✨ Gold: 6,000 Years of Obsession—and Why It Still Matters

From ancient tombs to modern trading floors, gold has always fascinated humanity. It’s not just a precious metal—it’s a mirror reflecting how we deal with beauty, fear, wealth, and uncertainty. Even in today’s fiat world, when headlines turn dark, one instinct remains unchanged: buy gold.

In this week’s spotlight, we break down what drives gold’s lasting appeal—its supply constraints, shifting demand, price logic, and what investors should really know.

🪙 A Limited Supply—With Global Reach

Roughly 210,000 tonnes of gold have been mined in human history. If you poured it all into a football field, it would only reach about 1.5 metres high. That’s how rare gold truly is.

Production surged during the 1848 California Gold Rush and again in Australia soon after. But surprisingly, South Africa—not the US—was historically the biggest contributor, once providing a third of global supply. Today, China (380 metric tonnes), Australia (310), and Russia (290) lead annual output.

Unlike oil, there’s no OPEC for gold. Mining remains market-driven: if prices fall, producers simply cut back.

💍 Why People Buy Gold

Gold demand breaks down into four key categories:

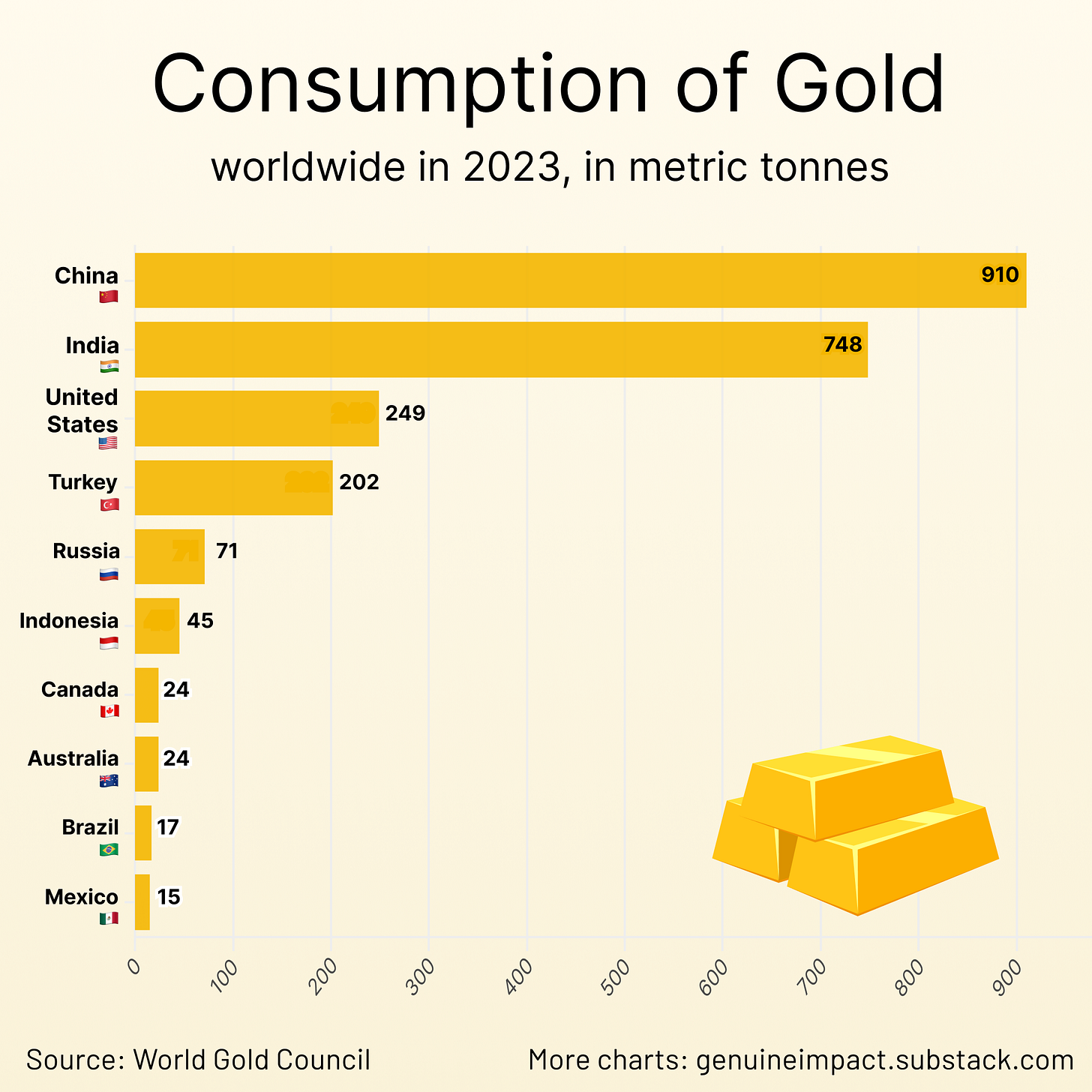

Jewellery (50%): Loved for its beauty and durability, especially in China and India, which together make up around 50% of global demand.

