Sponsored content

Today’s newsletter is all about Exchange Traded Funds (ETFs). These are funds that pool investment securities (such as stocks, bonds, currencies etc.) together and allow you to access a wide range of markets. Knowing that, today we visualise which are the most popular ETFs based on the value of their assets under management (AUM), which ETFs have been performing the best over the last ten years, and which asset management firms have the most AUM.

Top ETFs by AUM

The SPDR S&P 500 ETF Trust is the most popular ETF and has $413.2B AUM. This is almost $85B more assets than the next most popular ETF by BlackRock. While SPDR may have the most popular ETF, you can see that within the top 50 it is actually Vanguard and BlackRock that have the most individual ETFs here. It should also be noted that the top 3 ETFs are all those that follow the S&P 500 Index, clearly a popular choice for passive investors.

Join Retool on July 13th as we announce a new way to build secure portals for customers and partners. We’ll run a live demo and live Q&A with customers to help you start building today.

Join our team as we share a fast and secure way to build business-critical software for customers and partners. You’ll hear from Retool customers who have saved valuable engineering hours while delivering new products faster. Then, follow along as we build customer portals live.

*This is sponsored advertising content.

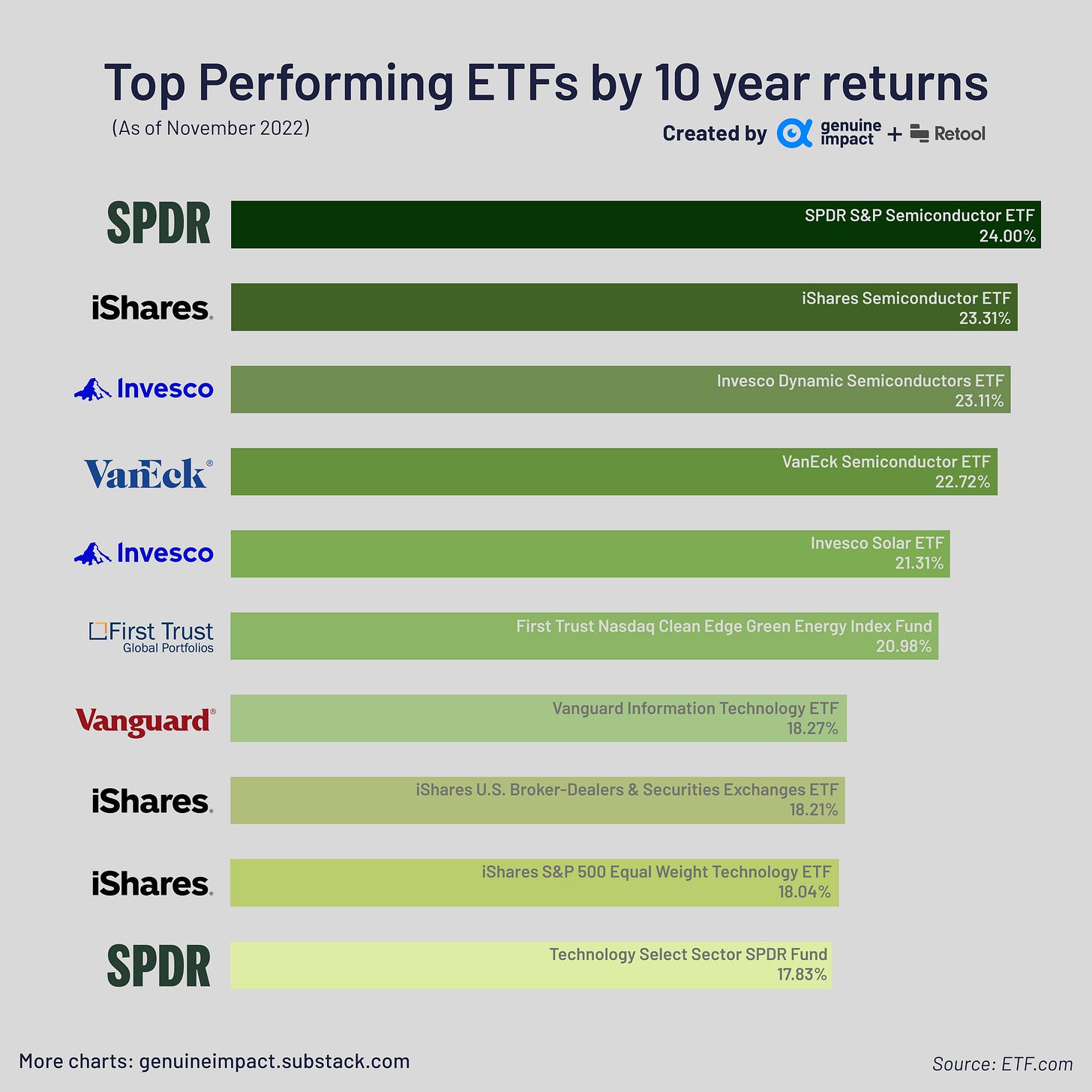

Top Performing ETFs

Once again SPDR comes out on top, with their ‘SPDR S&P Semiconductor ETF’ having the highest 10 year returns at 24%. They are closely followed by BlackRock’s 'iShares Semiconductor ETF’ at 23.3%. There is a clear pattern here where semiconductor and technology ETFs have achieved the highest returns over the last 10 years. Have you been invested in any of these ETFs?

Top Asset Management Firms

We take a look at which the top asset management firms are based on the value of their total AUM. BlackRock takes top spot at $9.1T, followed by Vanguard at $7.6T. This is unsurprising if you remember the first chart, and how many of the top individual ETFs were managed by these two firms. After Vanguard, the total AUM drops off fairly significantly with the next top asset management firms having fairly similar AUM.

See you on Wednesday for charts on Real Estate Investment!

Created by Amara

New to investing? Check out our handy video guides.

This newsletter started free, and we aim to keep it free for as long as we can. However, any support is always much appreciated - feel free to buy us a coffee using the link below <3

Want to advertise your brand on our newsletter? Click below and we’ll get back to you ASAP!