📊 GitLab — Quietly Powering the AI Development Pipeline

Enterprise AI truly begins

Overview

While GitLab has often remained under the radar compared to its better-known peer GitHub, the company’s recent financial results and product developments suggest it is emerging as a critical player in the evolving AI software infrastructure landscape.

Q1 FY2026: Solid Financial Performance with Operational Discipline

Revenue: $214.5 million (+27% YoY)

Non-GAAP Operating Margin: Improved from -2% to +12%

Free Cash Flow: $104.1 million (up from $37.4 million YoY)

Large Enterprise Adoption: 1,288 customers with >$100K ARR (+26% YoY)

Net Retention Rate: 122%, indicating strong expansion within existing clients

CEO Bill Staples emphasised that AI adoption is transforming development practices—a theme underpinning GitLab’s ongoing product evolution.

The Strategic Bet: AI as Infrastructure, Not Just Models

While most attention in AI remains centred on language models (e.g. GPT-4) and coding assistants (e.g. Copilot), GitLab is targeting a more foundational layer: integrating AI directly into the full software development lifecycle.

GitLab’s AI initiative, GitLab Duo, focuses on embedding intelligent automation across code writing, review, security, and deployment.

The upcoming agentic AI version of Duo (scheduled for release this winter) aims to automate complex multi-step refactoring tasks, providing transparent execution plans and improving engineering team efficiency.

Current private beta feedback has been positive, with participating teams already delegating sophisticated workflows to the platform.

Rather than competing at the model layer, GitLab positions itself alongside infrastructure players such as Databricks and Snowflake—quietly enabling scalable AI application development at the enterprise level.

Market Reaction: Solid Business, Cautious Valuation

Share Price (as of 16 June 2025): $42.08 (approximately 40% off its February peak)

Despite healthy revenue growth and improving free cash flow, investor sentiment remains cautious for several reasons:

Slower forward revenue guidance has raised concerns about the pace of future expansion.

Elevated interest rates continue to weigh on valuations, particularly for growth-oriented software companies.

Fatigue around AI narratives has led to reduced enthusiasm for companies heavily marketing AI capabilities without near-term financial impact.

