The Magnificent 7's Financial Performance in Q2 2024: A Reflection on AI Investment and Market Sentiment

The market value of the "Magnificent 7" tech giants in the US stock market dropped by an astonishing $1.27 trillion last month." Did the earnings reports trigger the stock decline?

In July, the combined market capitalisation of the top 7 tech giants in the US stock market dropped by an astounding $1.27 trillion. On Monday, the US stock market declined significantly following Friday’s jobs report, which revealed a weaker-than-expected labor market, triggering sharp losses, while The S&P 500 saw more than 4% drop- making it its most painful day since September 2022. The Dow Jones Industrial Average dropped 2.8%, marking its worst decline since September 2022. The "Magnificent 7" tech giants were hit hardest, with Apple down 8%, Microsoft 5%, Nvidia 14%, Alphabet 6%, Amazon 8%, Meta 7%, and Tesla 11%. These companies, representing about a third of the S&P 500's market cap, collectively lost $1.2 trillion shortly after trading began. Notably, looking at the group, we can see that the Magnificent 7 traded at an average valuation on 16 July that was 13.6% above the five-year average. The substantial market sell-off following these companies' earnings reports has intensified investor skepticism regarding the AI boom.

Is the underperformance of these tech giants' earnings reports really to blame? Why did Google and Microsoft, despite surpassing financial expectations, still see their share prices fall?

Did the Earnings Reports Trigger the Stock Decline?

The recent fluctuations in the stock market are driven by various factors, not just earnings reports. According to BlackRock's analysis, central bank policy expectations, equity rotation, and currency shifts are the main drivers. The global "Black Monday" intensified concerns, with Japan's rate hike and a weak U.S. jobs report prompting investors to move away from overvalued tech giants toward small-cap and cyclical stocks. Additionally, skepticism about AI profitability has grown, which has led to significant sell-offs among the "Magnificent 7." The slowing growth of these tech giants, combined with doubts about the returns on substantial AI investments, has eroded their market appeal.

Furthermore, macroeconomic factors have shifted investment preferences, including anticipated interest rate cuts and the fallout from the yen carry trade. The latest U.S. jobs report, showing a rise in the unemployment rate to a three-year high of 4.3%, triggered recession fears, as indicated by the Sahm rule, which has already breached its critical threshold. Despite significant capital expenditures in AI, with companies like Meta and Microsoft reporting growth in related areas, investors are increasingly questioning whether these investments will deliver the expected returns. This growing uncertainty has led to a marked decline in their stock prices.

Magnificent 7s’ Q2 2024Financial Performance

Meta has exceeded expectations despite a surge in AI costs, achieving a net profit of $13.5 billion in Q2 2024, marking a remarkable year-on-year increase of approximately 73.1%. Sales also saw a notable increase, rising to $39.1 billion, a 22% growth compared to the same period last year. The company's advertising revenue, which accounts for 98% of its total income, is expected to reach between $38.5 billion and $41 billion in the third quarter.

Despite these positive figures, Meta's Reality Labs division, responsible for producing the Quest headsets and Ray-Ban Meta smart glasses, continues to operate at a loss, with a quarterly operating deficit of $4.5 billion. Additionally, Meta's investments in the AI sector have been increasing, leading the company to revise its minimum capital expenditure forecast for 2024 to at least $37 billion, with the upper estimate remaining at $40 billion. Capital expenditure for this quarter was $8.47 billion, reflecting a year-on-year increase of 33.4%.

On the AI front, Meta has introduced a new large language model, Llama 3.1, and plans to invest $10 billion in infrastructure to support its AI development. Following strong sales forecasts and improved profitability, Meta's shares surged 7% on the day of the earnings release, followed by a further 4.8% increase the next day. Over the past year, Meta's stock has risen by close to 50%, driven by the enhanced targeting capabilities provided by its AI technology.

