The Impact of June 2024 CPI on Markets and What to expect

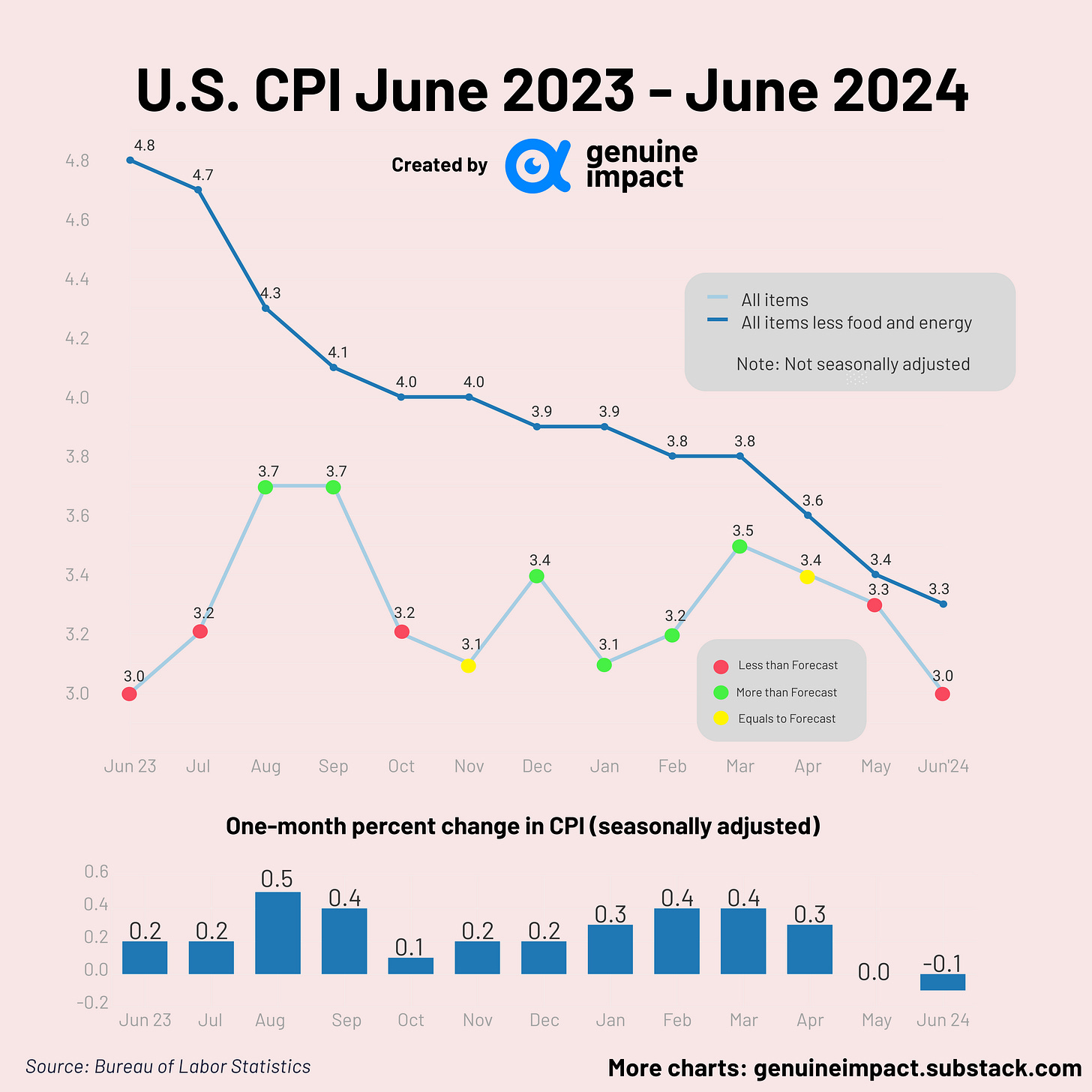

The CPI of the USA, a broad measure of costs for goods and services, declined 0.1% from May, resulting in a 12-month rate of 3%. Is it a good sign? What does it mean for investors?

The consumer price index, a broad measure of costs for goods and services across the U.S. economy, declined 0.1% from May, putting the 12-month rate at 3%. Core CPI, which strips out volatile food and energy prices, reached 3.3% on an annual basis. Both the CPI and core CPI are below the economists’ expectations, of 3.1% and 3.4% receptively.

The monthly inflation rate dipped in June, reaching the lowest point in over three years. It increased the likelihood that the Federal Reserve will start lowering interest rates later this year.

Key CPI component change and labour market

The most significant factor in this CPI change is housing inflation, which had been the most uncooperative part of the price index. It only rose 0.2% comparing to 0.4% average from Feb 2024. Energy prices maintained the downward trend of oil prices in May, and gasoline prices fell by -3.8% month-on-month in June, continuing to fall slightly from the previous value. Both factors contributed to the overall decline in inflation.

