From Tulip Mania to Meme Stocks

A Detailed Examination of Financial Speculation Through the Ages

Become business savvy in just 5 minutes with bite-size news from Morning Brew!

The phenomenon of financial speculation, a recurring theme in capitalist economies, is marked by a cyclical pattern of meteoric rises and catastrophic collapses. Today we embarks on a journey through time, tracing the path of speculation through the centuries and illuminating the commonalities that bind these seemingly disparate episodes together.

Tulip Mania

The saga begins in the 17th-century Dutch Republic, amid the frenzy of the Dutch Tulip Mania. Tulip bulbs, novel and intriguing, imported from the Ottoman Empire, became status symbols among the Dutch upper class. These flowers' unique patterns and colours ignited a speculative fire that engulfed the society. Prices reached astronomical heights, with rare bulbs reportedly being traded for the cost of high-end houses. The bubble was, however, short-lived. In 1637, a sudden loss of confidence triggered a market crash, wiping out fortunes overnight. The Tulip Mania, though over three centuries old, embodies the central themes of speculative behaviour – irrational exuberance, societal status, and the painful aftermath of a burst bubble.

The South Sea and Mississippi bubbles

Fast-forward to the early 18th century, there were two significant speculative events that shook Europe - the South Sea Bubble in Britain and the Mississippi Bubble in France. Both centred around monopolistic trading companies - the South Sea Company in Britain and John Law's Mississippi Company in France. These companies, backed by their respective governments, held exclusive trading rights with overseas territories. Investors, lured by the potential for profits from international trade and colonization, flocked to buy company shares. Prices soared, fuelled by unbridled optimism and the novel allure of the stock market. But in 1720, both bubbles burst, leading to economic calamity and public outrage. These episodes underscored the dangers of speculation and highlighted the perils of mixing politics and finance.

Railway Mania

In the 1840s, the invention of the steam locomotive sparked another speculative frenzy in Britain, known as the Railway Mania. Investors, captivated by the transformative potential of rail travel, poured capital into railway stocks. Fuelled by easy credit and a competitive race among railway companies, share prices spiralled upwards. The boom led to an overbuilding of railways, many with little economic rationale. When the market corrected itself, realizing that projected profits were wildly overestimated, the bubble burst. Railway stocks crashed, and numerous companies went bankrupt, leaving a trail of economic devastation.

