Google’s Q1 Playbook: Search Growth and a Cloud Push

Resilient Results Amid Rising Competition and Cloud Constraints

🌟 Alphabet Delivers a Strong Quarter, Easing Investor Fears Over Search and AI

Alphabet kicked off 2025 with an upbeat set of results, offering some much-needed reassurance to investors amid ongoing concerns about its core search business and rising competition from AI-driven platforms.

📈 Financial Highlights

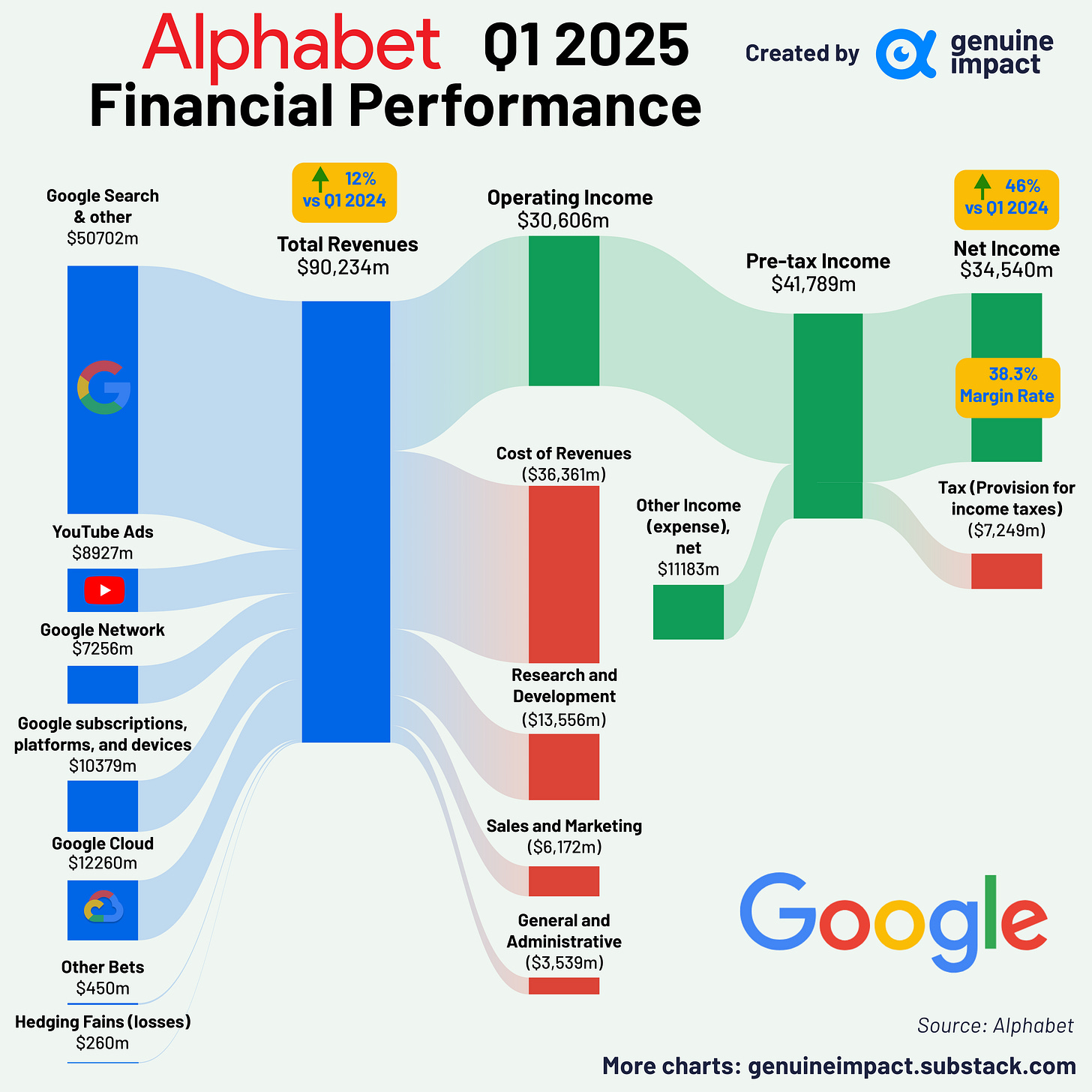

In Q1 2025, Alphabet’s consolidated revenues rose 12% year-on-year—or 14% in constant currency terms—to $90.2 billion, driven by robust momentum across all major business units.

