Megatrends can transform the priorities of societies and drive innovation to not only affect how we live, but also influence government policies and corporate strategies. Therefore, being aware of megatrends and their impacts can ensure that you, as an investor, are making sound investment decisions.

Climate Change

Perhaps the most alarming megatrend we have today is climate change. We are already witnessing its effects, for example through more extreme weather events. Unfortunately, as time goes on and without radical intervention, the consequences will only get worse. If we observe climate change from a purely economic standpoint, it is clear that certain industries will start to see lower returns. For example, in the chart below we can see industries that produce and rely on fossil fuels heavily are projected to have negative returns. On the other hand, other industries such as renewables and nuclear are set to benefit. Have you started adjusting your portfolio to reflect the consequences of climate change?

The rise in thematic ETFs

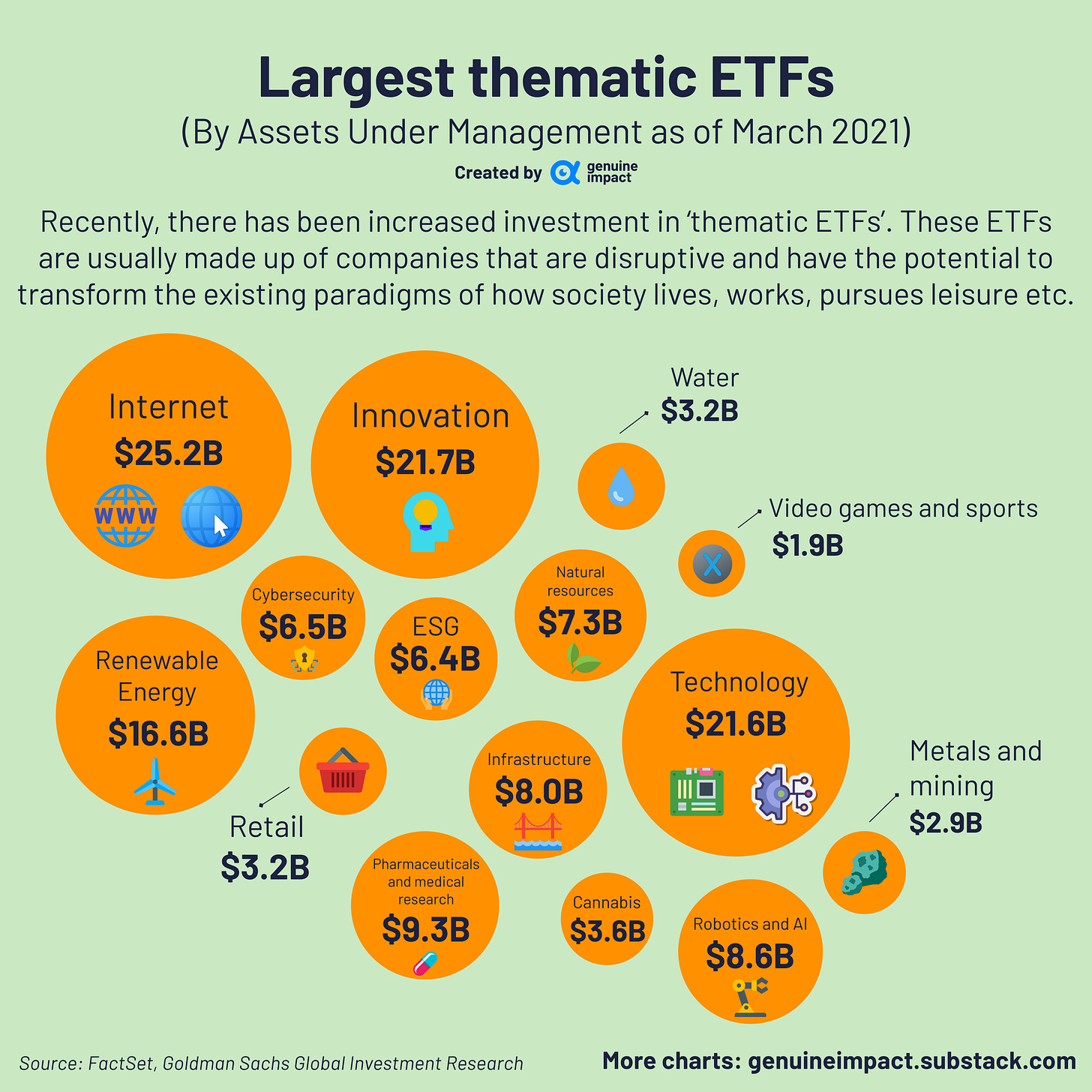

Due to these megatrends, there has also been a rise in ‘thematic ETFs’. These ETFs include companies that are involved in disruptive trends, and set to benefit from them which can therefore constitute as a long term investment strategy for some. Examples of thematic ETFs include: 5G, quantum computing, cutting-edge health care, hydrogen power, robotics, or cannabis.

Below, we summarise the largest thematic ETFs by category and also list their assets under management.

International Intrigue

Staying informed about the world doesn’t have to be boring.

International Intrigue is a free global affairs briefing created by former diplomats to help the next generation of leaders better understand how geopolitics, business and technology intersect. They deliver the most important geopolitical news and analysis in <5-minute daily briefing that you’ll actually look forward to reading.

*this is sponsored advertising content

Investment in AI

AI seems to be everywhere at the moment, with many companies coming up with their own renditions. This is reflected when looking at corporate investment in the chart below. In fact, from 2013 to 2021, corporate investment in AI has increased by over 2,900%, so it is not surprising at all how quickly AI is being developed and improved.

We also break down the types of investment: merger/acquisition, minority stake, private investment and public offering. It is clear that in recent years, private investment, followed by M&As are the largest contributors to corporate investment in AI.

See you on Friday for a Tesla deep dive!

Created by Amara

This newsletter started free, and we aim to keep it free for as long as we can. However, any support is always much appreciated - feel free to buy us a coffee using the link below <3