Official Reserves (25%): Central banks—especially in China, Turkey, and Russia—are quietly hoarding gold as a hedge against dollar risk.

Private Investment (20%): Physical bars, coins, ETFs, futures—you name it. Even Costco has been selling gold bars, with sky-high demand.

Industry (5–10%): Electronics and dentistry rely on gold’s conductivity and corrosion resistance. No substitutes here.

💸 What Really Moves the Price?

Supply is stable. What swings gold prices? That’s where psychology takes over.

🔎 Rational forces like inflation fears and risk aversion tend to push investors toward gold. As a non-yielding asset, it’s valued for its ability to hedge against currency devaluation and market stress. Historically, it moves in the opposite direction of equities, serving as a counterbalance in turbulent times.

❤️ But emotion plays just as powerful a role. Centuries of cultural belief in gold’s value fuel instinctive demand, especially in times of uncertainty. And in the age of social media, herd behaviour, viral headlines, and speculative hype often trigger sudden rallies. That’s why gold is more volatile than many expect—its annualised price swings can reach 20%, exceeding even those of stocks.

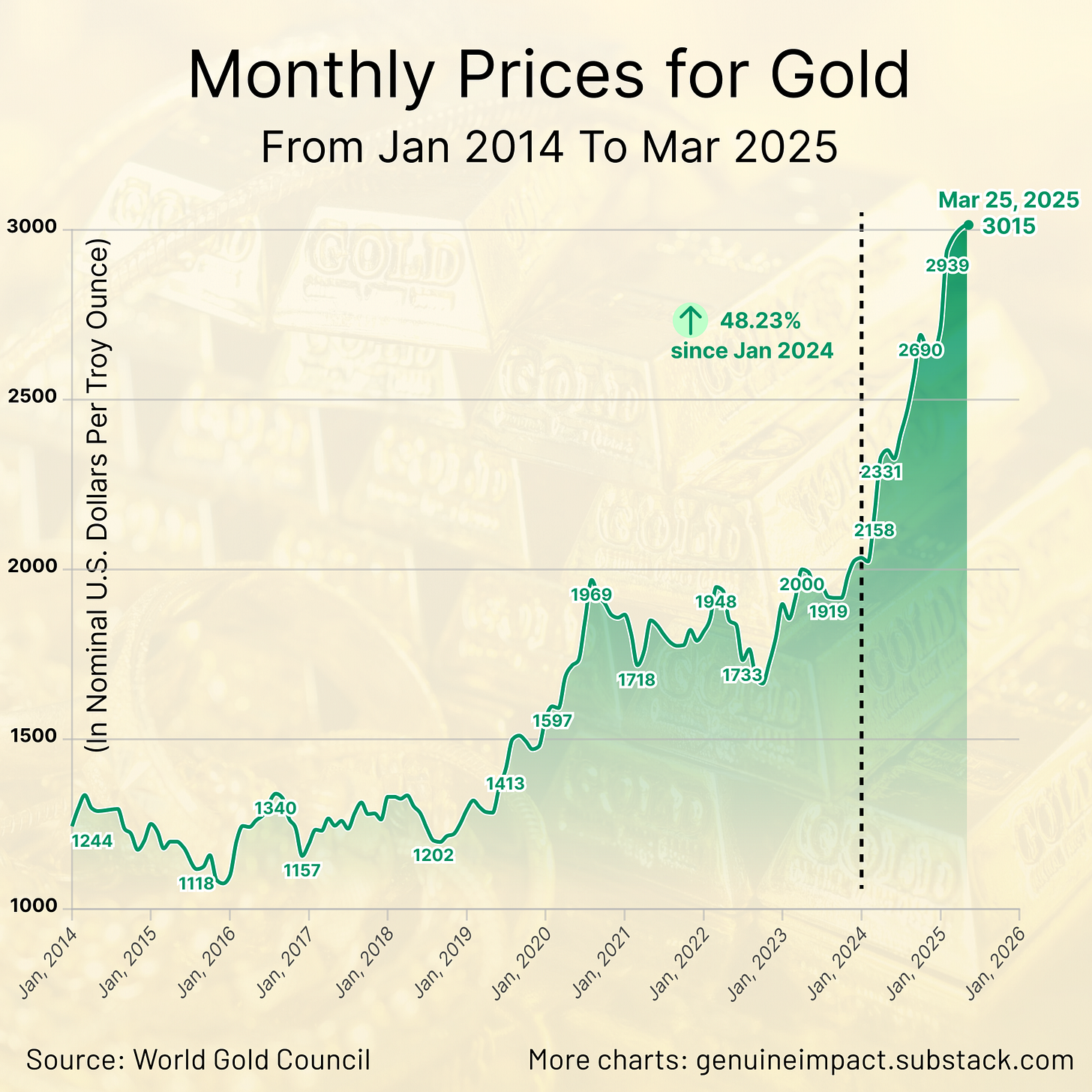

In 2024, a modern gold rush swept through the digital marketplace. Global instability and rising geopolitical tensions dominated the news cycle, and gold reclaimed its spotlight as a strategic safe-haven asset. Central banks led the charge—collectively purchasing over 675 tonnes of gold by Q4 2024, significantly influencing market movements.

The result? A powerful surge. Since January 2024, gold prices have jumped around 48%, reaching $3,015 per troy ounce by March 25, 2025. This rally sparked a logistical frenzy—gold bars began flowing from vaults in London to New York, as investors and institutions tried to arbitrage regional price gaps. Meanwhile, public figures like Elon Musk stirred public debate, calling for audits of national gold reserves, including the famously opaque Fort Knox.

Behind the headlines lies a deeper signal: global governments are once again treating gold not just as a commodity, but as a pillar of monetary sovereignty and strategic security. As the world navigates economic uncertainty, gold remains a key anchor in the search for stability and resilience.

⚖️ Should You Invest in Gold?

Should you invest in gold? ✅ As a crisis hedge, gold offers high liquidity across major markets like London, New York, and Shanghai, and has low correlation with traditional assets—making it a strong diversifier. ⚠️ However, it generates no cash flow, can lag behind equities over the long run, and its price is often volatile and sentiment-driven. That’s why most professional investors limit gold to around 5% of their portfolios.

💡 Five Golden Tips for Gold Investors