Operating income grew by 20%, with operating margins expanding by 2 percentage points to 34%. Net income soared 46%, and EPS jumped 49% to $2.81. Alphabet also announced a 5% increase in its quarterly dividend to $0.21 and authorised a $70 billion share buyback, matching last year’s level.

🚀 Advertising Rebounds: Search Defies Doubts

Core search and advertising revenues rose nearly 10% to $50.7 billion, beating expectations of 8–9% growth. This performance was closely watched, given investor fears that AI chatbots like OpenAI’s ChatGPT, Anthropic’s Claude, and Elon Musk’s Grok could erode Google’s search dominance—especially as the company rolls out AI-generated summaries (AI Overviews) in search results.

CEO Sundar Pichai stressed that search growth remains "strong," bolstered by increasing adoption of AI features. "We are investing heavily in AI Overviews, expanding them to more countries and addressing more queries," Pichai noted. Chief Business Officer added that the monetisation rates for AI Overviews are "roughly similar" to traditional search links, though he declined to share detailed click-through metrics.

Analysts were broadly reassured. Several described the results as “better than feared,” citing solid ad and cloud performance. Still, concerns remain: macro headwinds and escalating tariffs could weigh on Q2 and Q3, especially as Chinese advertisers scale back spending on U.S. platforms like Google and Meta following the latest White House tariff hikes.

