Navigating the Market Storm: Is the Global Economy on the Brink?

Is the Economy Headed for a Recession?

In the last two weeks, global financial markets experienced an unprecedented storm, with the VIX fear index soaring nearly 70%. Multiple countries and regions saw their stock markets trigger circuit breakers several times, plunging the markets into a state of panic.

This financial turmoil has not only caused heavy losses for investors but also sparked global concerns about economic prospects. So, why did this stock market storm happen? Is the global economy really starting to decline?

Is the underperformance of these tech giants' earnings reports really to blame? Why did Google and Microsoft, despite surpassing financial expectations, still see their share prices fall?

Global Stock Markets Encounter "Black Monday"

On August 5, global stock markets faced a "Black Monday."

🇯🇵Japan: Japanese stock markets plummeted, triggering circuit breakers on the TOPIX futures and Nikkei 225 volatility futures. The Nikkei 225 index closed down more than 12%.

🌍Global Markets: Beyond Japan, global stock markets also saw a collective adjustment. Major indices across the Asia-Pacific region and Europe also fell sharply.

🇺🇸United States: The U.S. stock market wasn't spared from "Black Monday," closing significantly lower on Monday. The Dow Jones Industrial Average plunged over 1,000 points, the Nasdaq dropped 3.4%, and the S&P 500 index recorded its largest one-day decline since 2022. Fears of a U.S. economic recession led to a global market sell-off.

🇨🇳China: In this round of declines, China's A-shares and Hong Kong stock markets avoided major losses, only seeing minor decreases.

On Tuesday, Japanese stocks rebounded sharply. After the opening, the market surged more than 10%, recovering most of the previous day's losses. The KOSDAQ futures in South Korea also soared, triggering the "SIDECAR" suspension mechanism. However, as global market anxiety continues to rise, future market prices may fluctuate like a roller coaster.

Why Did Global Markets Collapse?

The market collapse partly stems from changes in fundamentals, but a larger portion is due to widespread panic.

Fundamental Analysis

1️⃣ The Biggest Culprit of "Black Monday"—The Unwinding of Yen Carry Trades:

The yen's sharp appreciation is causing significant losses for investors who borrowed yen, as it increases the cost of repaying debt and forces many to close their positions.

Money for closing positions may come from selling assets like Japanese stocks, U.S. stocks, or even gold, which fell 1.6% on Monday. This suggests forced liquidation to meet margin calls. The unwinding of yen carry trades may also have added to U.S. stock market volatility.

2️⃣ Weak U.S. July Employment Report Sparks Fears of U.S. Economic Downturn:

Unwinding yen carry trades and July's U.S. non-farm payroll data have sparked recession fears, leading to declines in U.S. stocks.

July's unemployment rate rose to 4.3%, the highest in three years.

This rise triggered the "Sahm Rule" recession warning, with the indicator at 0.53%, above the 0.5% threshold. Consequently, market sentiment worsened, causing volatility in U.S. stocks, bonds, and forex markets.

3️⃣ Struggles of Tech Companies—Is the AI Bubble Bursting?

Investors in tech stocks are realizing that artificial intelligence, especially the chip manufacturing industry, has faced unrealistic expectations. Within ten days of major tech companies like Tesla, Alphabet, Amazon, Apple, Meta, and Microsoft releasing their earnings, U.S. stock prices saw significant volatility.

These companies reported earnings below expectations, leading to massive market sell-offs and increased doubts about the AI boom.

