Inside the trillion dollar insurance industry💵

How does United Health make money?

Insurance plays a vital role in safeguarding individuals, businesses, and assets from various risks. In today’s newsletter, we’re taking a peek into the trillion-dollar industry, and exploring how some of the major players make money.

How does insurance work?

Insurance policy holders establish contracts with insurance companies to protect them from certain risks. In exchange for the insurance company managing these risks on your behalf, you pay a premium to the company.

Insurance companies are profitable because of the concept of risk pooling. Insurance companies gather a large number of policyholders who face similar risks, but are unlikely to experience those risks at the same time. The probability of an individual submitting a claim is pretty slim, and as the number of policy holders within a company increases, the standard deviation of the fraction of policies resulting in a claim reduces.

In this way, insurance companies profit from those of us paying regular premiums and never making a claim. Some types of insurance, such as vehicle insurance, are mandatory, whereas others, including health, life, and mortgage insurance, may be optional in some areas.

Insurance premiums

Insurance premiums can change from year to year due to several factors influencing the insurance market and the individual policyholder's risk profile. Some of the key reasons for changes in insurance premiums include:

Number of previous claims submitted

Regulatory changes

Market conditions

Inflation

National disasters and pandemics

Demographic changes

Below we visualise the change in insurance premiums in the United Kingdom, United States, and in the OECD on average.

Together with Waivly

Get the latest in Web3, AI, and tech with Waivly, the platform for future-led tech professionals and enthusiasts! Waivly keeps you up to date with the very latest going on in all of these spaces through daily easy-to-read and to-the-point style content.

Join thousands of readers from companies such as Coinbase, VeeFriends, Twitter, World of Women, a16z, Google, and BAYC and subscribe to Waivly now!

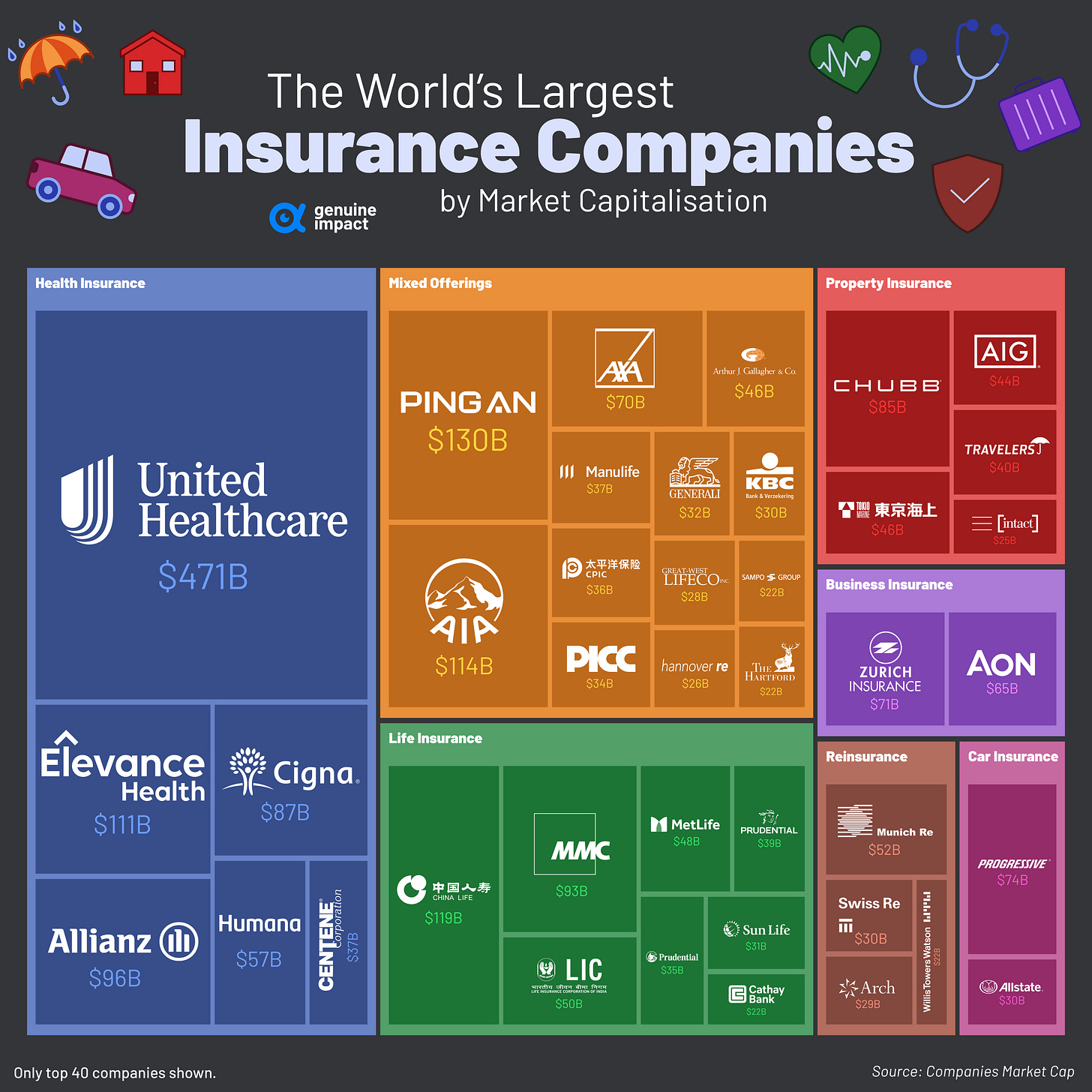

The largest insurance companies

Let’s take a look at the 40 largest insurance companies worldwide based on their market cap.

As you can see, United Health group is the clear market leader, with a market cap of $471 billion and a 2022 revenue of $322 billion. Below we visualise United Health’s financials:

See you on Wednesday for charts on the gig economy!

Created by Shivani

This newsletter started free, and we aim to keep it free for as long as we can. However, any support is always much appreciated - feel free to buy us a coffee using the link below <3

Great series of charts and informative as always! The insurance industry is one of the most misunderstood industries today.

Because of risk pooling, most only see what they pay to the insurance company....they don't see just how much is paid out . A LOT is paid out every day. A small premium of $1000 could easily have a $1 Million claim.