In the first half of 2024, major global assets have performed strongly, especially precious metals and base metals🤑. In the 🇺🇸 US stock market, the profits of AI-related industries have shown significant growth. The 🇬🇧 UK stock market has also performed well due to falling inflation and expected interest rate cuts. Looking ahead, it's important to watch for US inflation pressure, election uncertainties, and the potential peak and decline of the dollar and interest rates.

Major asset performance review

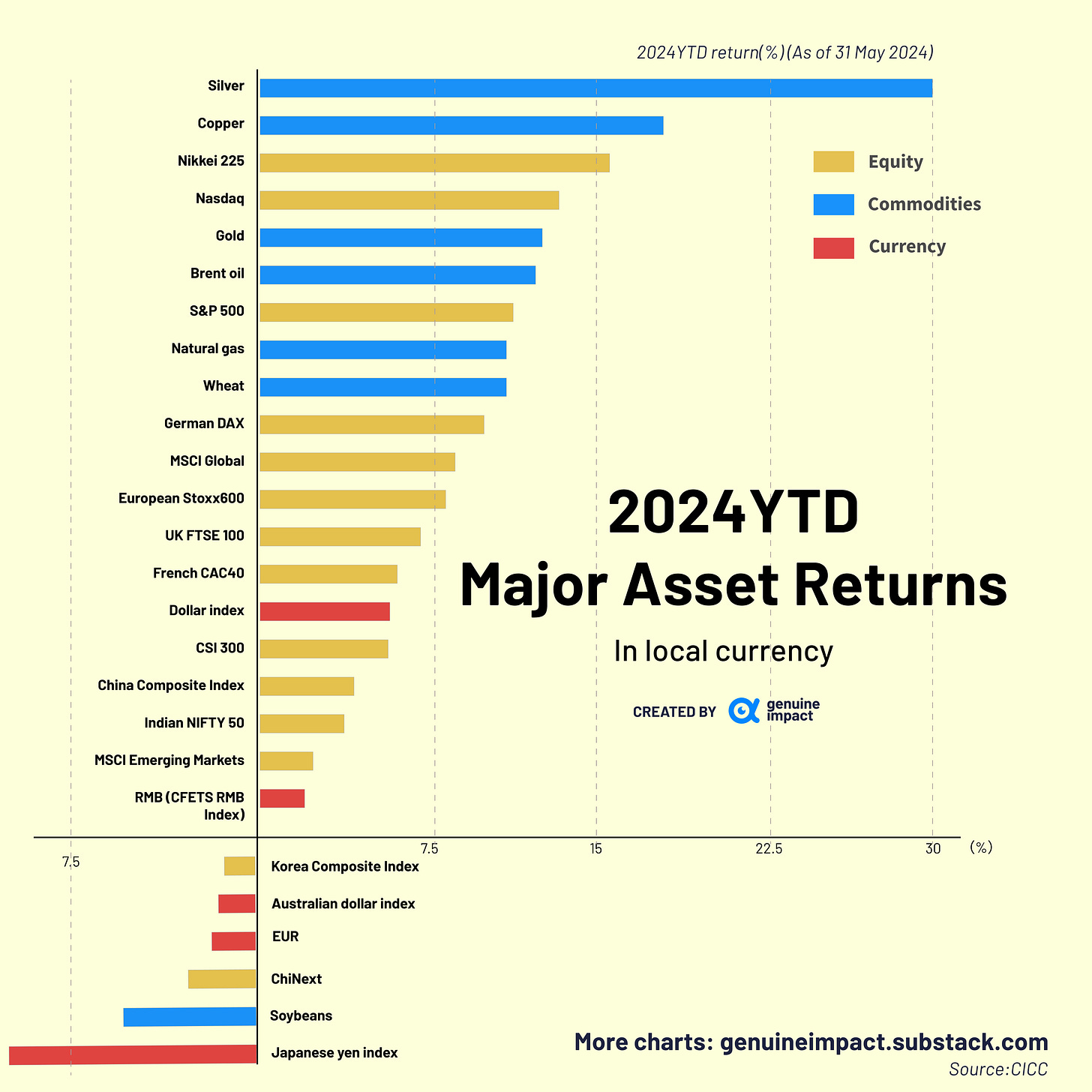

Year to date, commodities (GSG) , particularly precious and base metals, are enjoying stronger rallies in 2024. Precious and base metals like silver, copper, and gold have outperformed expectations. During periods of sudden geopolitical tensions and heightened global economic uncertainty, gold will go strong due to flight-to-safety sentiment. The unexpected resilience of the US economy has kept US bond yields and the dollar high, boosting industrial metals like copper.