Microsoft's recent financial report for the fourth quarter of fiscal year 2024 revealed impressive figures, with $64.7 billion in revenue and $22 billion in net income. The company experienced a 15% year-on-year revenue increase and a 10% growth in net income, largely attributed to significant advances in cloud services and gaming, particularly in the Azure and Xbox divisions. Microsoft achieved a record $109 billion in operating income for the fiscal year.

Despite Azure cloud services' overall 29% growth, it slightly missed the anticipated 30.6%, marking the first instance in nearly two years where it fell short of Wall Street's expectations (based on FactSet data). The deceleration in Microsoft's cloud business growth suggests that the time frame for AI returns may be longer than initially projected. While investor enthusiasm about AI contributed to a nearly 25% surge in Microsoft's stock over the past 12 months, the slower growth of Azure disappointed investors, causing Microsoft's stock to decline by 7% after the earnings report, mainly due to concerns about AI infrastructure spending.

Regarding AI investments, Microsoft's capital expenditure this quarter, which includes cash spending and financial leasing for equipment purchases, reached a substantial $19 billion, equivalent to the company's entire annual expenditure five years ago. This significant outlay is not surprising, as Microsoft and other major tech companies have publicly stated their commitment to substantial investments in generative AI since last year. The Chief Financial Officer highlighted that a significant portion of the capital expenditure will be earmarked for AI, particularly for the construction of data centers.

The recent earnings report from Apple revealed revenue of $85.78 billion, which marks a 5% year-on-year increase, surpassing expectations. Following this news, the stock saw a 2.8% increase on Friday, making it the only stock among the Magnificent 7 to experience gains for the week. The gross margin came in at 46.3%, slightly exceeding the anticipated 46.1%. While iPhone revenue reached an impressive $38.3 billion, it did show a 1% year-on-year decline. Notably, iPhone sales decreased only in Greater China, despite mainland China setting a new record for iPhone adoption.

Regarding the highly anticipated Apple AI, management has not disclosed specific details. The market's fascination with Apple AI is essentially tied to its distinctive AI strategy, including collaboration with OpenAI to develop an intelligent ecosystem that prioritises user convenience. During the developer conference, Apple revealed that its AI will exclusively operate on the iPhone 15 Pro and Pro Max, potentially driving an upgrade cycle and bolstering Apple's revenue. However, the latest updates suggest that Apple AI will not come pre-installed on the iPhone 16, leaving the impact of AI on Apple's revenue to be determined.

Last Thursday, Amazon released its earnings report, revealing revenue of $147.98 billion, representing a 10.1% year-on-year increase but falling short of market expectations. AWS Cloud revenue reached $26.3 billion, slightly above expectations, with a 19% year-on-year growth. However, Amazon's cloud services growth was relatively subdued compared to Microsoft's Cloud revenue growth rates (29%) and Google's (28.8%). Operating income reached $14.67 billion, exceeding expectations, with an operating margin of 9.9%, above the expected 9.2%. Following the earnings report, Amazon's share price dropped by 7% the next day.

The CFO noted that North American revenue growth was also below the company's internal expectations, as North American consumers increasingly opt for cheaper goods, reflecting a broader trend of consumer downgrading. Regarding AI expenditure, the company reported capital expenditures of $30.5 billion in the first half of the year, with expectations of continued increases in the second half to support AWS infrastructure and AI services.

Nvidia is scheduled to release its quarterly earnings report in late August. Given the company's history of surpassing expectations in its last four earnings reports, analysts may have high expectations this time. Despite recent adjustments, Nvidia's stock has surged by 142.3% year-to-date, making it one of the key drivers of the S&P 500 index.

According to a report by The Information, Nvidia informed Microsoft that the production schedule for its "Blackwell" AI chips would be delayed by at least three months due to a design flaw.

Currently, Nvidia's AI chip is the H100, which is highly popular and in short supply. The B200 chip is set to succeed the H100. Nvidia anticipates that chip production will ramp up in the "second half" of the year. Additionally, Nvidia is conducting a new round of testing with chip manufacturer Taiwan Semiconductor Manufacturing Company (TSMC), with Microsoft, Google, and Meta having already placed orders worth "hundreds of billions of dollars" for the B100 chips.

