Wall Street Financial Giants Performance Analysis

We're in the early stages of a multi-year investment banking-led cycle

Almost all the Wall Street financial giants report higher investment banking revenue, fueled by growing confidence in the U.S. economy that prompted companies to raise more money and strike deals.

The world-known Morgan Stanley, Goldman Sachs, and BlackRock achieved solid financial performances in Q2 2024. Favourable market conditions, increased client engagement, and strength in investment banking were common underlying factors across these three firms.

BlackRock

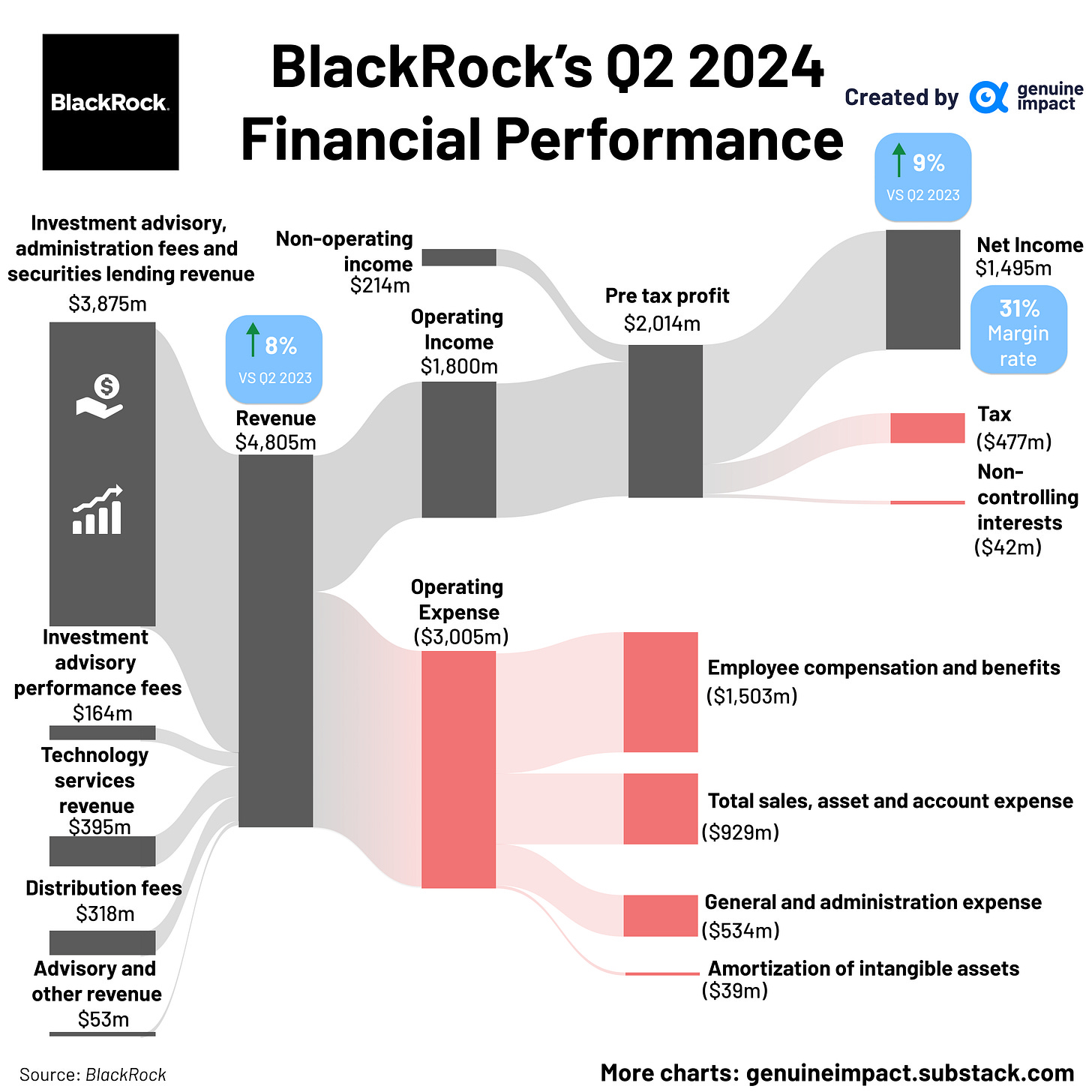

BlackRock demonstrated strong financial performance in Q2 2024, surpassing Q2 2023. The company achieved $4.8 billion in revenue, an 8% increase from the previous year. The company's net income rose by 9% to $1.5 billion, with a notable margin of 31%.📈

The favourable macroeconomic environment and positive market movements played crucial roles in boosting asset valuations and inflows, supporting the overall growth in assets under management (AUM) to a record $10.6 trillion. BlackRock's effective cost management also enhanced operational efficiency, contributing to an 11% growth in operating income despite an increase in operating expenses, particularly in employee compensation and general administration. Moreover, its strategic acquisitions, such as the planned acquisitions of Global Infrastructure Partners and Preqin, are expected to strengthen BlackRock's offerings in private markets and further diversify its revenue streams, contributing to its robust financial performance and profitability.

Goldman Sachs

Goldman Sachs reported a significant increase in net income for Q2 2024, reaching $3 billion, a 150% rise compared to Q2 2023. Total revenue for the quarter was $12.7 billion, representing a 17% year-over-year growth. The company achieved a net income margin of 24%, with earnings amounting to $3 billion.

The robust results were primarily driven by the Global Banking & Markets segment, which generated revenues of $8.2 billion(up 13.8% year-to-year), particularly excelling in debt and equity underwriting. Additionally, the Asset & Wealth Management segment generated revenues of $3.8 billion, benefiting from gains in equity investments and higher management fees. Moreover, the company experienced higher total revenues alongside lower total operating expenses in Q2 2024 compared to the same period last year, leading to a 150% increase in net income. However, the decline in revenues and earnings compared to Q1 2024 suggests potential challenges or seasonal factors that may need to be addressed in the future.

Morgan Stanley

Morgan Stanley's Q2 2024 financial performance showed strong growth, with total revenues reaching $15.0 billion, up 11.6% from Q2 2023. The firm reported a net income of $3.1 billion, reflecting a 41% increase from the previous year. Key revenue drivers included significant contributions from rapidly increasing Investment Banking ($1.735 billion) and Trading ($4.131 billion), alongside solid asset management revenue ($5.424 billion).

The robust results were supported by a favorable market environment, leading to increased client engagement and activity, particularly in Equity and Fixed Income trading. This positive market sentiment also contributed to record asset management net revenues in the Wealth Management segment ($6.8 billion)🏆, driven by cumulative fee-based asset flows. Additionally, the firm saw growth in commissions and fees, totaling $1.183 billion, and net interest income of $2.067 billion. These factors combined to deliver strong results in Institutional Securities, with significant increases in Investment Banking revenues (up 51% from a year ago), particularly in M&A advisory and equity underwriting, along with a rise in non-investment grade fixed-income issuances.

Created by Shawn & Wendy