We anticipate that copper and silver will continue to rise after short-term corrections, while oil will remain volatile. Election year volatility increases the appeal of gold.

Maximize your productivity

Revolutionize your workflow with Notion - the all-in-one workspace for teams. From project management to note-taking, database organization to task tracking, Notion adapts to your unique workflow, fostering collaboration and efficiency. Experience the power of seamless integration, dynamic layouts, and customizable tools that elevate your productivity. Try Notion today and transform the way you work.

*This is sponsored advertising content.

🇺🇸US Market

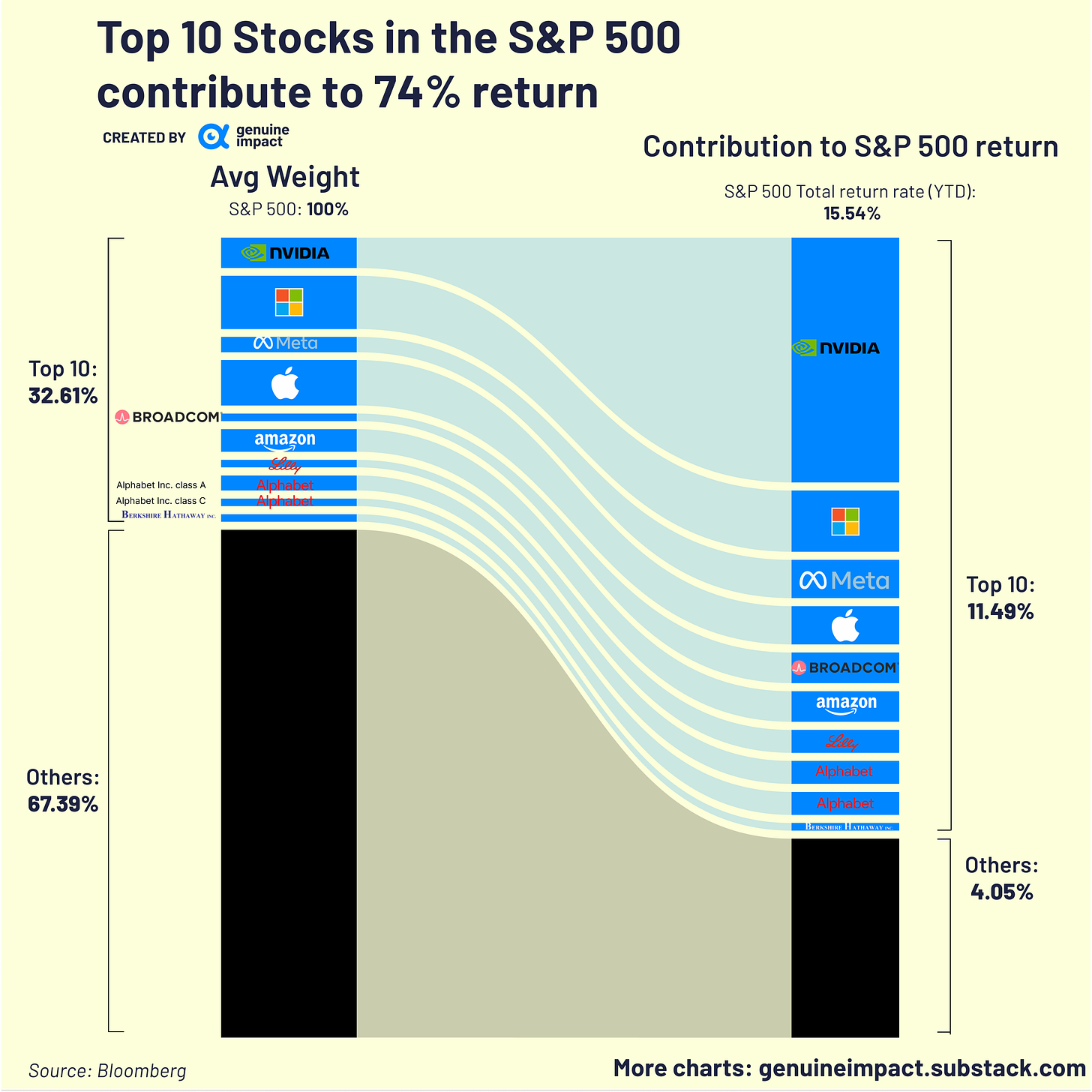

The whole world is embracing AI to boost productivity and creat new business models. AI has helped propel the US stock market to all-time highs this year, enabling Nvidia Corp., Microsoft Corp., and Meta to generate enormous profits. The S&P 500 index gained 15.54% in the first half of 2024. Notably, 74% of these gains came from the top 10 companies, including eight tech firms. Nvidia, an AI chip supplier, alone contributed one-third of the S&P 500's gains😮.