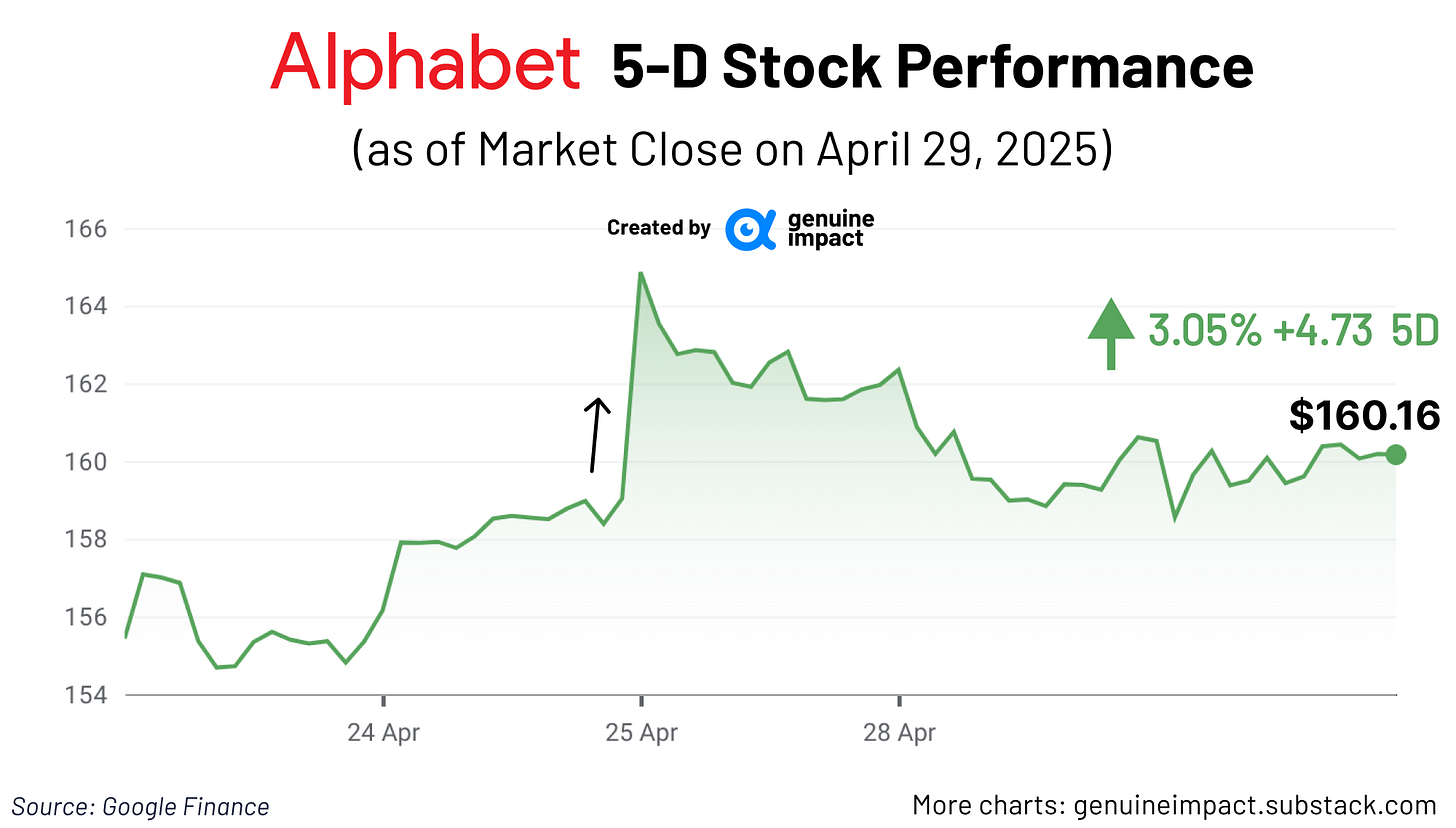

📊 Alphabet shares jumped over 4% in after-hours trading following the earnings release.

☁️ Google Cloud: Strong Growth, but Capacity Constraints Loom

Google Cloud delivered another robust quarter, with revenue climbing 28% year-on-year to $12.3 billion. Demand remains strong, fuelled by the AI boom and the surging need for data centre and network services. However, growth moderated slightly from the previous quarter’s 30.1% pace, as Alphabet cited supply constraints—its current data centre infrastructure is struggling to keep up with enterprise demand.

Google Cloud Platform (GCP) stands alongside Amazon Web Services (AWS) and Microsoft Azure as one of the world’s leading public cloud providers, collectively known as "hyperscalers." Recent surveys show that 79% of enterprises are using AWS for public cloud services. Historically, GCP has been less entrenched in enterprise IT compared to AWS and Azure, offering fewer services and catering more directly to software developers. However, that gap is narrowing: companies such as Spotify and Goldman Sachs have adopted GCP in recent years, signalling increasing traction among large enterprise customers.

🔹 Public vs Private Cloud — and Why It Matters Now

Public cloud services allow organisations to access computing power, storage, and applications over the internet, paying only for what they use. This model supports rapid scaling, lower maintenance costs, and global reach—an attractive proposition as businesses deploy more AI and data-intensive applications. Private clouds, by contrast, offer dedicated infrastructure with greater control and security, though often at a higher cost.

In today’s enterprise landscape, most companies are embracing hybrid strategies—blending public and private clouds to maximise flexibility while maintaining security and compliance. This shift is playing to Google’s strengths, as GCP continues to scale both infrastructure and AI-native tools.

📈 Looking Ahead

Despite concerns over Big Tech’s aggressive $300 billion collective infrastructure spend this year, Alphabet remains undeterred. It is doubling down on investment in chips, networking equipment, and data centres to meet AI-driven demand. As GCP strengthens its enterprise integration and AI offerings, it is positioning itself not just as a developer favourite, but as a serious contender for long-term enterprise cloud growth.

Alphabet's latest results offered a clear signal: despite mounting competitive pressures, its core businesses—search, ads, and cloud—are still delivering strong performance. Yet challenges loom on the horizon, from tariff-driven advertising headwinds to infrastructure supply bottlenecks. For now, though, investors can breathe a little easier.

📩 In these volatile times, curious how we’re positioning across assets and equities? 👉 Don’t miss our Friday’s premium edition, where we’ll break down our stock picks, portfolio allocations, and trade ideas — all for just $6/month (or £5/month).

Join 36,000+ savvy investors who believe: “Your money deserves better.”

Keep in touch with Genuine Impact!

Instagram | X/Twitter | LinkedIn

Created by Arya