Tariffs reshape global trade

How Trump’s Trade War Could Disrupt the Global Economy

How will the latest U.S. tariff policies reshape global trade?

Where is the U.S.-China trade war headed next?

How much did Palantir's strong Q4 results deliver for investors?

Tariffs Back in the Spotlight—Trump’s Economic Nationalism Returns

Trade tensions are heating up once again, and at the centre of it all is President Donald Trump’s economic nationalism. His “America First” policy has long emphasised protecting U.S. industries, reducing reliance on foreign markets, and reviving domestic manufacturing. Now, with a fresh round of aggressive tariff hikes, Trump is doubling down on his belief that higher trade barriers will bring jobs back to the U.S. and encourage consumers to buy American-made products.

This protectionist stance resonates strongly with blue-collar workers in Rust Belt states and small business owners—groups that have long felt left behind by globalisation. But while tariffs might be popular among these voters, the international fallout is already taking shape.

Targeting the Big Three

On February 1st, Trump announced sweeping tariffs targeting the United States' three largest trading partners: Mexico, China, and Canada. Starting February 4th, China was set to face an additional 10% tariff on top of existing levies, while Mexico and Canada were initially slated for a 25% tariff.

Why these three countries? What's the official reasoning? To punish these countries for their trade surpluses with the U.S. and their supposed failure to curb illegal drug flows. In 2023, 🇲🇽 Mexico ($475.6B) overtook 🇨🇳 China ($427.2B) as the U.S.’s largest trading partner. 🇨🇦 Canada ($ 421.1B) followed closely, benefiting from deep trade ties with the U.S. under agreements like the United States-Mexico-Canada Agreement (USMCA).

📊 The urgency is clear—America’s trade deficit is ballooning. In 2023, U.S. imports hit $3.86 trillion, significantly outpacing the $3 trillion exports. For Trump, slapping tariffs on key trade partners is not just about economic policy—it’s about political messaging, reinforcing his stance that foreign competitors have been taking advantage of the U.S.

Mexico and Canada Catch a Break—But What About China?

In a political twist, Mexico and Canada have dodged Trump’s tariff hammer—for now. On 3rd February, Mexican President Claudia Sheinbaum announced that, following a call with Trump, the U.S. had agreed to postpone its planned tariffs on Mexican goods for one month. Soon after, Trump confirmed the news, calling it a “very good” deal.

Wall Street wasted no time reacting. The stock market, shaky from tariff fears, quickly rebounded. The Dow Jones surged over 700 points, with the S&P 500 and Nasdaq following suit. In forex, the Mexican peso and Canadian dollar jumped. By market close, futures were up—S&P 500 by 0.7%, Nasdaq by 0.8%, and Dow by 0.5%. Analysts saw the delay as classic Trump strategy—keeping trading partners on edge while holding the tariff threat over them.

And the dominoes kept falling. With Mexico getting a temporary reprieve, Canada was next in line for relief. In an evening report, CNN revealed that Trump’s call with Canadian Prime Minister Justin Trudeau had been “very smooth”—which, in Trumpian language, roughly translates to we’re hitting pause on the trade war, for now. Trudeau later confirmed on X (formerly Twitter) that tariffs on Canada would also be postponed for at least 30 days.

