ICVCM's Bold Move: The Future of the Voluntary Carbon Market at a Crossroads

Renewable Energy Projects in Question as the VCM Navigates Uncertainty and Growth

Last week, the Integrity Council for the Voluntary Carbon Market (ICVCM) announced that renewable-energy projects would not receive its high-integrity Core Carbon Principles (CCPs) label. As a key participant in setting global carbon offset standards, ICVCM’s decision has triggered strong market reactions. Supporters see it as a necessary move to eliminate low-quality credits and enhance the VCM, while critics worry it could disrupt nearly one-third of the market, exacerbating existing challenges.

Why does this decision have such a significant impact on carbon offsets? What lies ahead for the global Voluntary Carbon Market?

What is the Voluntary Carbon Market (VCM)?

The Voluntary Carbon Market (VCM) provides an avenue for companies, organisations, and individuals to voluntarily engage in the purchase and exchange of carbon credits. These credits represent reductions or removals of greenhouse gas emissions achieved through reforestation and renewable energy projects. Unlike regulated compliance markets, the VCM offers a platform for entities, including individuals and corporations without legal obligations, to address their carbon footprint voluntarily, often with the goal of achieving carbon neutrality or fulfilling environmental responsibilities. When a buyer purchases and subsequently "retires" a carbon credit (permanently cancelling it to prevent reuse), it effectively offsets an equivalent amount of carbon emissions through the associated project. Transactions within the VCM can take place directly between buyers and project developers, through brokers, or via exchanges where carbon credits are treated as tradable commodities. The credibility and environmental impact of these credits are ensured by standards such as Verra's "Verified Carbon Standard (VCS)" and the "Gold Standard," which validate and verify carbon credit projects.

Despite its contribution to emission reductions, the VCM has been met with criticism. Some companies may utilise the VCM to fulfill their emission reduction obligations, projecting a "green" image without genuinely decarbonizing their value chains or systematically implementing sustainable practices—an issue commonly referred to as "greenwashing." Unlike compliance carbon markets like the EU ETS, the VCM currently relies on self-regulation through third-party verification and certification bodies, prompting concerns regarding consistency and transparency.

VCM Faces Decline After Years of Rapid Growth

The Voluntary Carbon Market (VCM) experienced substantial growth prior to 2023. The number of companies pledging to achieve net-zero emissions doubled from 2019 to 2020. Between 2020 and 2022, the increasing significance of ESG considerations and the need for more corporations to compensate for emissions that could hardly be reduced internally led to a surge in demand for carbon credits, more than doubling their average price. During this period, there were notable improvements in market transparency and verification standards, bolstered by recognised bodies such as Verra and the Gold Standard. In 2022, the market achieved record volumes of carbon credit retirements, offsetting 187 million tons of CO2, marking a 240% increase over four years.

In 2023, the Voluntary Carbon Market (VCM) faced significant challenges. Global inflation and increasing energy costs prompted companies to reduce non-essential expenses, including carbon offsets. There was also growing doubt about the effectiveness of carbon credits due to the decentralised and unregulated nature of the VCM. Concerns arose about the quality of projects and their actual environmental impact. Additionally, renewable energy credits, which accounted for about one-third of the market, were criticised for not providing significant additional climate benefits, particularly because renewable energy projects like solar farms would likely have been developed regardless of the credits. Some scholars stated that the extra revenue from carbon credits often ended up in developers' pockets rather than contributing to climate solutions. By the end of 2023, the value of retired carbon credits in the VCM had decreased by nearly a quarter from 2022, and spot credit prices had dropped from $8.5 per ton to around $5 per ton.

Why Does ICVCM "Reject" Renewable Energy Projects?