🇬🇧UK Market

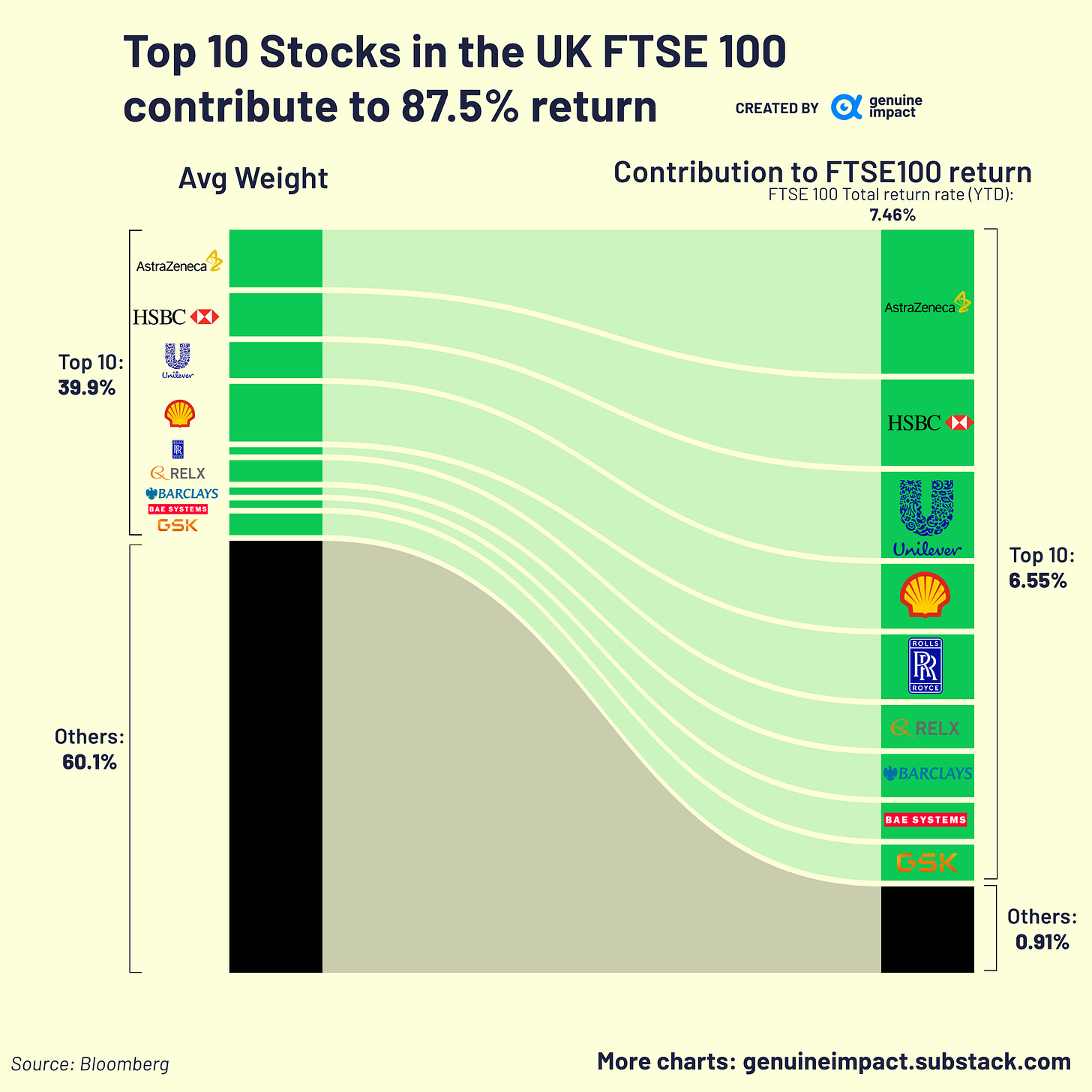

The UK stock market has performed strongly, with the FTSE 100 index reaching a historic high in April. The FTSE 100 total return was 7.4% in the first half of 2024, with 87.5% of the returns coming from the top ten companies. As UK inflation eases and expectations rise for the Bank of England to cut rates, the UK market outlook is positive.