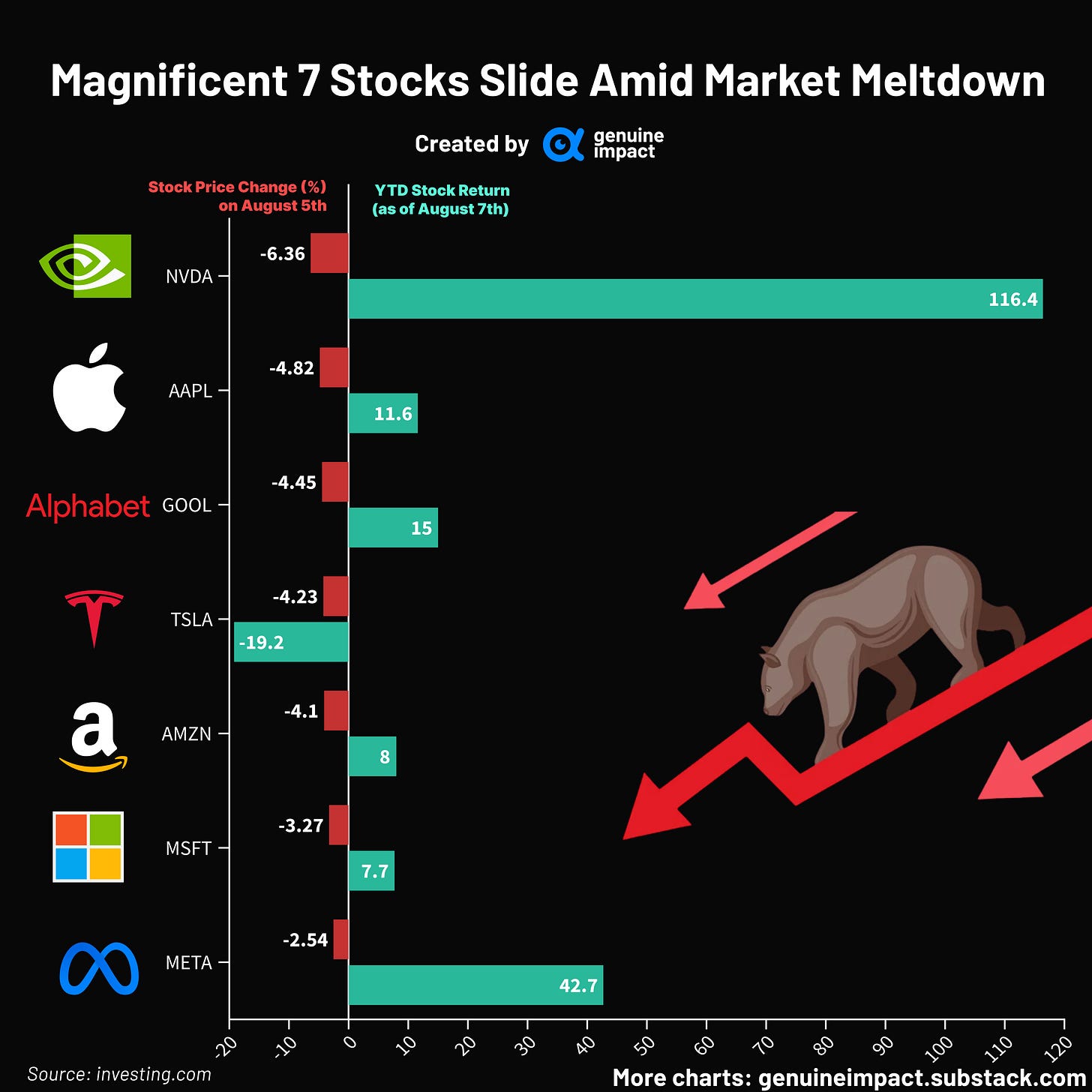

On August 5, the "Magnificent Seven" tech stocks collectively fell, losing $800 billion in market value. Apple closed down 4.82%, its worst since September 2022, worsened by Berkshire Hathaway's significant reduction in its Apple stake. Nvidia closed down 6.36%, Alphabet fell 4.45%, Tesla dropped 4.23%, Amazon declined 4.1%, Microsoft slipped 3.27%, and Meta dipped 2.54%. This broad sell-off shows waning investor enthusiasm for AI-related stocks.

Panic Analysis

2023 and early 2024 saw excessive greed and complacency. People believed in a guaranteed soft landing for the economy, rapid AI advancements, and no interest rate hikes in Japan, leading to risky trades. These trades are now collapsing, triggering liquidity events.

The yen interest rate hike, unsatisfied tech earnings, and weak U.S. data exposed the risks of yen carry trades and excess investment in tech.

🇯🇵 Yen Carry Trades: Low Japanese interest rates allowed cheap global borrowing, but yen appreciation now threatens leveraged bets. This could trigger margin calls, global sell-offs, and higher commodity prices, leading to more interventions by the Bank of Japan and market turmoil.

🇺🇸 Excess Investment in Tech Stock: Investors concentrated in tech giants like Nvidia, leading to high leverage and low volatility. High valuations made any poor performance trigger sharp market drops. Buffett's sell-off reflects concerns over high valuations, with tech stock declines sparking panic.

Market panic could disrupt the financial system, slow lending, and push the global economy into a recession.

Is the Economy Headed for a Recession?

From a fundamental perspective, neither the U.S. nor Japan's economies have fallen into deep trouble.

Historically, the U.S. economy goes through the following steps before entering a recession:

Central Bank raises interest rates significantly.

Market signals excessive tightening: Inverted yield curve.

The curve remains inverted for 12-27 months.

Economic slowdown.

The yield curve steepens in the later stages.

Finally, a recession occurs.

The market reaction appears as if the economy is close to step 6, but data suggests we are only at steps 4-5.

The inversion suggests pessimism about the future economy, as investors buy long-term bonds to lock in higher yields, increasing demand and lowering yields.

Despite fears, the U.S. job market is normalizing and still strong. The Sahm Rule's trigger doesn't guarantee a recession. Economic indicators show growth, and the Federal Reserve can lower interest rates to stabilize the economy.

Japan's economy remains stable, with no major company troubles or financial system concerns. The recent stock decline may be overdone, and market stabilization policies are expected to restore rationality.

In summary, while macroeconomic data suggests the trend of economic slowdown has not changed, the market's current overreaction is mainly due to panic.

Created by Yiding & Wendy

The signs of the inversion of the long-term T-Bonds when compared to the short term Notes (six month bonds), is most alarming… Insiders who are responsible (smart money), know something that common stock investors are more or less oblivious to. However the writing is on the wall.