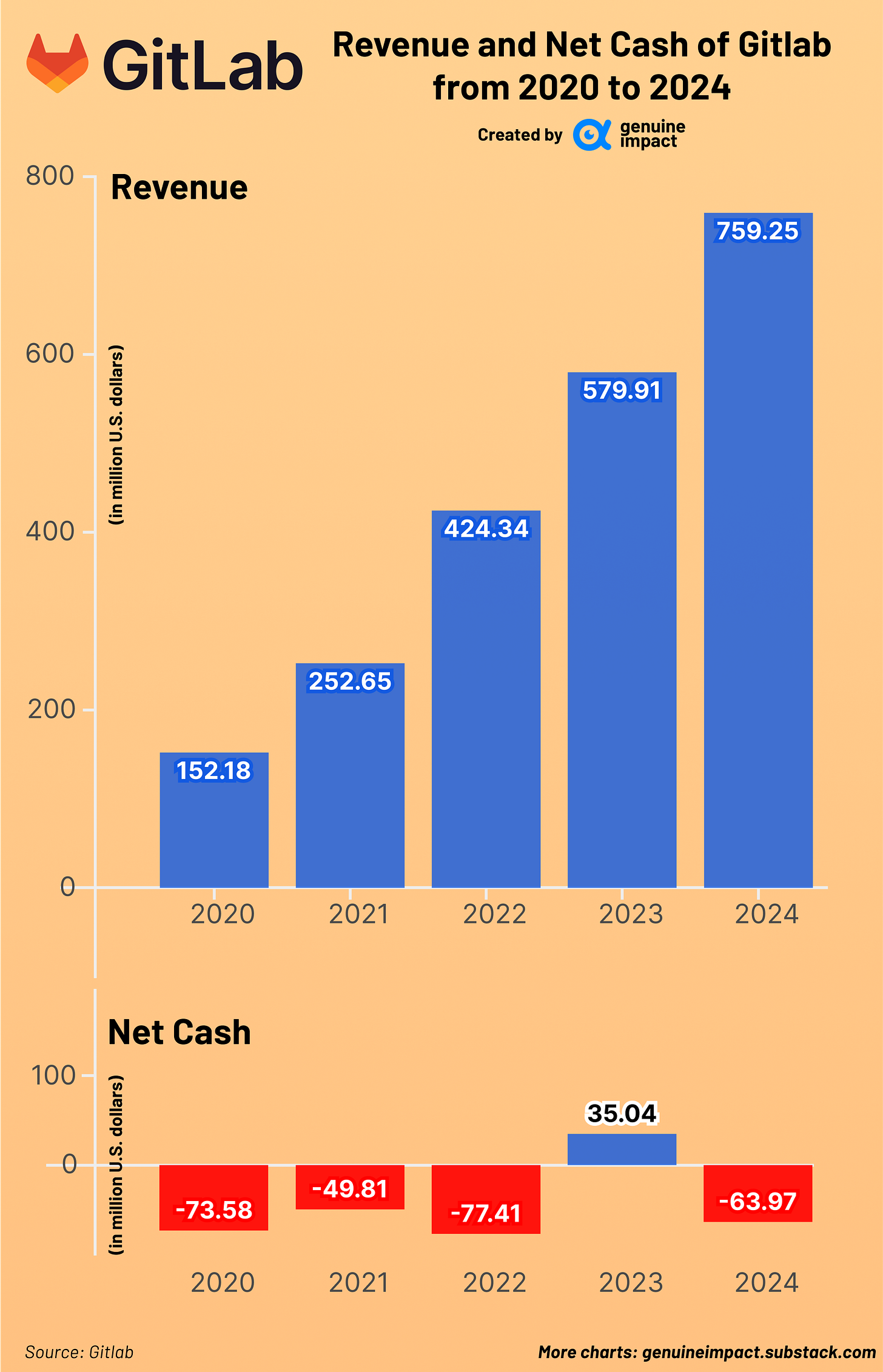

From a profitability standpoint, GitLab’s operating loss stood at -$142.7 million (FY2024), an improvement of approximately $71 million since 2020, but still not on a consistently upward trajectory. Its net cash position also remained in negative territory at -$63.9 million (FY2024), highlighting ongoing cash burn despite recent free cash flow improvements.

Unlike many high-profile AI names capturing headlines, GitLab’s role as enterprise infrastructure offers less immediate visibility, but may provide steady long-term operational leverage as AI integration becomes more deeply embedded in enterprise software development processes.

Why GitLab Matters

As AI moves from isolated model deployment into full production software pipelines, companies will increasingly require robust, auditable, and automated development platforms to manage growing complexity. GitLab’s end-to-end DevSecOps approach, combined with expanding AI-native features, positions it as a quiet enabler of the broader AI transformation.

In an ecosystem where NVIDIA supplies hardware and OpenAI supplies models, platforms like GitLab may quietly power the pipelines that bring enterprise AI products to market at scale.

Stay tuned for our Friday premium edition where we’ll break down portfolio moves, sector rotations, and our next trade idea — all for just $6/month (or £5/month).

Join 36,000+ savvy investors who believe: “Your money deserves better.”

📬 In Case You Missed It: Two Big Tech Stories This Week

📱 WhatsApp to Introduce Ads — A Monetisation Pivot

On Monday, WhatsApp announced it will begin rolling out paid advertisements globally over the coming months. With over 3 billion monthly active users, including 200 million businesses, WhatsApp is Meta’s most popular messaging app — but one of the least monetised.

The ads will appear in the Status tab (similar to Instagram Stories) and can be accessed via the Updates section, deliberately kept separate from the main chat interface. This marks a major shift: WhatsApp’s original founders famously championed an ad-free experience before selling the company to Facebook in 2014.

In addition to ads, WhatsApp is also launching paid subscription Channels, offering users exclusive content streams from creators. This is Meta’s long-awaited move to unlock revenue from WhatsApp without disrupting core user experience.

🇺🇸 TikTok Gets a Third Extension in the U.S.

The Biden administration has granted TikTok a third 90-day extension, allowing the app to continue operating in the U.S. despite ongoing national security concerns.

U.S. lawmakers had previously passed a law requiring parent company ByteDance to divest TikTok or face a ban — a deadline that has been repeatedly pushed back, most recently to this Thursday.

ByteDance has consistently refused to sell, with China's government publicly opposing any forced sale. According to eMarketer, TikTok is projected to generate nearly $16 billion in U.S. ad revenue in 2025. But without access to its core algorithm, analysts believe the platform’s sale valuation could be just $40–50 billion — comparable to Musk’s $44B Twitter acquisition, whose global ad revenue remains below $5B annually. If TikTok ultimately exits the U.S. market, Meta (Facebook & Instagram) and YouTube stand to gain the most from its nearly 1-hour average daily user engagement.

Keep in touch with Genuine Impact!

Instagram | X/Twitter | LinkedIn

Created by Arya and Roy