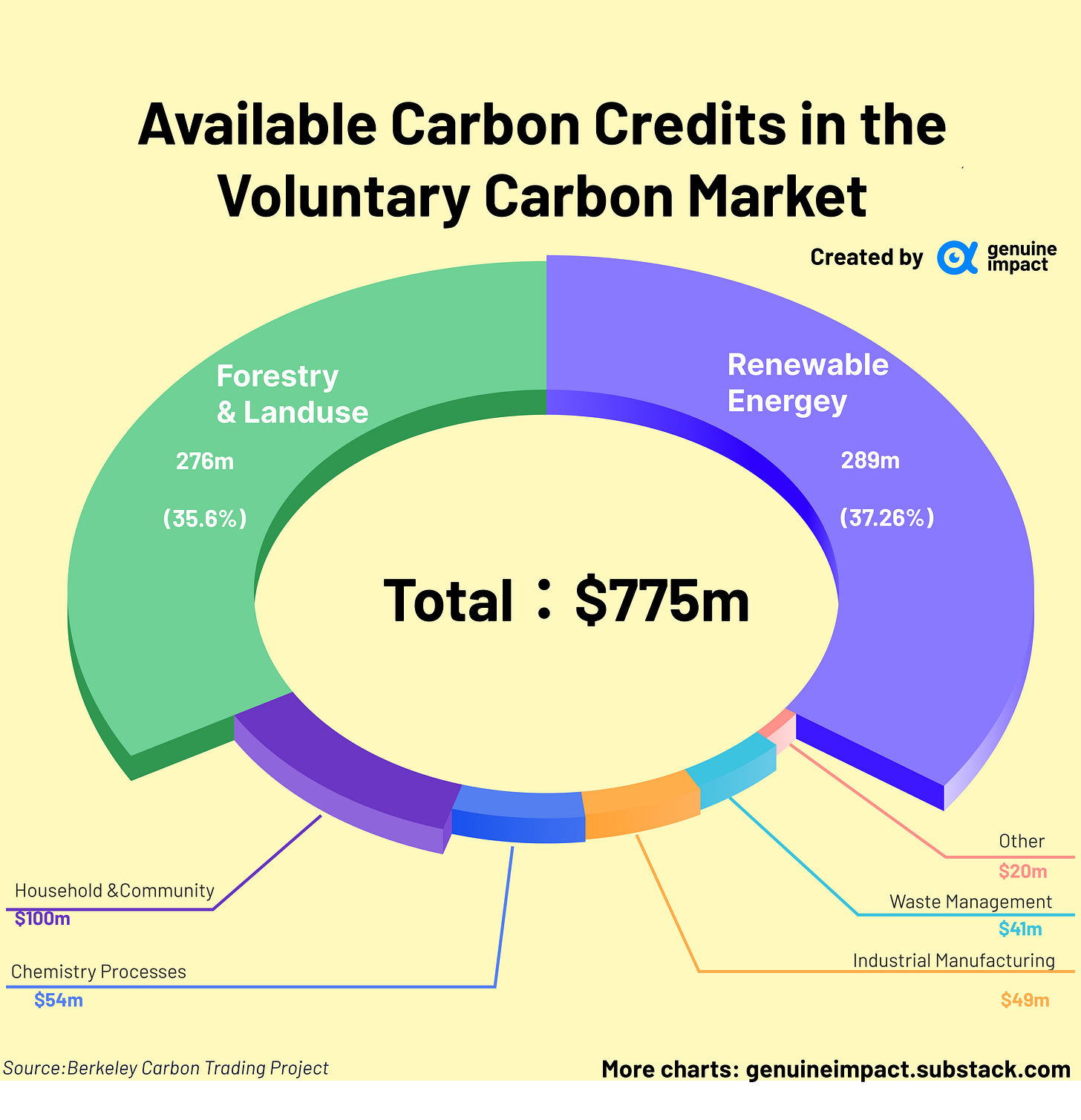

As of March 31, 2024, approximately 37% of the 775 million carbon credits available in the Voluntary Carbon Market (VCM) originated from renewable energy (RE) projects. However, following ICVCM's recent announcement that carbon credits issued under existing renewable energy methodologies will not be eligible for its high-integrity CCP label, the VCM will likely face a period of turbulence. This decision is rooted in the concept of "additionality," which questions whether RE projects truly need the financial boost from carbon credit revenue to proceed. MSCI supports this stance, highlighting that an integrity assessment of over 1,700 VCM projects ranked RE projects the lowest, with 78% scoring below 3 out of 5, compared to just 30% for other projects. Furthermore, due to previous concerns about the effectiveness of carbon offsets from RE projects, their credit prices have fallen significantly, averaging only $1.8 to $2.8 in the first half of 2024—approximately half the overall market average. Despite being less prevalent in the market, forestry and land use projects are also considered high-risk categories, prone to overestimating emission reductions and issuing excessive credits. Nevertheless, many companies opt to purchase these lower-quality offsets due to their lower costs.