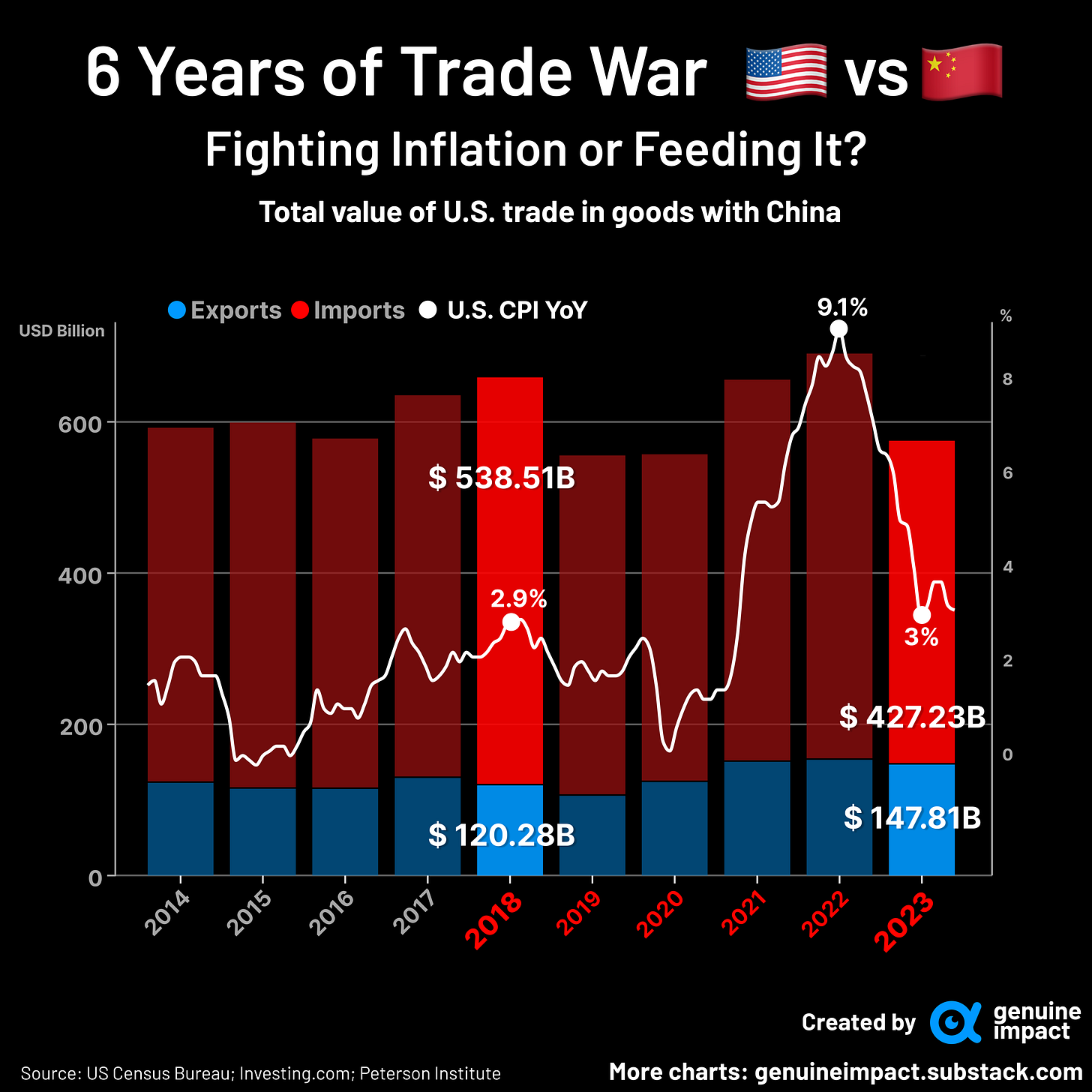

However, the same can’t be said for China. If history tells us anything, it's that Trump’s trade battles with Beijing don’t tend to de-escalate—they escalate. What about the outcome of the trade war that started in 2018? The numbers paint a clear picture:

📈 U.S. Exports from China:

2018: $120.28B ➡️ 2023: $147.81B (+22.89%)

📉 U.S. Imports to China:

2018: $538.51B ➡️ 2023: $427.23B (-20.66%)

Yes, exports to China have increased while imports have declined, but the trade deficit remains massive. And inflation? It soared to a 40-year high during the U.S.-China trade war, cooling slightly in 2023 but still sitting above pre-war levels.

So, will Beijing receive the same diplomatic lifeline as Mexico and Canada, or is Trump preparing for another round of economic combat? Will tariffs be a strategic bargaining chip or an economic wrecking ball?

💰 Wondering how this tariff turbulence could impact your investments? We’re now offering exclusive insights and access to our Insider’s Portfolio (currently up 97%!) for just USD $6/month (or GBP £5/month)! 🚀

Join over 32,000 subscribers who know that “Your money deserves better.”

In Case You Missed It 📬

🚀 Palantir Surges 20% After Strong Q4 Results

📈 Palantir reported a total revenue of $828M, a 36% YoY increase that exceeded expectations. U.S. revenue grew by 52% YoY, with commercial revenue leading at 64% growth. Net income was $79M (-20.6%), impacted by stock-based compensation costs. For FY 2025, Palantir expects revenue to reach $3.74–$3.75B, with a projected 54% growth in U.S. commercial revenue and $1.5-1.7B in free cash flow. However, with a market capitalisation of approximately $190 billion, Palantir trades at a premium of over $100 billion compared to peers with similar fundamentals.

💡 Why is Palantir’s stock surging despite concerns over valuation? Palantir’s accelerating commercial adoption, cash generation, and expanding gross margins reinforce its position as a premier AI platform company. Palantir’s AI platform is achieving network effects, driving higher customer acquisition velocity (+43% YoY), and increasing returns to scale.

📍 This transformation supports its premium valuation, as investors focus on long-term operational leverage and market dominance in AI-driven enterprise solutions. While valuation and volatility concerns persist, Palantir’s expanding role in enterprise AI and government intelligence makes it a compelling player in the high-growth AI sector.

Keep in touch with Genuine Impact!

Instagram | X/Twitter | LinkedIn

Created by Arya