Accept the volatility—short-term drops are normal

Think long-term—gold’s true value emerges over years

Watch transaction costs—physical gold can have 5–10% spreads

Don’t go all in—stick to a certain allocation

Don’t over-rely on technicals—price sometimes moves on emotion, not logic

Gold isn’t just about economics—it’s about emotion. It reflects fear, faith, and our craving for something tangible in a digital, uncertain world.

Its weight is more than metal. It carries the burden—and comfort—of history itself.

📩 In these volatile times, curious how we’re positioning across assets and equities? 👉 Don’t miss this Friday’s premium edition, where we’ll break down our stock picks, portfolio allocations, and trade ideas — all for just $6/month (or £5/month).

Join 36,000+ savvy investors who believe: “Your money deserves better.”

In Case You Missed It 📬

🐣 The Business of Bunnies: Easter Spending Keeps Climbing

Easter might be about spring blooms and chocolate eggs—but make no mistake, it’s big business. U.S. consumers are expected to shell out $22.4 billion on the holiday, according to the National Retail Federation’s 2024 report. That averages $177 per person—one of the highest Easter spends on record.

💸 Where the Money Goes

Here’s how America’s Easter basket breaks down:

$7.3B on food 🍽️

$3.5B on new clothes 👗

$3.4B on gifts 🎁

$3.1B on candy 🍬

$1.6B on flowers 🌸

The National Confectioners Association says confectionery sales will clear $5 billion, with 92% of Americans celebrating including candy in their plans.

🥚 Eggflation is Real

Inflation’s bite is hitting even the humble egg. In early 2025, a dozen Grade A eggs soared to $5.90, nearly double from $3.00 the year before, driven by another round of avian flu outbreaks. Traditional egg hunts? They’re getting pricey. Rising prices aren’t just hitting eggs:

72% of consumers say inflation is impacting Easter plans

43% are hunting harder for sales

16% will trim their holiday meal budgets

14% plan to host fewer guests

The 2025 Easter spending forecast is still in the works—but if trends hold, cost-conscious celebrations will continue. Expect more shoppers to swap giant chocolate bunnies for budget buys or DIY traditions.

In the Easter economy, it’s clear: consumers love a good deal—almost as much as chocolate.

This information is for guidance purposes and may become out of date at any given time. It is not investment advice. Investments can rise and fall in value. Genuine Impact won’t make any assessment of whether the investments you choose are appropriate or suitable for you. If you are unsure of the suitability of any investment, investment service or strategy, you should seek independent financial advice. Past performance does not indicate future results. Your capital is at risk.

Keep in touch with Genuine Impact!

Instagram | X/Twitter | LinkedIn

Created by Arya and Peggy