The Fed Under Fire: Why Trump’s Tantrum Is Backfiring in the Markets

Market Meltdown: Cracks in the Dollar Dominance Faith

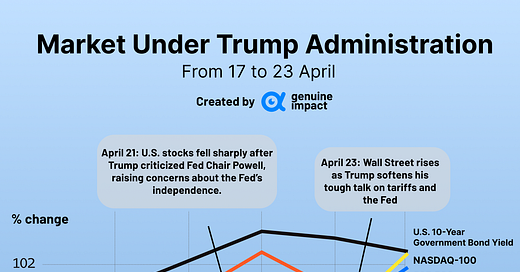

Trump lashes out at Fed Chair Powell, demanding rate cuts to ease trade war fallout—but markets aren't buying it.

Markets tumble as confidence in USD assets wavers, with a rare “triple whammy” sell-off in stocks, bonds, and the dollar forcing Trump to concede

Despite Trump's walk-back, long-term fears over Fed independence and inflation risks continue to loom investors.

How our insider portfolio is adjusting to the current market turbulence?

How does Jay Powell become Trump’s latest target

Jay Powell, the head honcho at the Fed, has become Trump’s latest punching bag. After months of grumbling about the Fed’s refusal to slash interest rates, Trump finally lost the plot over the weekend. In a typically restrained social media rant (read: not at all), he dubbed Powell “Mr. Too Late” and “a major loser.” One of his advisers even floated the idea of giving Powell the boot—though Trump quickly backpedalled. Classic.

So why is Trump fuming? Simple: he wants rate cuts, and the Fed’s not playing ball. With interest rates still sitting at a lofty 4.25%–4.5%, the Fed is in no rush to bring them down. But Trump’s got three big reasons for wanting them slashed: