How to evade taxes legally...I'm kidding. Or am I?

If Apple can do it, then so can you! (this is not financial advice)

In life, only two things are certain: death, and taxes. On the one hand, life expectancy worldwide is rising all the time, so we’re working on the first part…on the other hand, that means more years spent doing tax returns. You win some, you lose some. Unless you’re a multinational corporation registered in a tax haven country, in which case you don’t really lose anything.

Become business savvy in just 5 minutes with bite-size news from Morning Brew!

*sponsored content

Does anyone actually know how to fill out a tax return?

Americans in the most common tax bracket (earning between $50k to $75k) pay about $4,567 a year in federal income tax. This would give an effective income tax rate between 6%-9%, and excludes all other forms of tax like state income tax or property tax.

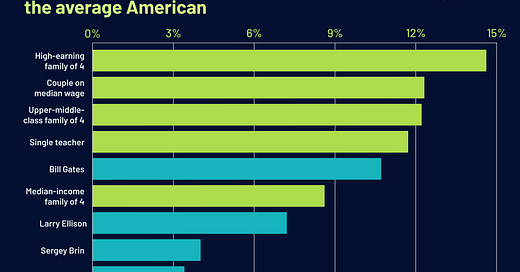

Comparing these figures to the top 10 richest billionaires in the US, it’s a sobering sight. A single, first-year, public school teacher with an average starting salary of $40,154 per year will pay 6% employee payroll taxes plus 5.7% federal income tax, equating to 11.7% or $4698. And when factoring in the rent of a simple 1 bed apartment in somewhere like NYC, that leaves -$12,484 for food, other bills, and leisure. That minus is not a typo. People simply can’t afford to live. Of course, it’s not just the low pay but the high rent, bills upon bills, and the fact that a dozen eggs cost more than $7 earlier this year.

On the other end of the spectrum, Meta CEO Mark Zuckerberg, with reported income of $3.9bn between 2013 and 2018, paid $536 million in those 5 years at an approximate income tax rate of 13.7% - however if you include wealth growth (where Zuckerberg gained $49bn, and paid no taxes on it) then his effective tax rate plummets to a measly 1.1%. Even if he did pay 13.7% tax on his full wealth growth between 2013-2018, it would still leave him with billions of dollars spare - and yet, he pays a lower effective tax rate than most Americans.

What these wealthy people do isn’t necessarily illegal, by the way. Much of their wealth growth comes from unrealised gains such as from investments or property. $5000 of MSFT stock at IPO would be worth over $10.5m today for example - and although selling these assets do have taxes attached (capital gains), the strategy is to use them as collateral for loans, and just…never sell assets.

Time for a (tax) holiday

Taxes, both income and corporate, vary widely around the world. Colombia has a corporate income tax (CIT) of 35%, while Switzerland’s is only 8.5% (excluding cantonal and communal taxes). As such, multinational companies tend to register their companies in tax-friendly countries like Switzerland, where they would pay a lot less taxes on their earnings than wherever they primarily operate. IT consulting giant Accenture for example, was founded in the US but moved its registered place of incorporation to Ireland to pay only 3.5% tax.

Boost Your Productivity With AI

Join 25,000+ subscribers and get a free daily 5 min newsletter. Learn how to free up time and achieve financial freedom with AI. Read by executives from Tesla, NASA, Meta, and more.

*sponsored content

The best countries to evade taxes in

Accenture is by no means an exception. Think of any Fortune 500 company, and chances are they’re registered in one of the countries highlighted below. We looked at the Tax Justice Network’s Corporate Tax Haven Index to rank the most renowned tax havens around the world, and it’s no surprise to see most of the biggest companies in the world registered there.

The CTHI score is calculated by measuring how easy a country’s tax laws are for a company to abuse (assessed against 20 indicators), and weighted against how much financial activity from multinational companies occurs within the country. You can check out the complete list of countries here.

Standing at number one are the British Virgin Islands with a score of 2,853 and the stats are incredible - over 400,000 companies list the islands as their home. With a population of 31,000, that comes out to just under 13 companies per resident. Other island nations with favourable tax laws include the Cayman Islands, Mauritius, and the Bahamas.

There have already been several court cases with these large multinationals accused of evading taxes like Apple or Microsoft - in fact, Google “ <big company name> tax evasion” and you’ll almost definitely find a scandal or two.

Let me know in the comments which multinational company doesn’t have a tax scandal associated with it!

Two special mentions: the Isle of Man, situated between Ireland and England, is home to many companies that want easy access to the UK and EU. It also has the 2nd highest number of private jets registered in Europe, as owners do not need to pay VAT upon purchase of their shiny new jet.

Finally, the US. Corporate rates at the federal level are fairly average, but state income tax gets added on and can result in an extra 10% of more being paid. However, some states offer 0% income state tax - these include Alaska, Florida, Nevada, Tennessee, South Dakota, Texas, Washington, and Wyoming.

I’ll leave you with this tidbit: Manchester United plc’s registered office is in the Cayman Islands. This meant the Glazer family, who own the club, avoided a potential 15% capital gains tax upon IPO in 2012 (which would have been around $495m). Cayman laws also make it extremely difficult for hostile takeovers. Greedy - or strategic?

See you on Wednesday for charts on economic speculation throughout history!

Created by Miguel