IPOs

Who are the latest big names to go public?

In today’s newsletter, we update some stats relating to IPOs, and take a look at the biggest five IPOs of 2023. Finally, we also explore how the number of companies going public has changed over time, and digging in to why this number can vary quite a bit from year to year.

Largest IPOs worldwide

The largest IPO is that of Saudi Aramco, the Saudi Arabian oil and gas company, which went public in December 2019. Although the exact valuation and amount raised have been subject to fluctuations, it was anticipated to be one of the largest IPOs globally, reflecting the immense scale of the company. Another notable example is the Alibaba Group Holding Limited IPO, which took place in September 2014. Alibaba, a Chinese e-commerce giant, raised a staggering $22 billion, making it the largest IPO at that time.

Maximize your productivity

Revolutionize your workflow with Notion - the all-in-one workspace for teams. From project management to note-taking, database organization to task tracking, Notion adapts to your unique workflow, fostering collaboration and efficiency. Experience the power of seamless integration, dynamic layouts, and customizable tools that elevate your productivity. Try Notion today and transform the way you work.

*This is sponsored advertising content.

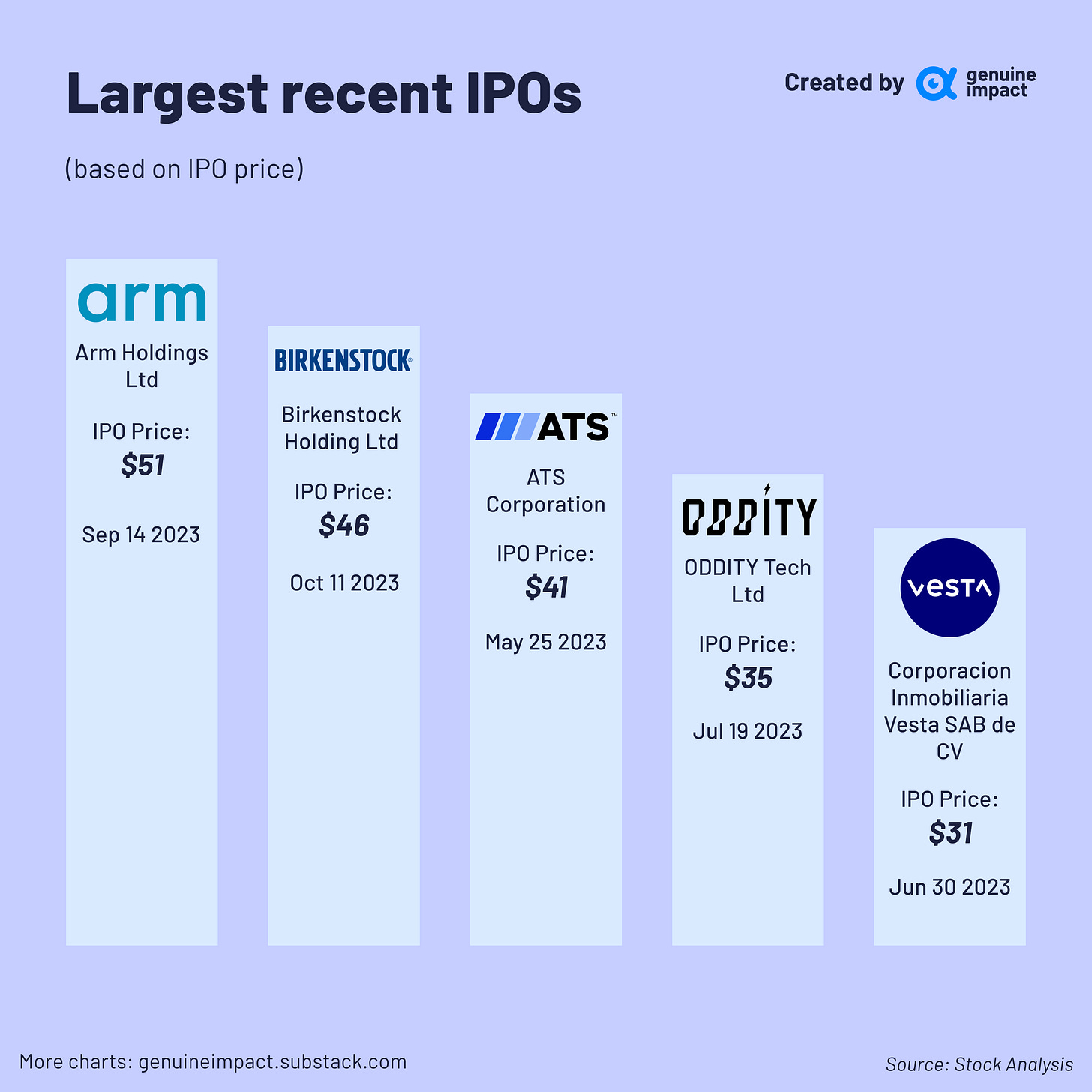

Largest recent IPOs

Based on IPO price, the largest IPO as of 2023 is Arm Holdings which went public on September 14th 2023. This company is a British semiconductor and software design company, and their designs are low-cost and energy-efficient. This makes them popular in consumer products like smartphones, where it has a market share of 99% in the premium category. In second place is Birkenstock, the popular German sandal maker. Unfortunately, they ended their first day of trading down almost 13%, making it one of the worst debuts for a billion dollar deal in a decade.

Number of IPOs by year

Below we explore how the number of IPOs has changed from year to year, beginning in 2000. Particular areas of note include the significant dip in 2008-09 which was of course down to the consequences of the financial crisis. In contrast, 2021 had over 1,000 IPOs, over double the number in 2020. This was down to the strong performance of the stock market and high liquidity which encouraged funding from investors.

Created by Amara