In the short term, while Nvidia has exceeded expectations in its last four quarterly earnings reports, the margin by which it has done so has been narrowing. The market may react strongly to the new AI chip B200 design flaw. In the long term, Nvidia maintains a durable competitive advantage in the GPU and AI accelerator market due to the market dominance of its CUDA platform. However, several major tech companies have recently publicly announced that they are using non-Nvidia chips.For instance, Apple's models are trained using Google's TPUs, whereas Microsoft utilises AMD's chips.

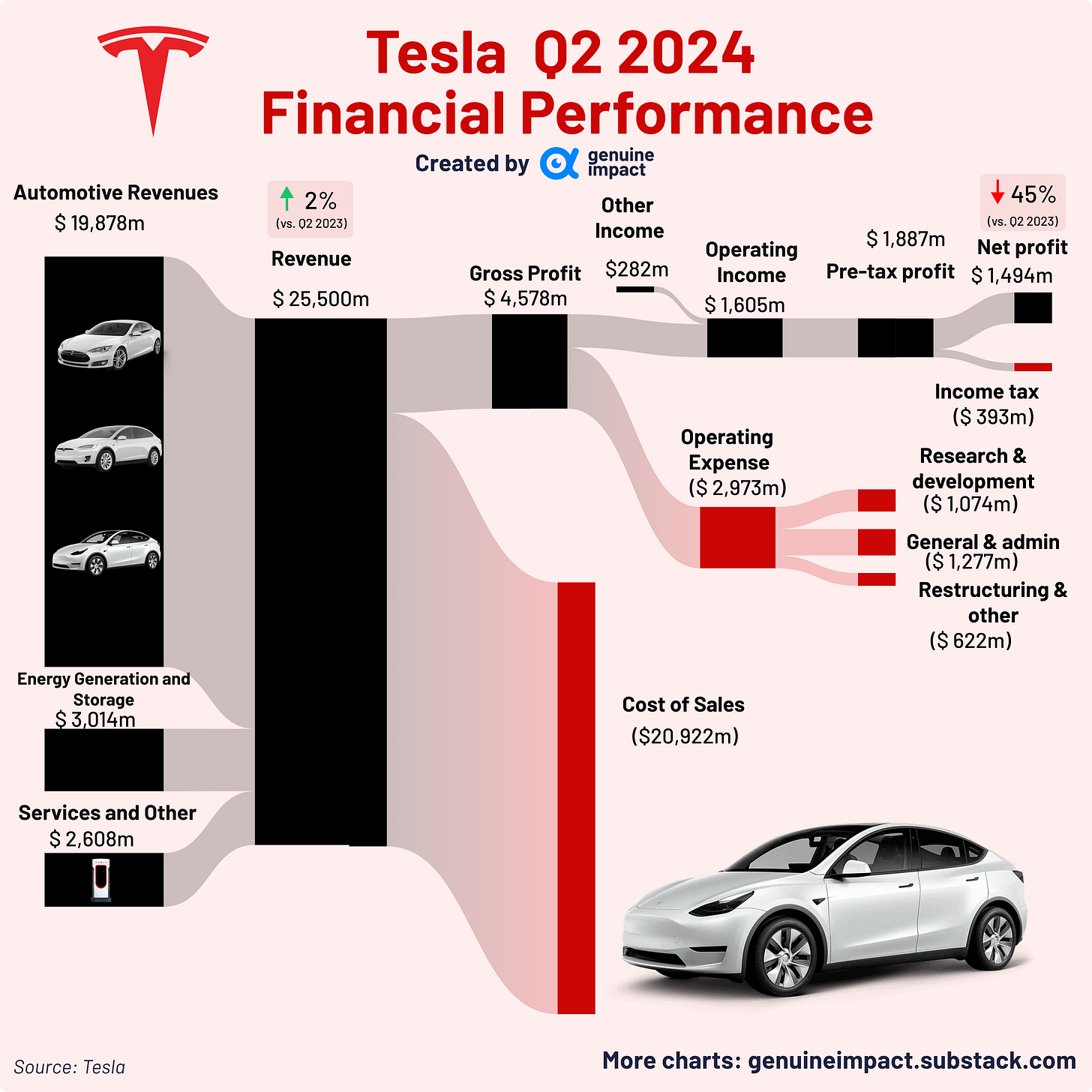

Tesla posted a record revenue of $25.5 billion this quarter, signaling a return to growth following a 9% year-on-year decline in the first quarter, and achieving a growth rate of 2.3% in the second quarter. The gross profit also rebounded to $4.6 billion, up from $3.7 billion in the previous quarter, representing a year-on-year increase of approximately 1%. This positive trend is reflected in the company's gross margin, which increased by 1% year-on-year after a significant 18% decline in the first quarter.

The operating income for the quarter was $1.61 billion, with a net profit of $1.49 billion, reflecting a 45% year-on-year decline. Tesla's earnings were considerably impacted by price cuts on its core models, resulting in a significant profit reduction. As a result, Tesla's share price dropped by 12% on the following trading day. However, the company's cash flow showed improvement, with operating cash flow totaling $3.6 billion, out of which $2.27 billion was allocated to capital expenditures, including investments in AI and autonomous driving R&D.

Last week, Google released its earnings report, revealing a 14% year-on-year revenue increase to $84.7 billion, marking its highest-ever earnings per share. However, the stock price fell 8% the next day, as investors expressed concerns about Google's significant investment in AI. In the last quarter, capital expenditure surged to $13.2 billion, a 91% year-on-year increase, with the majority of investments directed toward technology infrastructure such as servers, network equipment, and data center construction to support AI demand.

