From niche blind boxes in Beijing to celebrity-stamped bag charms in Paris, Pop Mart has evolved from a local novelty into a global cultural phenomenon—redefining what it means to collect, connect, and consume.

Curious how it all began—and where it’s headed next?

👇 Swipe through the journey below.

📈 Global Growth, Fueled by a Mischievous Gremlin

In its 2024 annual report, Pop Mart reported a remarkable shift: nearly 40% of its total revenue now comes from overseas markets, underscoring the success of its international expansion strategy. Revenue from the Americas and Europe surged 900% and 600% year-on-year, respectively—clear evidence that global audiences are embracing the brand.

Domestically, Pop Mart generated ¥7.96 billion (~$1.1 billion USD) in revenue from mainland China in 2024, with ¥3.83 billion (~$530 million USD) coming from offline channels. Its iconic roboshops—automated vending machines for blind boxes—alone contributed ¥698 million (~$96 million USD) in retail sales, highlighting the strength of its omnichannel distribution.

At the heart of this global wave? Labubu—a wild-haired, wide-eyed gremlin designed by Hong Kong artist Kasing Lung. With a mix of creepy-cute charisma, Labubu has captured the imagination of everyone from Paris Fashion Week fashionistas to K-pop icons like BLACKPINK’s Lisa.

So fierce is the demand that Pop Mart had to pause in-store sales of Labubu in the UK following crowd control issues and customer clashes. In China, customs authorities have launched crackdowns on smuggling, with travellers caught attempting to resell large quantities of the toy abroad.

💡 Pop Mart’s Model: What If Disney Met Streetwear?

At its core, Pop Mart is not just a toy company—it’s an IP platform.

Much like a record label scouts musicians, Pop Mart discovers independent artists, commercialises their characters, and builds emotional narratives that foster long-term fandom.

