🗓️ Global Fixed Income Market Outlook – July 2025

Navigating Global Bonds Amid Policy Shifts and Market Divergence

Executive Summary

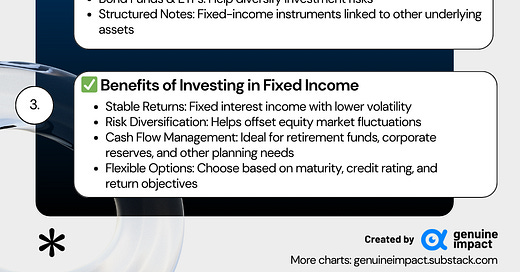

In an environment defined by macroeconomic volatility and heightened policy uncertainty, the strategic value of fixed income assets is increasingly prominent.

This month, Genuine Impact presents a comprehensive review of bond opportunities across the U.S., U.K., Eurozone, and select emerging markets, offering asset allocation insights that balance yield potential with risk factors.

As a global financial intelligence platform, our mission is to empower investors—both individuals and institutions—with data-driven strategies that support long-term wealth generation.

This report is a snapshot of our fixed income research engine in action—delivering forward-looking views for navigating a complex and fragmented market landscape.

I. Fed Policy Shift & Short-Term Treasuries

Despite the Fed’s balancing act between inflation control and economic resilience, markets broadly anticipate a dovish pivot should growth indicators weaken. In this context, short-term U.S. Treasuries—those maturing within a year—remain an attractive option. With yields well above historical averages and low credit risk, they provide a core holding for defensive portfolios.

II. U.S. Corporate Bonds: Enhancing Yield with Manageable Risk

High-quality U.S. corporate bonds offer compelling spreads over Treasuries, with credit risk still at manageable levels. For investors seeking to enhance returns without significantly increasing risk, investment-grade corporate debt presents a valuable allocation channel.

III. U.K. Gilts: A Diversifier with Policy Stability

With growing uncertainty around U.S. fiscal and monetary policy, U.K. Gilts offer an appealing alternative. Backed by a stable policy and political environment, Gilts provide attractive relative yields. Markets anticipate a rate cut from the Bank of England later this year, which could support further bond price appreciation.

IV. Eurozone Bonds: Less Room to Run

Despite a modest growth recovery and falling inflation, Eurozone bonds trade at elevated valuations. With the ECB signalling the end of its rate-cutting cycle, the upside for European sovereign bonds appears limited, constraining their overall appeal.

V. Emerging Market Debt: Selective Bright Spots

Some emerging markets show sound fiscal health and offer significantly higher yields than developed peers. Select sovereign and corporate EM bonds—particularly those issued in USD—are gaining traction among global allocators seeking yield diversification. Volatility remains a key consideration, but fundamentals are supportive.

U.S. Fixed Income Market Outlook

1. Macro Indicators

Inflation: U.S. CPI has undershot expectations, suggesting disinflation remains intact. Summer tariffs have yet to materially pass through to consumers.

Labour Market: Unemployment remains stable, supported by tight labour supply. Permanent unemployment is trending higher, warranting close attention.

2. Trade & Fiscal Policy

Tariffs: Average effective tariff rates have climbed to 15%, pressuring inflation and corporate planning.

The "One Big Beautiful Bill": Proposed tax cuts aim to boost investor sentiment but may worsen the fiscal deficit by $3.3 trillion by 2034.

Section 899 Withdrawn: The proposed foreign investor tax on U.S. bond yields was scrapped, easing market concerns.

3. Treasury Market & Fed Policy

U.S. short-term Treasuries remain in favour amid high real yields and Fed ambiguity.

Fed has entered a rate-cutting cycle, targeting 3.5% by year-end. Historical comparisons (e.g., 2019) support a dovish bias given low core inflation and rising unemployment.

4. U.S. Corporate Bonds

Investment Grade: Strong corporate earnings underpin low risk in this segment. Regulatory relaxation could offer sector-specific tailwinds.

High Yield: With yields >7.3% and average duration of ~3 years, HY debt presents attractive upside. ETFs help mitigate single-issuer risk.

Non-U.S. Fixed Income Outlook

U.K. Gilts

Yields: Steepening curve raises long-term appeal.

Macro: May inflation cooled to 3.4%, while unemployment rose to 4.6%.

Policy: Bank of England expected to begin cutting rates in August, continuing into November.

Stability: Political and policy stability positions Gilts as a sound diversifier versus U.S. debt.

Eurozone Bonds

Valuation: Elevated prices limit yield appeal.

Growth: GDP forecasts hover around 1% for 2025.

Inflation: Headline inflation fell to 1.9% in May.

ECB Policy: The current easing cycle is likely near its end.

Diversification Value: Stable monetary policy and low FX volatility make Eurozone assets a viable diversification tool.

Emerging Markets

Fundamentals: EM sovereign debt levels remain manageable, with many markets less dependent on foreign borrowing.

Yield Advantage: USD-denominated EM debt offers a meaningful yield premium.

Policy: While some EM central banks have begun easing, most are holding rates steady amid external volatility.

FX vs. USD-Denominated: We prefer USD-denominated EM debt over local-currency bonds due to FX volatility, despite strong YTD performance in the latter.

Final Thoughts

At Genuine Impact, we view fixed income not as a passive buffer, but as a strategic tool for navigating cycles. Through granular market analysis, macro scenario planning, and smart diversification, we aim to help investors stay ahead in an uncertain world.

📩 Stay tuned for our Premium Edition, where we unpack the week’s most investable themes across markets, business, and macro strategy—plus our latest trade idea. All for just $6/month (£5/month).

Join 36,000+ globally minded investors who believe: “Your money deserves better.”

Instagram | X/Twitter | LinkedIn

Created by Genuine Impact