Omair Sharif of Inflation Insights argued that housing costs had turned a corner, and now he expects inflation to be “meaningfully slower.”

The latest data supports US Federal Reserve chair Jay Powell’s message to US lawmakers this week that the US economy is no longer “overheated”, with the labour market showing more signs of cooling. Powell told the Senate banking panel on Tuesday that the labour market "appears to be fully back in balance," lowering the bar for interest-rate cuts.

Powell's status-quo description was somewhat of a letdown after Friday's June jobs report. The report showed that hiring slightly exceeded expectations, but private-sector hiring was soft, and job growth in prior months was revised much lower. Unemployment rose to 4.1% for the first time since late 2021, while wage growth matched a three-year low.

Since late 2022, Powell has emphasised inflation in non-housing services as crucial to the interest-rate outlook, given that wages constitute a high percentage of costs for service businesses, from health care to haircuts to hospitality. On Tuesday, Powell noted that the labour market is "not a source of broad inflationary pressures for the economy now."

This followed Powell's dovish statement at a European Central Bank forum last week: "We are getting back on a disinflationary path," though he added that more positive inflation data is still needed.

Impact on the Market

In the following section, we will look at how various assets are moving after the release of the June CPI data: The U.S. dollar, U.S. stock futures and gold.

To U.S. dollars

The U.S. Dollar Index (DXY) is on shaky ground this week after the latest CPI report indicated decreasing inflationary pressure in the U.S. On July 16th, it saw a 0.11% increase after initially dropping to a -0.3% decrease following the release of the CPI figure.

To Stock market

After the CPI data was released, the stock market experienced a volatile week, especially the Dow Jones Index rebounded significantly after the early decline, exceeding 40,000 points and hitting a record high. The main reason is that U.S. stocks have experienced a wave of gains due to relatively optimistic June inflation data and high expectations for two interest rate cuts this year. In addition, the United States has entered the earnings season and the "Trump trade" driven by Trump's increased probability of winning the election has pushed up the U.S. stock market.

For more information on the impact of the "Trump Trade" on the market, please follow our analysis on Monday

As of late Tuesday, 16th of July:

SP500: The S&P 500 fell 0.9% on the day after the CPI release, ending a streak of six record closes. Then showing slight declines and increases, ending with a modest positive return around 0.43%.

DOW: Displayed a relatively stable trend initially with minor dips, followed by a notable rise, ending with the highest positive return of 2.72%. As interest rates fall, this will help lift stock valuations, especially low-valuation stocks. These low-valuation stocks are mainly concentrated in the Dow, which is also the reason for the recent rebound of the Dow.

NDAQ: Exhibited more volatility, with several peaks and troughs, as Nvidia, Tesla and other big tech stocks retreated.

To Gold

Since the CPI figure release, there is a noticeable upward trend in the Gold price and, despite some volatility, it continued its upward trajectory, closing at 3.89% on 16th of July.

