📢 Exciting Updates to Our Monday Newsletter!

Starting this week, we’re refreshing our Monday Edition with something special:

🔍 Insider Portfolio Overview — your exclusive snapshot of how our expertly curated investment portfolio is performing.

What is the Insider Portfolio, and how’s it doing?

The Insider Portfolio is a global equity portfolio built by our in-house investment team at Genuine Impact, exclusively for subscribers. Every Monday, you’ll receive a visual and data-driven update on its latest performance, sector allocation, and the week’s standout movers — helping you see how we’re navigating shifting market conditions in real time.

Want the full breakdown? Stock-level details and trade ideas are shared in our Premium Friday edition.

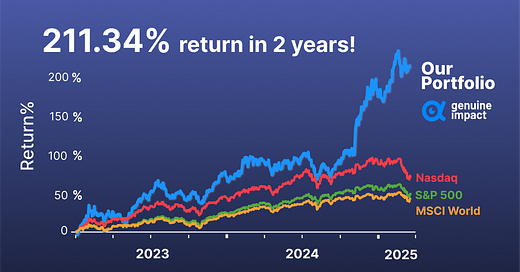

With a two-year return of 211.34%, our Insider Portfolio is off to a powerful start — and the best is yet to come.

💼 How Do We Choose Insider Stocks?

Our Insider Portfolio is a concentrated selection of 15–20 high-conviction, fast-growing public companies aligned with four structural themes we believe will shape global growth over the next decade:

🌍 Climate Change & Sustainability

We focus on companies driving the transition to a low-carbon future—leaders in solar and alternative energy, electric and hydrogen vehicles, and next-gen battery technology. These businesses benefit from both rising demand and favourable policy trends.

Examples: Constellation Energy, Tesla, First Solar, XPeng

🤖 AI and Big Data

From cybersecurity and semiconductors to data centres and high-performance computing, we invest in the infrastructure powering AI’s rapid evolution—especially the technologies enabling automation and intelligent systems.

Examples: Nvidia, Apple, Microsoft, Adobe, IonQ

🌐 De-globalisation

We look for opportunities in defence, supply chain reshoring, and frontier markets gaining from U.S.–China decoupling. UK small/mid-cap stocks also play a key role as we target companies poised to benefit from domestic economic shifts.

Examples: Oracle, BAE Systems, RTX

👥 Demographic Change

We back businesses meeting the demands of shifting lifestyles and population trends—ranging from healthcare, education, and fitness to entertainment and fintech solutions tailored to today’s evolving consumer behaviour.

Examples: Meta, Coinbase, Unilever

Our mission? To identify and invest in the fastest-growing, most resilient businesses driving structural change — and to hold them through their prime growth years.

📈 Investment Philosophy:

We don’t chase hype or trade the news. Instead, we:

Focus on long-term compounding by holding elite growth companies.

Avoid short-term speculation, options, or short-selling.

Adapt to market cycles using trend-following analysis and technical indicators.

Protect capital during downturns through disciplined portfolio hedging (using index futures or ETFs).

Take profits during overheated rallies and raise cash when necessary.

Our goal is simple:

➡️ Maximise long-term returns while navigating volatility with smart risk management.

➡️ Generate consistent alpha — no matter the macro backdrop.

🗓️ What to Expect Going Forward

Monday: Insider Portfolio — Get a snapshot of our portfolio performance, positioning, and key weekly highlights.

Wednesday: Macro & Market Shifts — Stay informed with major economic updates and business headlines, explained through clean, easy-to-read charts.

Friday (Premium): Deep-Dive Financial Insights — Unlock detailed stock breakdowns from our Insider Portfolio, plus exclusive trade ideas and timely analysis.

Curious about the stocks we hold? Wondering how much weight we’ve placed in each one? Don’t miss this Friday’s premium edition — all will be revealed!

💡 For just $6/month (or £5/month), we’ll help you stay ahead of the trends that matter most.

👉 Thanks for being part of our growing investor community. Join 36,000+ savvy investors who believe: "Your money deserves better."

This information is for guidance purposes and may become out of date at any given time. It is not investment advice. Investments can rise and fall in value. Genuine Impact won’t make any assessment of whether the investments you choose are appropriate or suitable for you. If you are unsure of the suitability of any investment, investment service or strategy, you should seek independent financial advice. Past performance does not indicate future results. Your capital is at risk.

Love what you’re reading? Share this newsletter with your network and help them stay ahead of market trends. 💼📈 Let’s build a community of savvy investors who are always in the know!

Instagram | X/Twitter | LinkedIn

Created by Genuine Impact

Where I can get the Friday information?

Impressive write up