Supporters of ICVCM's decision, disillusioned with the current state of the VCM, see it as essential for establishing a high-integrity market. They hope this move will positively influence the ongoing development of the United Nations' new carbon mechanism. However, some stakeholders view ICVCM's blanket rejection of all RE projects as rigid. Although the two largest carbon-crediting standards, Gold Standard and Verra, have severely restricted RE project credits since 2020, they still allow such projects in specific regions—such as least-developed countries and island nations lacking technological resources. These organisations argue that ICVCM's decision could hinder the transition to clean energy in the regions that need it most. Verra is revising its additionality criteria to address the deficiencies noted by ICVCM and plans to consult with ICVCM on these revisions next month. For major RE project carbon credit buyers like Audi, Shell, Aviva, and TotalEnergies, this announcement may shift their preferred types of carbon offsets, likely leading to higher costs.

Snapshot of 2024 Q2 Voluntary Carbon Market Trends and Future Prospects

Since the beginning of 2024, the volume of carbon trading in the market hasn't shown much improvement, with supply and demand remaining similar to last year. The issuance of carbon credits in Q2 2024 dropped by 25% to 68 million metric tons of CO2 equivalent (MtCO2e) compared to last year, primarily due to a decrease in nature-based projects. On the demand side, carbon credit retirements in Q2 2024 decreased by 11% year-on-year to 34 million MtCO2e, mainly due to reduced demand for renewable energy credits. However, there are positive signs: The share of projects meeting ICVCM's Core Carbon Principles (CCPs) increased to 3.6% of the total market by early August, indicating a rise in high-quality projects. Additionally, Q2 2024 saw the first issuance of credits from direct air capture (DAC) carbon removal projects, which are highly credible and commercially valuable. The average price in Q2 2024 was $5.8 per ton, higher than in the previous three quarters, driven by the strong performance of non-CO2 gas credit projects. With the release of new ICVCM regulations, the appeal of RE projects in the VCM is expected to significantly decline, likely resulting in a decrease in the issuance and retirement of carbon credits in Q3 2024.

Looking to the future, instilling confidence in the market will be crucial for a robust rebound in the Voluntary Carbon Market. MSCI is optimistic about the potential for new disclosure standards and regulations to enhance transparency, which is fundamental to establishing trust among investors and stakeholders. It’s worth noting that corporate climate commitments may drive demand, especially considering that only about 40% of publicly traded companies have established decarbonisation targets to achieve net-zero emissions. In the quest to meet the 2050 net-zero target set by the Paris Agreement, the VCM could serve as a strategic tool for companies to offset unavoidable emissions. According to an optimistic forecast by Bloomberg NEF, if the VCM becomes a central element of global climate strategy and carbon offset demand remains inelastic due to solid market information, carbon credits could potentially reach $238 per ton by 2050, creating a substantial $1.1 trillion market. As the market progresses, with the support of increasingly robust regulations and infrastructure, carbon credits are expected to shift towards higher quality, verifiable, and permanent emission reductions. For corporate buyers, selecting high-quality carbon credits certified by CCPs will be essential for upholding their sustainability reputations. They should also closely monitor projects that achieve carbon removal through emerging technologies like DAC to ensure their offset activities receive greater external recognition. Investors are advised to actively identify and support high-integrity, high-value carbon credit projects, particularly those that meet CCP standards and are empowered by emerging technologies. These projects adhere to stringent market requirements and offer significant long-term returns as the VCM matures.

Maximize your productivity

Revolutionize your workflow with Notion - the all-in-one workspace for teams. From project management to note-taking, database organisation to task tracking, Notion adapts to your unique workflow, fostering collaboration and efficiency. Experience the power of seamless integration, dynamic layouts, and customizable tools that elevate your productivity. Try Notion today and transform the way you work.

*This is sponsored advertising content.

Created by Shawn