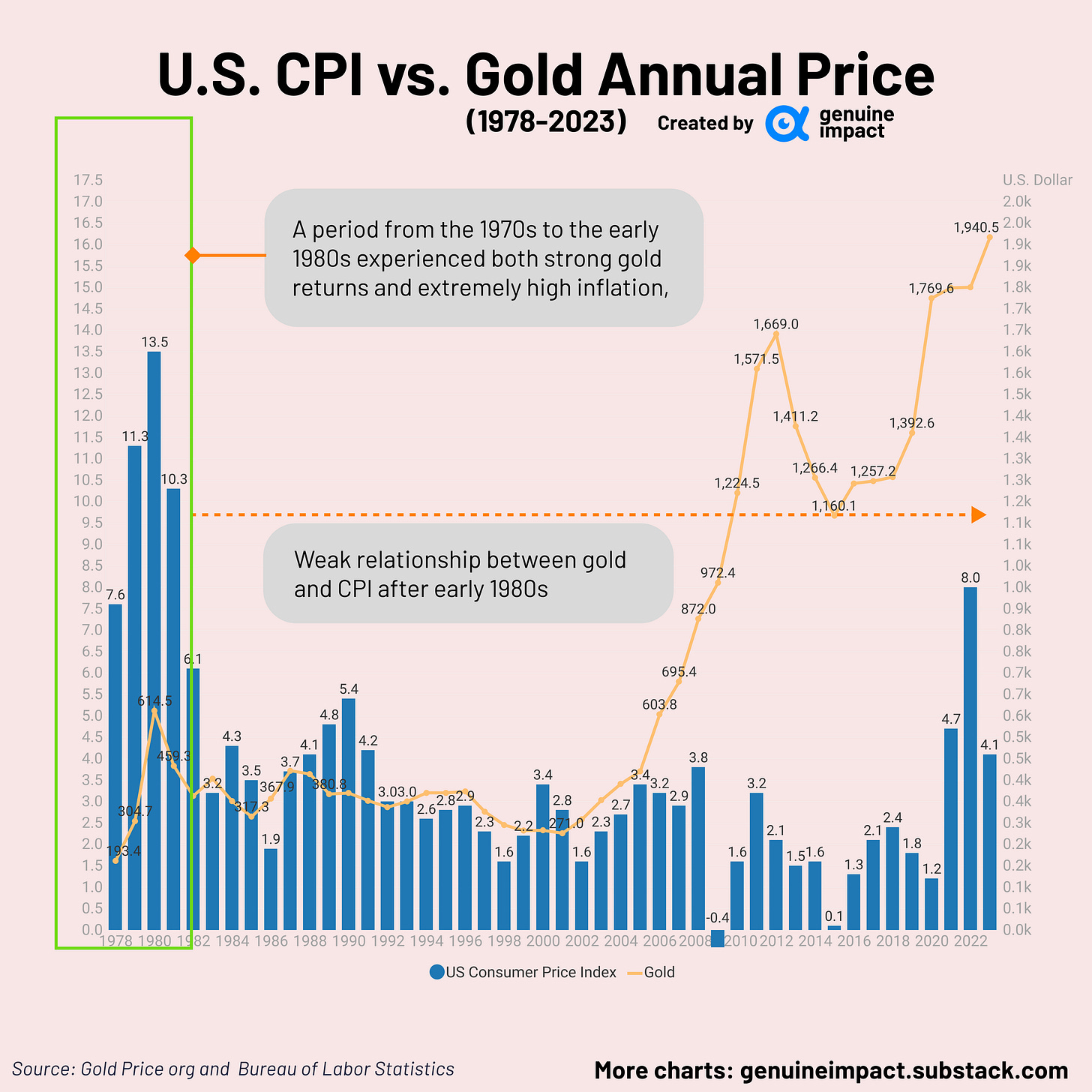

Gold is often seen as a hedge against a rise in the CPI; In theory, if CPI data shows a slowdown in inflation, it may weaken the safe-haven demand for gold and cause the price of gold to fall.however, data challenges this opinion, especially in the short and medium run, which can span decades. Gold primarily reacts to significant increases in inflation, while moderate inflation or declining inflation does not materially impact its price. A report by Reuters indicates that gold returns and CPI changes have a historically weak linear relationship. Since 1971, only 16% of the variation in gold prices can be explained by changes in CPI inflation.

Anticipation

Following the soft employment data in the United States, which indicated a cooling labor market, the unexpectedly lower CPI data has undoubtedly boosted market expectations for a rate cut within the year. After the release of the CPI data, the probability of the Federal Reserve initiating a rate cut in September rose to 93.3%. At the same time, the expectation of another 25 basis points rate cut in November increased from 33.5% to 56%. The anticipation of two rate cuts within the year subsequently led to a decline in long-term U.S. Treasury yields.

Looking ahead, given the current decline in the activity of the U.S. service sector and the resulting reduction in the primary drivers of new non-farm employment, the future wage levels in the United States may gradually decrease as the labour supply and demand balance. This could put pressure on consumer due to reduced income. Additionally, the downward trend in housing-related price indices, which may continue due to data lag, could increase the likelihood of a steady decline in future inflation.

With the Federal Reserve likely to cut rates in September, the inflation rate is expected to further decrease to the target level of 2%.

What it means to investors:

U.S. dollars: The CPI data, along with recent comments from Fed Chair Jerome Powell, has bolstered hopes of a rate cut in September. Consequently, the DXY could remain under pressure in the coming sessions.

U.S. Stock Market: With inflation moderating, it may be prudent to consider defensive stocks such as those in the utilities and consumer staples sectors. These stocks tend to perform well in uncertain economic conditions due to their stable demand. Also, consider investing in international markets. With the US dollar potentially weakening due to lower inflation and interest rate expectations, international investments could yield better returns.

Gold: The insignificant linear relationship between inflation and gold price does NOT preclude gold from being used as a hedge. Instead, it merely suggests that US CPI alone is often insufficient to push gold’s price up or down. But lower sensitivity should not lead to complacency. It is crucial to have a well-planned inflation strategy in place and gold should be a component of this strategy.

CPI data is a key indicator of inflation, and its changes directly affect the central bank's monetary policy decisions, thus having a profound impact on the stock, gold, bond and foreign exchange markets. Keeping an eye on CPI data can help investors adjust investment strategies in a timely manner to respond to market fluctuations.

Maximize your productivity

Revolutionize your workflow with Notion - the all-in-one workspace for teams. From project management to note-taking, database organization to task tracking, Notion adapts to your unique workflow, fostering collaboration and efficiency. Experience the power of seamless integration, dynamic layouts, and customizable tools that elevate your productivity. Try Notion today and transform the way you work.

*This is sponsored advertising content.

Created by Yiding & Wendy & Shawn