Every so often, a new market is created seemingly overnight, with disruptive technologies that change the rules of the game. Companies spring onto the stage with billions of VC (venture capital) funding, eager to sell their new product that will “change the world”. Let’s dive into some of the latest and greatest companies that have transformed our lives (or tried to) in one way or another, and explore which ones stayed at - or fell from - the top.

What makes a category king?

A very basic explanation of a category-defining company is one that pops into your head immediately when even just the industry is mentioned. They may have disrupted an existing market with a new business model or technology or created a whole new one, and tend to be relentless when it comes to innovation.

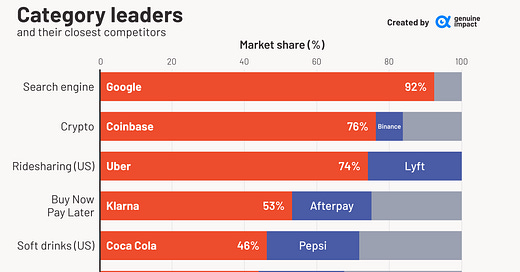

Category kings aren’t just market leaders by a few percentage points. Many of them absolutely dominate their market, often miles ahead of their nearest competitors in terms of market share - just look at the chart below.

One of the first category-defining companies that people think of is McDonald’s, and for good reason. First opened in 1940, the fast food giant has thousands of locations worldwide serving millions of their famous burgers and fries every day. It has consistently kept up its innovative nature to stay ahead of its competitors - outsourcing drive-through order-taking to serve an addition 30 cars per hour, adding a breakfast menu (their breakfast items are sold for a higher profit margin than other typical food items) and introducing a cheap coffee line are just three examples.

Now, they are not necessarily the best in their industry - they just have to be different. It’s obvious that McDonald’s doesn’t make the best quality burgers, so what makes them so successful?

Innovating existing products is one thing, but introducing completely new elements to their core offerings helped expand their potential customer base many times over. The coffee line for example brought in a new target customer - someone in a rush on their way to work, who needs a simple cup of coffee - and started a coffee war with Starbucks. This later expanded into a whole separate McCafe line, serving pastries and donuts; they now compete with the likes of Dunkin and Krispy Kreme!

Another aspect of McDonald’s dominance of the fast food market is the oft-repeated phrase that they are not a fast food chain anymore, but a real estate company. 85% of their stores are owned by franchisees, and McDonald’s buys the land upon which these franchises are built. So while franchisees pay a hefty amount of royalty money to use the brand name and associated processes, they also pay much higher amount of money in rent. And with over 30,000 McDonald’s restaurants in prime locations like Times Square, it’s no surprise that rent revenue alone was almost 40% of the company’s total revenue in FY 2022.

Get smarter in 5 minutes with Morning Brew

There's a reason over 4 million people start their day with Morning Brew - the daily email that delivers the latest news from Wall Street to Silicon Valley. Business news doesn't have to be boring...make your mornings more enjoyable, for free.

*This is sponsored advertising content.

Out with the old, in with the new(ish)

Want more recent examples of category-defining companies? Look no further than the tech giants of the 2010s. Google (search engines), Amazon (e-commerce), Uber (ride-sharing), Airbnb (holiday rentals) - most, if not all the tech tools and products we use today have their own category kings.

Many aren’t even the category-creators either. They simply innovated better, adapted more quickly, and were different enough to, well, make a difference. Take Hubspot - a new player to the CRM market, how could they beat the giant that is Salesforce, let alone the dozens of other CRMs already out there? Rather than saying what they did better than their competitors, Hubspot coined a new term - inbound marketing - and created a new market for themselves, marketing automation. Despite still essentially being a CRM, Hubspot’s market share within marketing automation is 31% which is more than 4x the share of their biggest competitor, Adobe Experience Cloud. Far easier than attempting to bring down Salesforce!

Narrowing down the scope even further, let’s look at US-based, VC-backed companies that IPO’d in the last 5 years. Think of the cool new tech startups promising a solution to a problem you didn’t know you had, with money going out a lot faster than it was coming in. 2018 (and really, several years before that) was the start of an intriguing era - VC money hyper-inflating valuations by throwing billions at any and all ideas, leading to an incredible number of unicorn companies.

And then the world stopped, and the money ran out. Peloton, Netflix, Coinbase, Robinhood - many of the pandemic big-hitters suffered huge drops in value once the bubble burst and people realised they could ride normal bikes again instead of a $2500 stationary one at home. Sure, many are still market leaders despite hits to their market value, but the number of these recently-IPO’d tech companies that are still profitable is far lower than the number of unprofitable companies.

Today, it looks like we could be at the start of a new bubble. Pandemic tech is out, and AI is in. We already have newer companies like OpenAI taking the market by storm, while existing big players including Google and Microsoft are developing their own AI tech in a bid to diversify. Will we see another year of VC-funded hyperinflated valuations? Maybe not this year, maybe not next year, but the glory days of the pre-pandemic unicorns are still fresh in many investors minds - so it’s probably a when, not if.

The question that you should think about however, is not if or when - it’s which ones to watch. We’re quite literally at the birth stages of AI, so identifying and investing in the new category kings could be an incredibly profitable endeavour.

Who do you think will be the new AI category kings? Let us know in the comments!

Created by Miguel

This newsletter started free, and we aim to keep it free for as long as we can. However, any support is always much appreciated - feel free to buy us a coffee using the link below <3

Want to advertise your brand on our newsletter? Click below and we’ll get back to you ASAP!

Very interesting read 🙌