US Macroeconomy

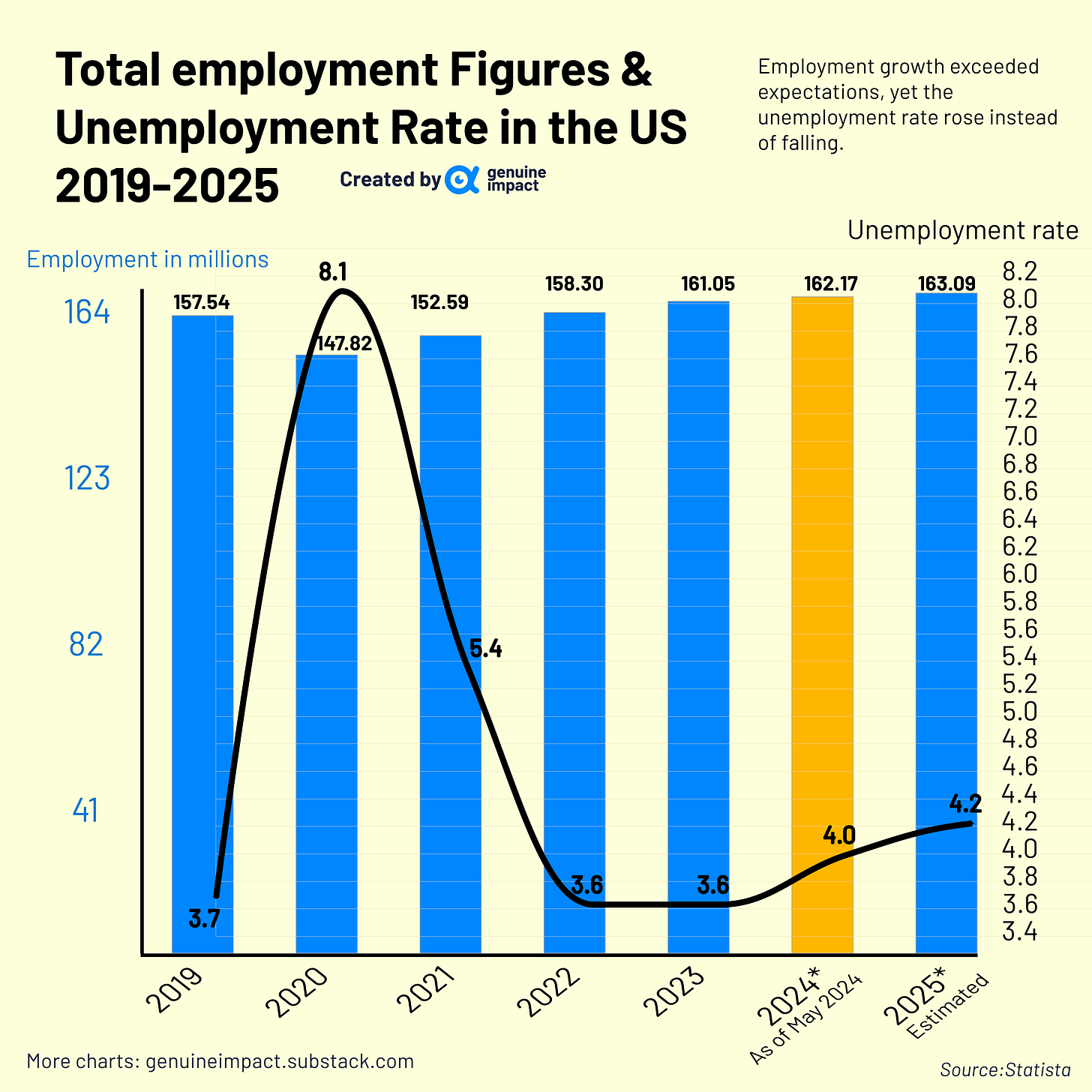

The uptick in unemployment and CPI figures suggests the Fed might lean towards cutting interest rates come September. Despite a notable rise in new jobs, much of the growth was driven by foreign workers and part-time roles, raising doubts about the strength of the U.S. job market. In May, CPI increased by 3.3% compared to last year, slightly below the expected 3.4%. Core CPI, which excludes volatile food and energy prices, grew by 3.4%, marking its slowest pace in over three years.