Google's allocation of operating cash flow to capital expenditures has risen from 24% to 49%, with nearly half of its business revenue now being channeled into building AI data centers. Analysts from BCA Research noted that despite the revenue growth and highest earnings per share, the market remains wary, with uncertainty about the extent to which the 14% sales growth can be attributed to AI.

Is the AI Boom Sustainable?

Tech giants are investing heavily in AI data centers, with projections suggesting that total spending on AI data centers could reach $1.4 trillion between 2024 and 2027. Nvidia remains the primary supplier of AI chips, but the entire supply chain also includes Taiwanese server manufacturers and American power companies. Despite the growing demand, there are risks of overexpansion if supply bottlenecks or a weakening of demand occur.

AI investments are heavily focused on chip manufacturing and equipment production, especially in the server manufacturing sector. However, the supply chain's heavy reliance on Nvidia and potential bottlenecks in power supply pose significant threats. If demand weakens, the AI supply chain could face substantial risks. Reports from Goldman Sachs and Sequoia Capital have raised concerns about the effectiveness of current generative AI tools. If AI profitability proves difficult to achieve, tech giants may reduce capital expenditures, leading to disruptions across the supply chain.

Tech Stock Valuations and the Long-Term Promise of AI Investments

Despite the recent decline in tech stocks, their valuations remain relatively high. Data shows that the expected earnings for S&P 500 companies in the second quarter are up 9.8% year-on-year, reaching 20.9%. Tesla's forward price-to-earnings ratio is 82.8, while Nvidia's is 34.9. Excluding the Magnificent 7, other companies are expected to see earnings growth of 5.9%. These high valuations could make smaller companies more attractive.

AI will undoubtedly yield significant returns in the long term, but these returns will take time to materialise. For example, after years of developing large models, Apple has gradually found a suitable path for AI development. Similarly, AI's impact will extend to the supply chain and areas such as cybersecurity. The recent tech stock correction could be a healthy signal, providing an opportunity for rational investment choices and the pursuit of long-term gains.

Created by Yiding & Shawn

Ping Pong