⚡️🚘 The EV Conversion: Car Sales vs Manufacturing 📉

What Vauxhall’s closure tells us about the EV revolution and industry struggles.

Why is Vauxhall closing its historic plant, deeply entwined with its surrounding community?

How will Europe balance EV growth with the looming economic upheaval?

Can Trump’s treasury wizard slash the deficit from 6.4% to 3%?

How did a $6.2M banana leave a vendor earning $12/hour baffled?

💬 Before we dive into the numbers, we want to hear from you!

Your feedback helps us improve, shape our stories, and bring you even better insights every week 🙌.

⚙️ Vauxhall’s Plant Closure Signals Big Shifts in the UK Auto Industry and Beyond

After 120 years of operation, Vauxhall’s Luton UK factory will close its doors in April 2025, leaving over 1,100 jobs at risk. Stellantis, Vauxhall's parent company, plans to soften the blow by transferring "hundreds" of workers to the Ellesmere Port facility in Cheshire UK, which is being transformed into a GBP £50 million electric vehicle (EV) production hub. Whilst Stellantis’ move underscores deeper challenges for the UK automotive industry, it’s still a trend impacting global auto manufacturers.

🚗 Why is Vauxhall Downsizing?

Declining Revenues and Market Share

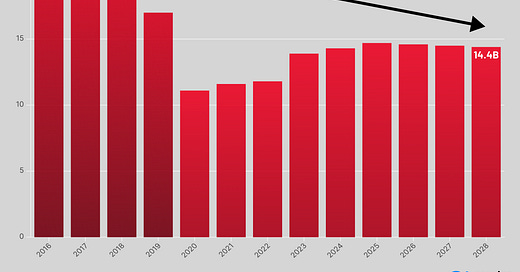

The numbers paint a grim picture: Opel/Vauxhall’s global revenues have dropped from USD $20.3 billion to USD $14.4 billion in just a few years, with a Compound Annual Growth Rate (CAGR) of -2.2%. In the UK, Vauxhall's market share shrank from 11% in Q1 2021 to just 6% by Q3 2024. For a brand once synonymous with British roads, these figures are hard to ignore.

Innovation Adoption Challenges

Vauxhall's core consumer base is also dragging its feet on EV adoption. According to Statista consumer report, 66% of Vauxhall drivers fall into the “laggards” or “late majority” categories when it comes to adopting new innovation products. Translation: most Vauxhall owners aren’t rushing to embrace electric vehicles. This slow shift in consumer mindset has put the company in a tough spot, especially as EV mandates tighten across the UK and EU.

🔋 The Shift to Electric: Ellesmere Port’s New Role

Stellantis’ GBP £50 million investment in Ellesmere Port is a silver lining for the region. This facility will become Stellantis’ first all-electric plant, producing EV vans and compact electric cars for the UK and European markets. With Vauxhall committing to becoming an all-electric brand by 2028—a timeline more aggressive than most of its competitors—Ellesmere Port is set to play a pivotal role in this transition.

The relocation package for Luton employees includes "relocation support" and "attractive benefits," but union leaders have called the closure a “slap in the face.” For many workers, moving north might not be an easy sell.