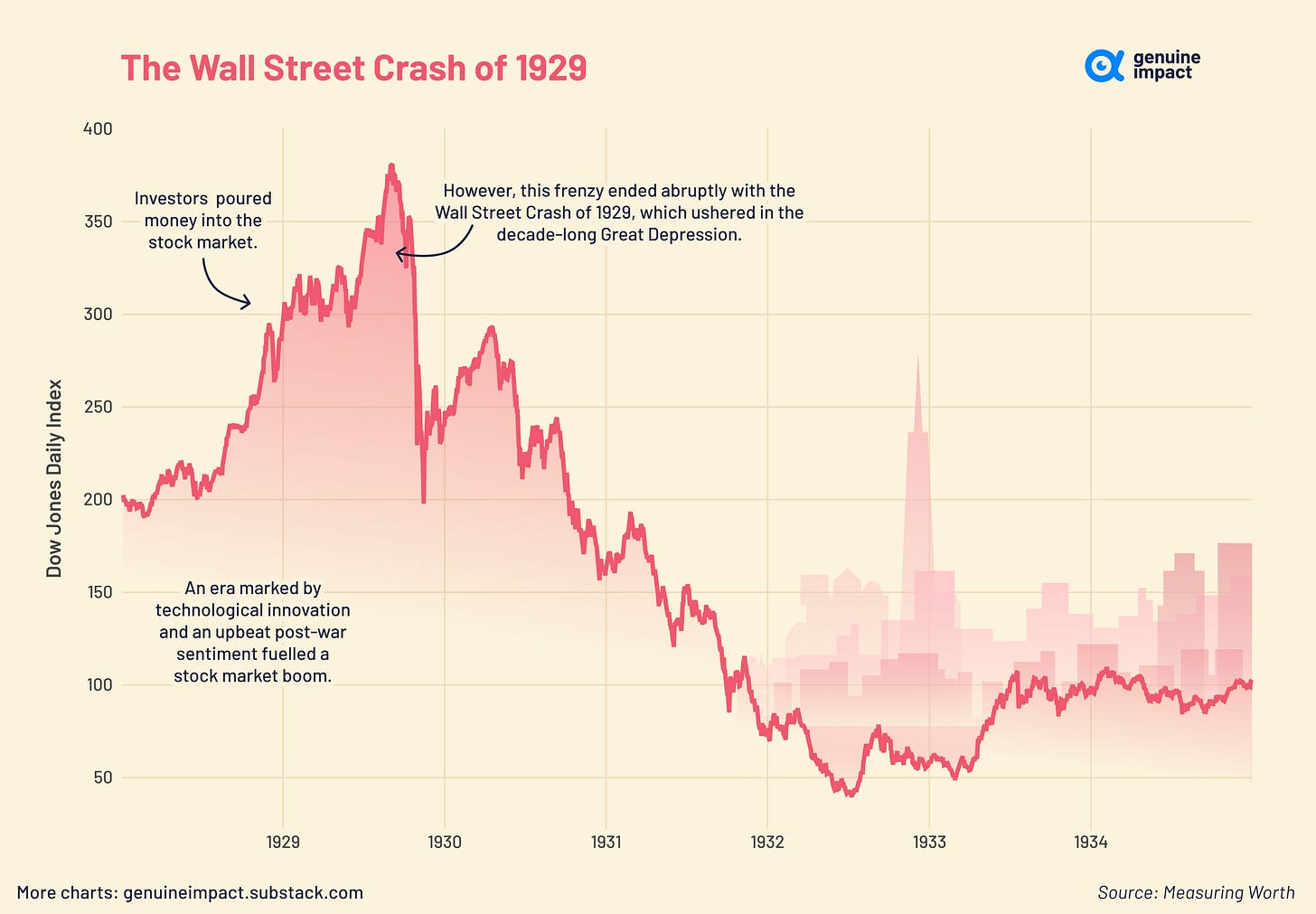

The 1929 Wall Street Crash

Turning to the American shores, we can then explore the Wall Street speculation during the Roaring Twenties. An era marked by technological innovation and an upbeat post-war sentiment fuelled a stock market boom. Investors, driven by the belief in everlasting economic growth, poured money into the stock market. However, this speculative frenzy ended abruptly with the Wall Street Crash of 1929, which ushered in the decade-long Great Depression.

Check Your Home's Climate Risk at Habitable*

Habitable's free climate risk tool gives you an instant snapshot of your property's risk for flood, fire, heat and drought.

*This is sponsored advertising content.