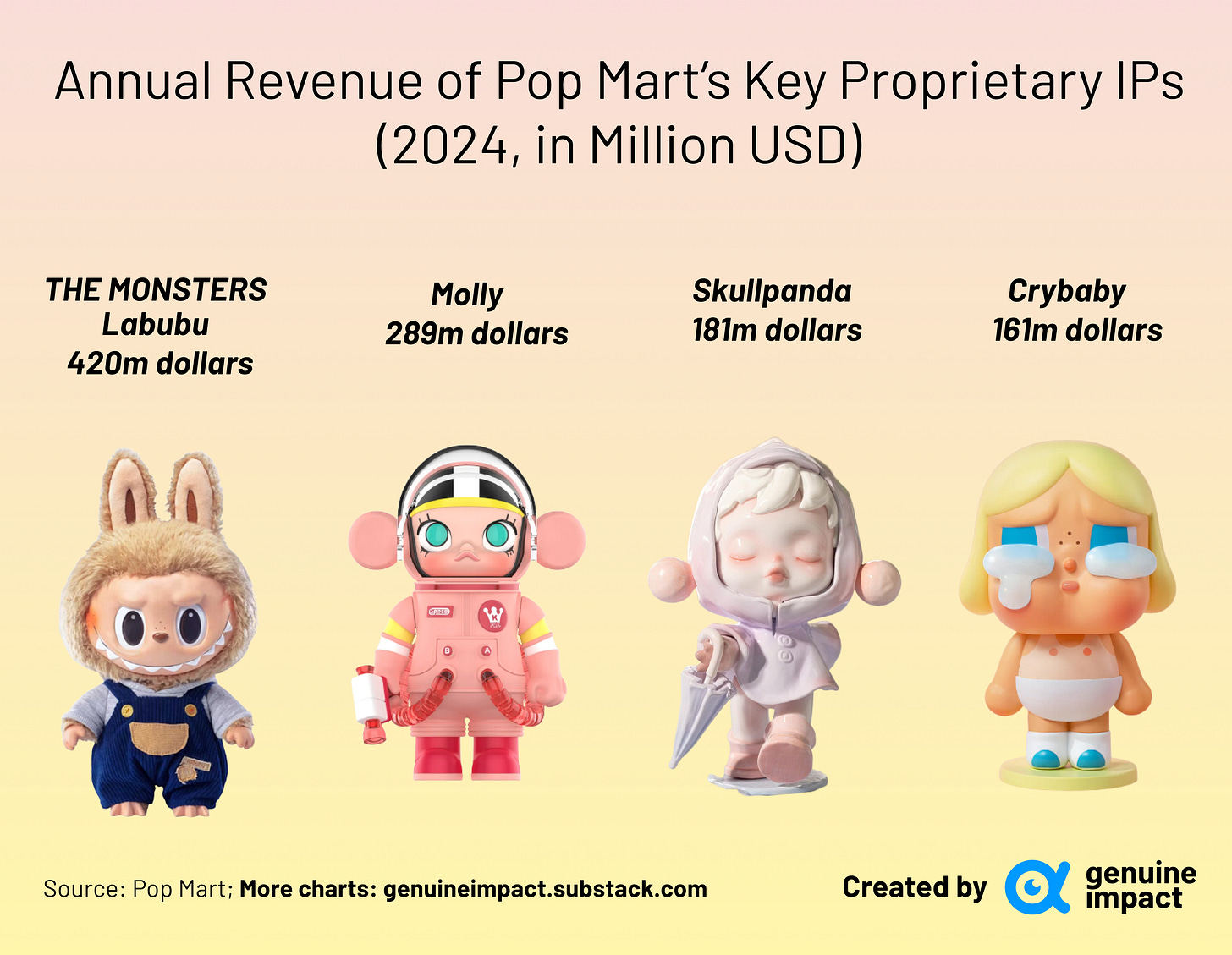

Its signature three-pronged strategy—IP creation + IP monetisation + IP operation—has given rise to billion-yuan brands like Molly, Skullpanda, CryBaby, and of course, Labubu. In 2024, Molly alone brought in ¥2.09 billion (≈$290M USD).

Unlike traditional IP companies that rely on slow, high-stakes content pipelines (think Disney’s 5-year film cycles), Pop Mart excels in agile, low-cost market testing. New characters often debut via small-scale blind box trials, robot stores, or pop-up events. Feedback is immediate; scaling happens fast.

The result? A self-reinforcing flywheel. As Pop Mart’s global footprint grows, the world’s best character artists are now seeking it out—knowing their work has the best shot at commercial and cultural success within Pop Mart’s ecosystem.

📊 From Cultural Icon to Capital Market Darling

With revenue more than doubling to ¥13.04 billion (~$1.8 billion USD) in 2024 and adjusted net profit surging 185.9% to ¥3.4 billion (~$470 million USD), Pop Mart is proving that emotional resonance can drive not only fandom—but also formidable financials. Its gross margin climbed to 66.8%, reflecting a high-value, IP-driven business model that scales without sacrificing profitability.

Investors have taken note. On 27 May 2025, Pop Mart’s Hong Kong-listed shares (HKEX: 9992) jumped 5.42% in a single day, pushing its market cap past HK$313.2 billion (~$40 billion USD) for the first time. Just a month earlier, the launch of a new Labubu collection had already helped the company hit historic highs.

Now with J.P. Morgan initiating coverage with an “Overweight” rating and a price target of HK$250, Pop Mart’s global narrative is gaining institutional traction. The bank projects overseas sales to grow 152% YoY in 2025, with international markets expected to account for 65% of total revenue by 2027. At the centre of this expansion? Labubu—whose search volume has now eclipsed Hello Kitty, and whose The Monsters series is forecast to grow from ¥3B in 2024 to ¥14B by 2027.

Pop Mart isn’t just building a lifestyle brand—it’s laying the foundations for China’s next great global consumer empire. And it’s doing so one mischievous gremlin at a time.

Stay tuned for our Friday premium edition where we’ll break down portfolio moves, sector rotations, and our next trade idea — all for just $6/month (or £5/month).

Join 36,000+ savvy investors who believe: “Your money deserves better.”

Keep in touch with Genuine Impact!

Instagram | X/Twitter | LinkedIn

Created by Arya