📈 The Bigger Picture: A Growing EV Market

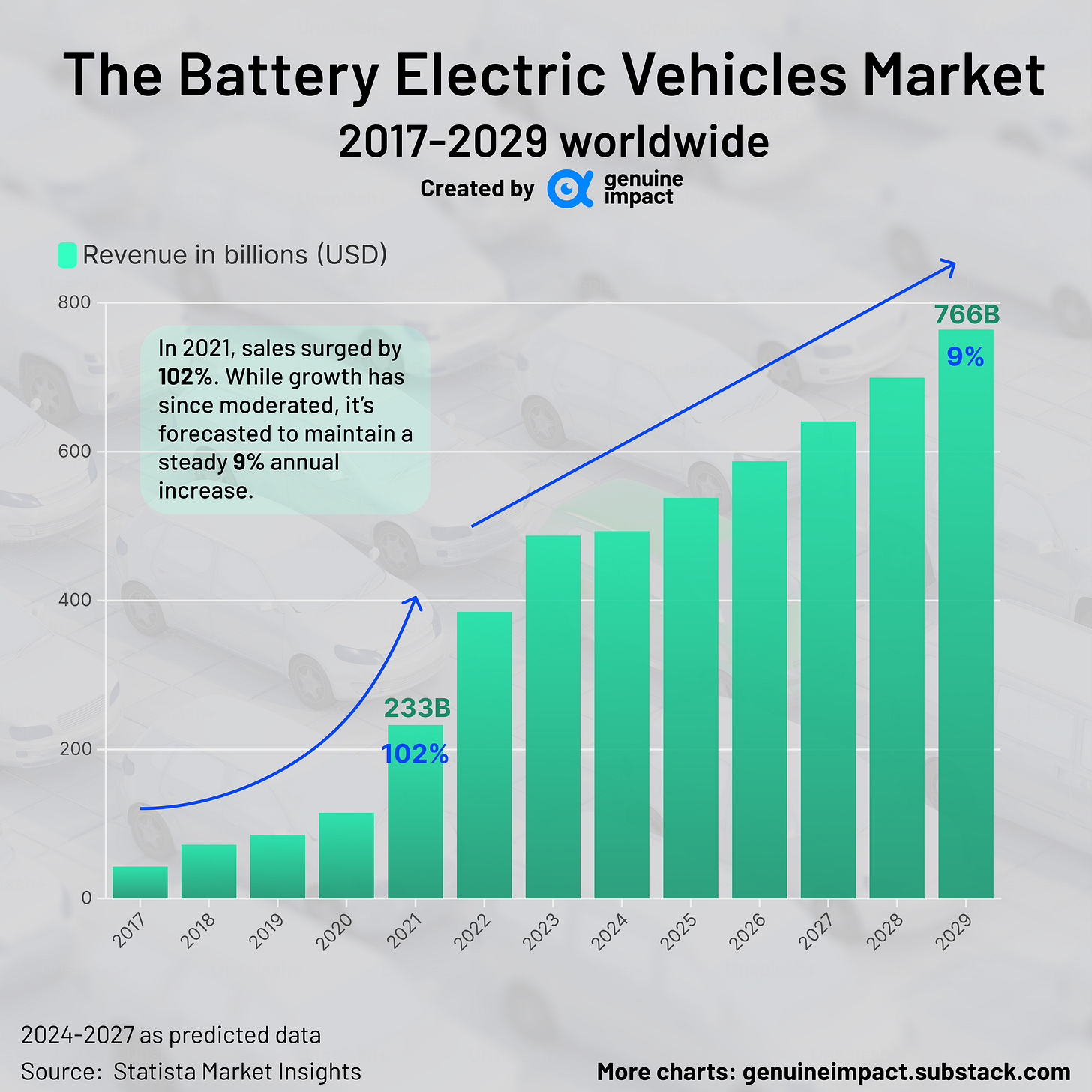

Globally, EV adoption is charging ahead. In 2021, sales surged by a staggering 102%. While growth has since moderated, it’s forecasted to maintain a steady 9% annual increase, with the global EV market reaching USD $766 billion by 2029. The shift to electrification, however, comes with significant consequences.

Germany, the beating heart of Europe’s automotive industry, is also facing unprecedented challenges as the transition to electromobility takes hold. As a prediction, by 2030, up to 210,460 jobs could be directly at risk, with another 78,310 indirectly affected. Entire regions tied to traditional auto manufacturing are bracing for economic upheaval, as the shift to EVs disrupts supply chains, production processes, and workforce dynamics. While EVs promise a cleaner future, they also pose critical questions about how to retrain and reemploy workers in an evolving industry.

🤔 Balancing Growth and Disruption

As Europe wrestles with the fallout of its EV transition, another powerhouse is making waves. China’s EV industry, fueled by relentless innovation, low production costs, and an export-driven strategy, is soaring to new heights.

This Friday, we’ll explore how China's rise as an EV giant is reshaping the global automotive landscape and challenging the dominance of established markets. Stay tuned! 🚗🌏

In Case You Missed It 📬

📊 From 6.4% to 3.0%: Can Trump’s Treasury Wizard Pull It Off?

Trump picked Bessent, a hedge fund wizard, to be treasury secretary, and he is known for wanting to cut the budget deficit to 3% of GDP. But looking at 2024, where the deficit hit 6.4% of GDP (totalling USD $1.83 trillion), Bessent’s got his work cut out for him.

🍌 From Quarter to Millions: The $6.2M Banana That Left a Vendor Baffled

A banana sold for 25 cents at a New York fruit stand became the centrepiece of a USD $6.2 million Sotheby’s artwork, only to be eaten by buyer Justin Sun at a Hong Kong press event. Sun, a crypto entrepreneur, later announced plans to buy 100,000 bananas—worth USD $25,000—from the same vendor. Generous? Hardly.

Shah Alam, the 74-year-old vendor who earns $12 an hour, called the offer more trouble than triumph. Transporting and storing such a massive haul would leave just crumbs of profit. The stand’s owner, Mohammad Islam, saw little impact on his workers' lives, saying, “It’s the difference between heaven and hell.” In a world where a banana can cost millions but the seller struggles to break even, this tale peels back the absurdity of wealth and inequality—one fruit at a time.

Keep in touch with Genuine Impact!

Instagram | X/Twitter | LinkedIn

Created by Arya