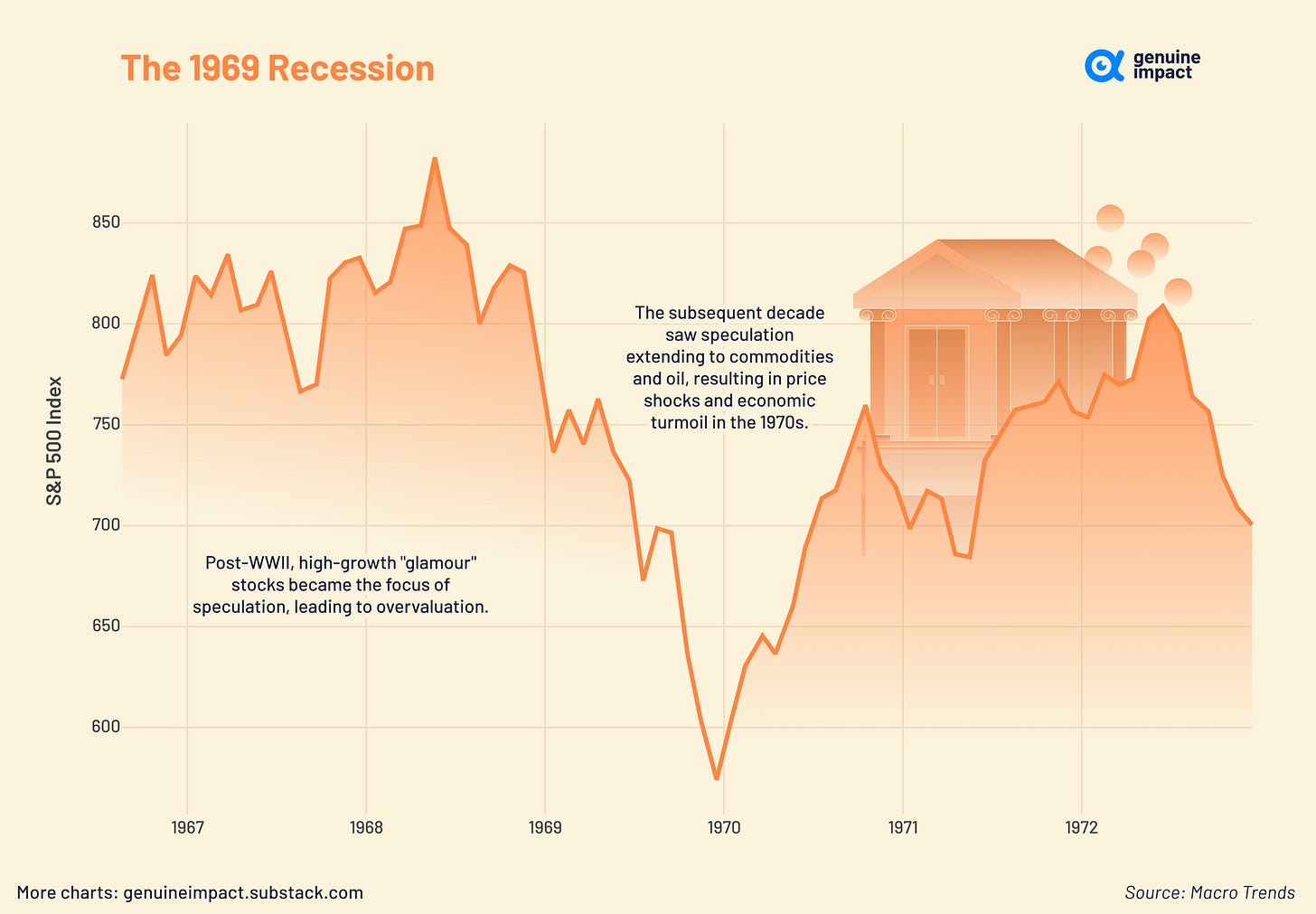

The 1969 Recession

The same narrative continues with the post-WWII period, characterized by speculation in various sectors, particularly during the 1960s' "Go-Go Years", an exuberantly bullish phase for the American stock market. High-growth "glamour" stocks became the focus of speculation, leading to overvaluation and an inevitable bear market in 1969-1970. The subsequent decade saw speculation extending to commodities and oil, resulting in price shocks and economic turmoil in the 1970s.

Japanese Assets

The end of the 20th century bore witness to another major bubble, this time in Japan. Throughout the 1980s, Japanese real estate and stock markets experienced rapid inflation, with prices reaching record highs, driven by easy credit conditions and strong institutional investments. However, when this bubble burst in the early 1990s, it led to an economic stagnation period in Japan often referred to as the "Lost Decade".

The DotCom Bubble

With the turn of the century came the Dot-Com Bubble, characterized by intense speculation in internet-related companies. The novelty of the internet and the promise of a new digital economy drove stock prices to dizzying heights. However, by 2000-2002, it became clear that many of these "dot-com" companies, despite their high stock valuations, lacked profits or even viable business models. The ensuing market crash wiped out many such companies, marking another chapter in the annals of speculative excess.

Meme Stocks

Our journey through historical speculation episodes does not conclude at the dawn of the 21st century and the spirit of speculation lives on, embodied in more recent phenomena like cryptocurrency and "meme" stock speculations.

Cryptocurrencies, led by Bitcoin, have attracted immense speculation since their inception. Driven by the promise of a decentralized digital currency and the potential for high returns, investors have poured billions into these digital assets. The speculative fever around cryptocurrencies reached a zenith in 2020-2021, with Bitcoin reaching record highs. However, the highly volatile nature of these assets, coupled with regulatory uncertainties, has led to dramatic price swings, underlining the speculative risks inherent in this new asset class.

Similarly, the speculative frenzy around "meme" stocks, most notably GameStop, gripped the financial world in early 2021. Enabled by easy access to trading platforms and fuelled by social media hype, retail investors drove up the prices of several heavily shorted stocks, leading to a "short squeeze". This phenomenon demonstrated the power of collective retail investor action, challenging traditional market dynamics. Yet, it also highlighted the dangers of speculation, as many latecomers to this frenzy faced significant losses when these stocks eventually crashed.

Through these diverse episodes of financial speculation, from tulip bulbs to digital currencies, We can see there is a rich tapestry of human behaviour shaped by greed, fear, and herd mentality. Each event, while unique in its context, echoes the same themes - a new opportunity, irrational exuberance, and an inevitable crash. As we navigate our own era of financial speculation, this article can serve as a poignant reminder of the past, urging us to heed the lessons from these historical bubbles. Financial speculation is a captivating dance with risk - one that promises immense rewards but can lead to ruinous outcomes.

This newsletter started free, and we aim to keep it free for as long as we can. However, any support is always much appreciated - feel free to buy us a coffee using the link below <3