Portfolio outperformed in a relatively calm week

Tesla and Bitcoin led the rise, risk sentiment elevated by optimistic tariff talks

1️⃣ Portfolio Performance

The equity market remained relatively calm last week. Despite the Federal Reserve's warnings about rising unemployment risks and persistent inflation, the S&P 500 still managed to post a 1% gain over the past five trading days. Our portfolio outperformed, achieving a 1.61% gain, driven by strong performances across most holdings. However, the VIX retreated as market sentiment improved following recent bouts of uncertainty. A notable highlight was gold, which saw a sharp increase after military tensions between India and Pakistan escalated in the Kashmir region.

2️⃣ Tesla and Bitcoin Lead This Week’s Rebound

This week’s biggest movers in our Insider Portfolio:

📈 Tesla (+4.94%)

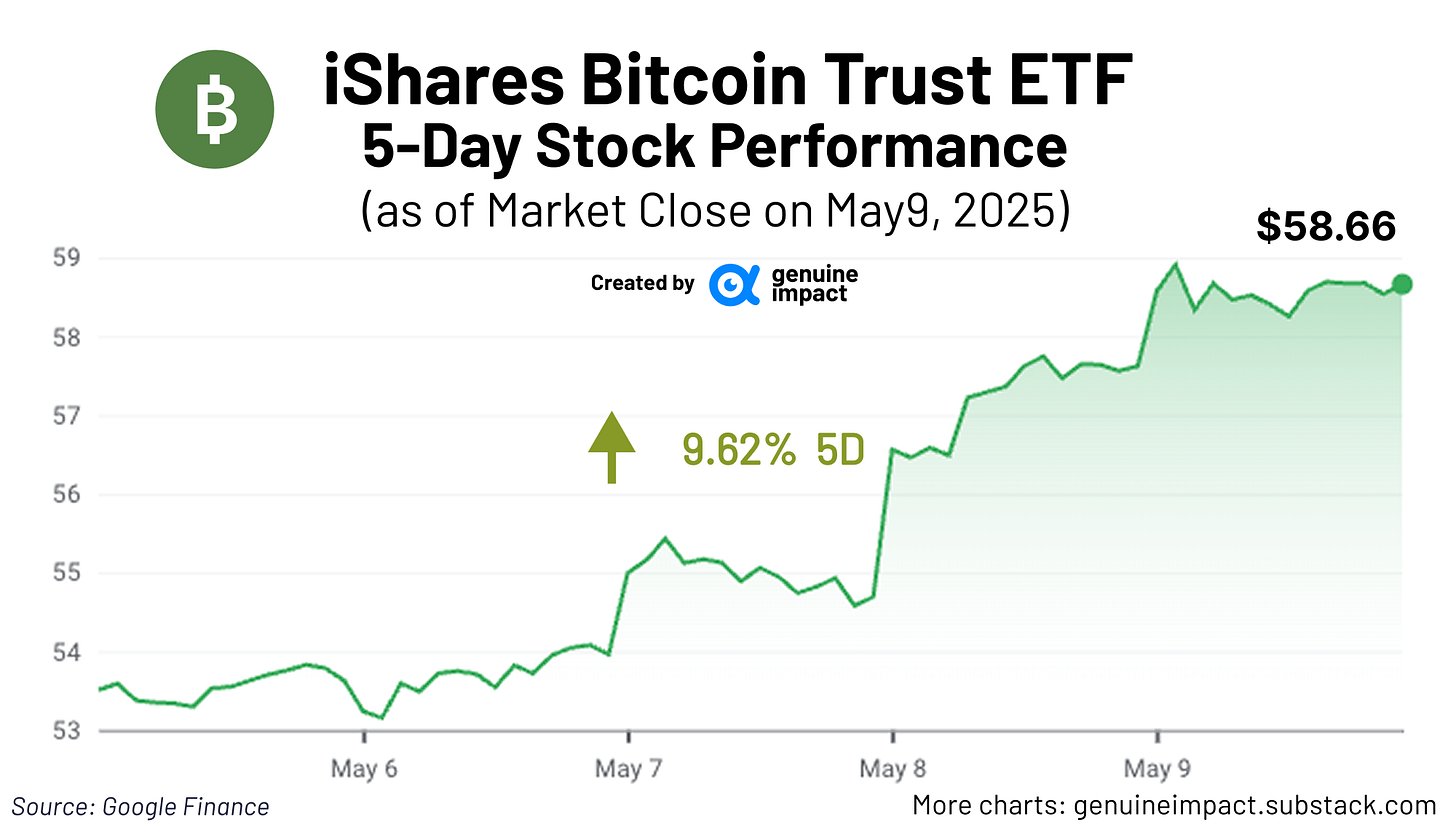

📈 Bitcoin (+9.62%)

Tesla: Growth Story Back in Vogue

Tesla’s stock charged up 4.94% last week and has now surged about 15% in a month—finally giving investors something to smile about after a two-month snooze. The jolt came from surprisingly strong delivery numbers: over 520,000 vehicles shipped globally, cruising past analyst estimates and reaffirming that Tesla can still walk the production walk. Add in Elon Musk’s latest cheerleading session, complete with promises of a cheaper model, more Cybertrucks, and better batteries, and suddenly the “growth story” is back in vogue. On the macroeconomic level, good news came as well. Last week, President Trump announced the first trade deal with Brits, and “substantial progress” was made in Geneva with Chinese. The elevated risk appetite gave Tesla a boost. Someone was euphoric. Cathie Wood from ARK Investment Management reiterated her confidence in $2,600 Tesla price, indicating 800% room of improvement!

But let’s not pop the champagne yet— European sales are sliding faster than a Model S on black ice, with registrations tanking across the continent, and merely 512 new registered models in UK in April. Back in the homeland, the inventory is also piling up in U.S. showrooms, hinting that even Elon can’t meme his way out of demand issues forever. But don’t forget, Tesla’s share price was seldom driven by fundamentals. Now with Elon back in “real business”, some Tesla believers are making huge bets!