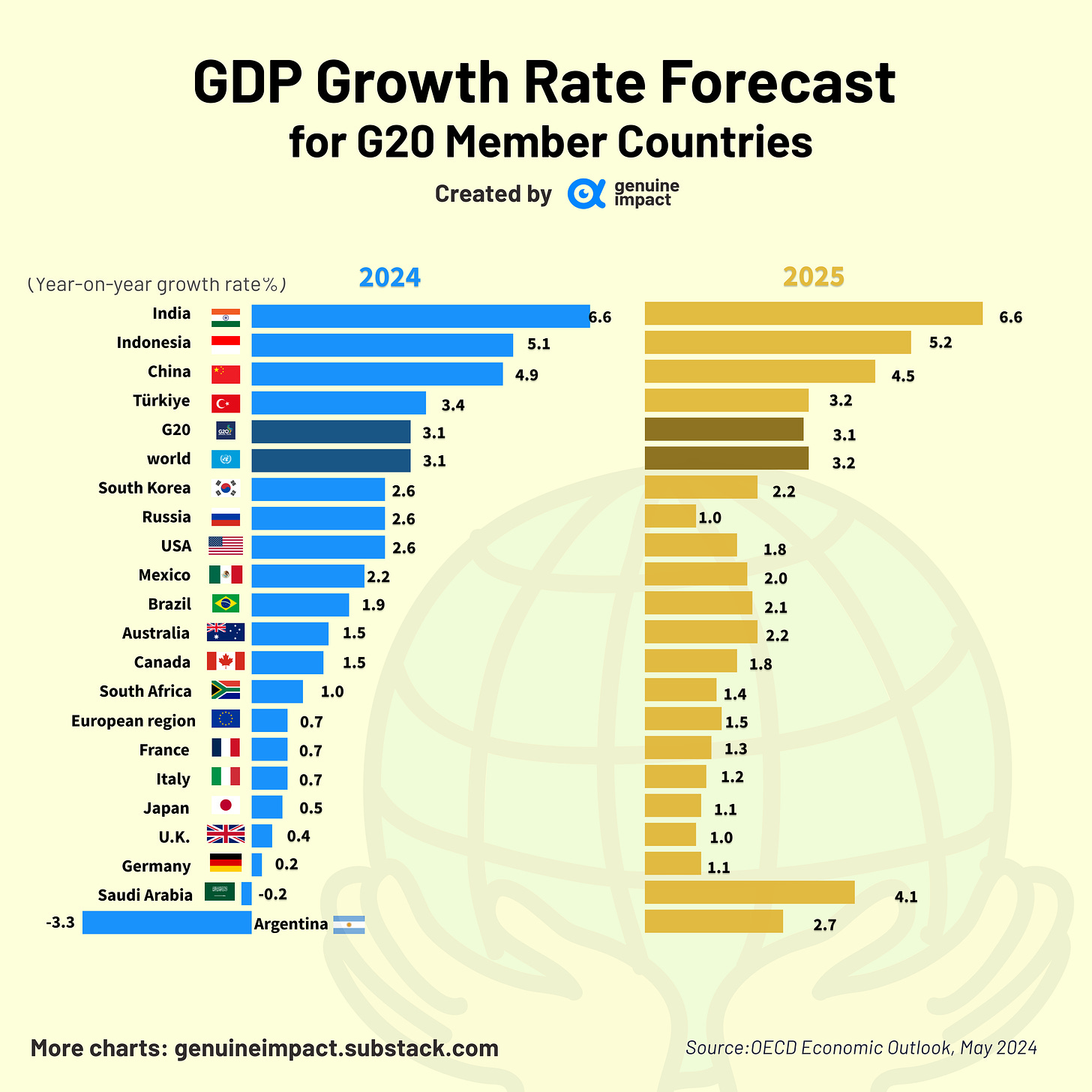

According to the OECD, global GDP is expected to grow by 3.1% in 2024 and 3.2% in 2025, similar to the 3.1% growth seen in 2023. 🇺🇸Robust consumer spending in the U.S. will support the job market, enabling the country to sustain economic resilience in 2024, with GDP growth estimated at 2.6%.

Factors to keep an eye on in the near future:

U.S. Inflation and Interest Rates: Watch for ongoing inflation pressures that might prevent the Federal Reserve from cutting rates this year.

Election Uncertainty: The U.S. elections are crucial for global market dynamics in the latter half of the year. Key events include the first Biden-Trump debate and any legal outcomes for Trump. A Biden win could adjust market risk preferences, with expectations of policy continuity and trade stability in the medium term. A Trump victory might lead to higher tariffs or priority issues, potentially reducing export expectations for countries with significant trade deficits with the U.S. and impacting their currencies.

Impact of Peaking U.S. Dollar and Rates: A future decline in the U.S. dollar and interest rates after peaking could create a more favorable external macroeconomic environment for emerging markets.

Created by Wendy & Shawn& Yiwei