Bitcoin: Back to Spotlight Again Over $100k

Bitcoin made a big leap this week, surging past $100,000 for the first time since February, after President Trump announced a U.S.-UK trade deal and hinted at more to come. This, plus some optimism about China talks, lit a fire under stocks—and crypto too. Bitcoin had been in a slump since February, weighed down by tariff fears and slow-moving crypto reforms, but it’s now up nearly 40% from last month’s lows and 10% for the year, closing Thursday at $102,700.

Though Bitcoin’s price is still wildly volatile and often seems to ignore logic, it’s getting a boost from Wall Street’s deep pockets. Tower Research Capital is reportedly increasing its bets on crypto, joining Citadel Securities in the crypto craze. Meanwhile, Bitcoin ETFs, which had a blockbuster year in 2024, saw nearly $2 billion in inflows last week, with BlackRock’s Robert Mitchnick declaring, "The flows are back in a big way." Looks like crypto’s not going anywhere anytime soon—unless, of course, it’s back down again.

Curious about the stocks we hold? Wondering how much weight we’ve placed in each one? Don’t miss this Friday’s premium edition — all will be revealed!

💡 For just $6/month (or £5/month), we’ll help you stay ahead of the trends that matter most.

👉 Thanks for being part of our growing investor community. Join 36,000+ savvy investors who believe: "Your money deserves better."

This information is for guidance purposes and may become out of date at any given time. It is not investment advice. Investments can rise and fall in value. Genuine Impact won’t make any assessment of whether the investments you choose are appropriate or suitable for you. If you are unsure of the suitability of any investment, investment service or strategy, you should seek independent financial advice. Past performance does not indicate future results. Your capital is at risk.

Love what you’re reading? Share this newsletter with your network and help them stay ahead of market trends. 💼📈 Let’s build a community of savvy investors who are always in the know!

Instagram | X/Twitter | LinkedIn

Created by Genuine Impact