⚡ The New Energy Emergency: Trump's Nuclear Bet

Critical Minerals Emergency

June 4, 2025: Trump issued a memorandum formally declaring a national emergency to invoke Defense Production Act (DPA) powers. This move enables him to bypass congressional funding caps and accelerate U.S. production of critical minerals—such as rare earths, graphite, and gallium—to reduce reliance on China.

This declaration coincides with projections of record-breaking electricity demand in the U.S. for 2025 and 2026. According to the U.S. Energy Information Administration, power usage will rise to 4,205 billion kWh in 2025, fuelled by AI data centres, crypto mining, and residential consumption. Goldman Sachs projects AI-related growth alone could boost global data centre electricity use by 165%.

The implications are as geopolitical as they are technological: the U.S. remains the world’s top nuclear operator, but China is rapidly closing the gap. For Trump, nuclear power is no longer just clean energy—it’s a pillar of national defence.

What Is Trump Doing Now?

In March, Trump signed an executive order doubling down on U.S. mineral independence. The order fast-tracks mining approvals on federal lands and expands the definition of "minerals" to include uranium, copper, potash, and gold. It also aims to break China's supply chain control, as China currently provides over half of the U.S.'s critical mineral imports.

At the same time, the Trump administration rescinded several Biden-era policies, removing solar panels, heat pumps, and other green technologies from DPA coverage. Analysts interpret this as a signal that Trump’s broader use of the DPA may prioritise economic nationalism and energy security over decarbonisation.

☢ The Nuclear Investment Thesis: Old Energy, New Growth

Nuclear power had the highest capacity factor among energy sources in the United States, at over 92% in 2024. Geothermal energy-generating facilities followed and had the largest capacity factor among renewable sources at 65%. In contrast, natural gas and petroleum ranked the lowest.

Cost of nuclear power in the United States

Despite the large capacity factor, nuclear power plants had one of the highest levelised costs of electricity in the country. The operating expenses of nuclear utilities in the U.S. are nearly 50% lower than those of fossil fuel power plants, indicating higher capital expenditure for these facilities.

As the AI boom, geopolitical instability, and U.S. industrial strategy are revitalising nuclear energy, three stocks are on our radar:

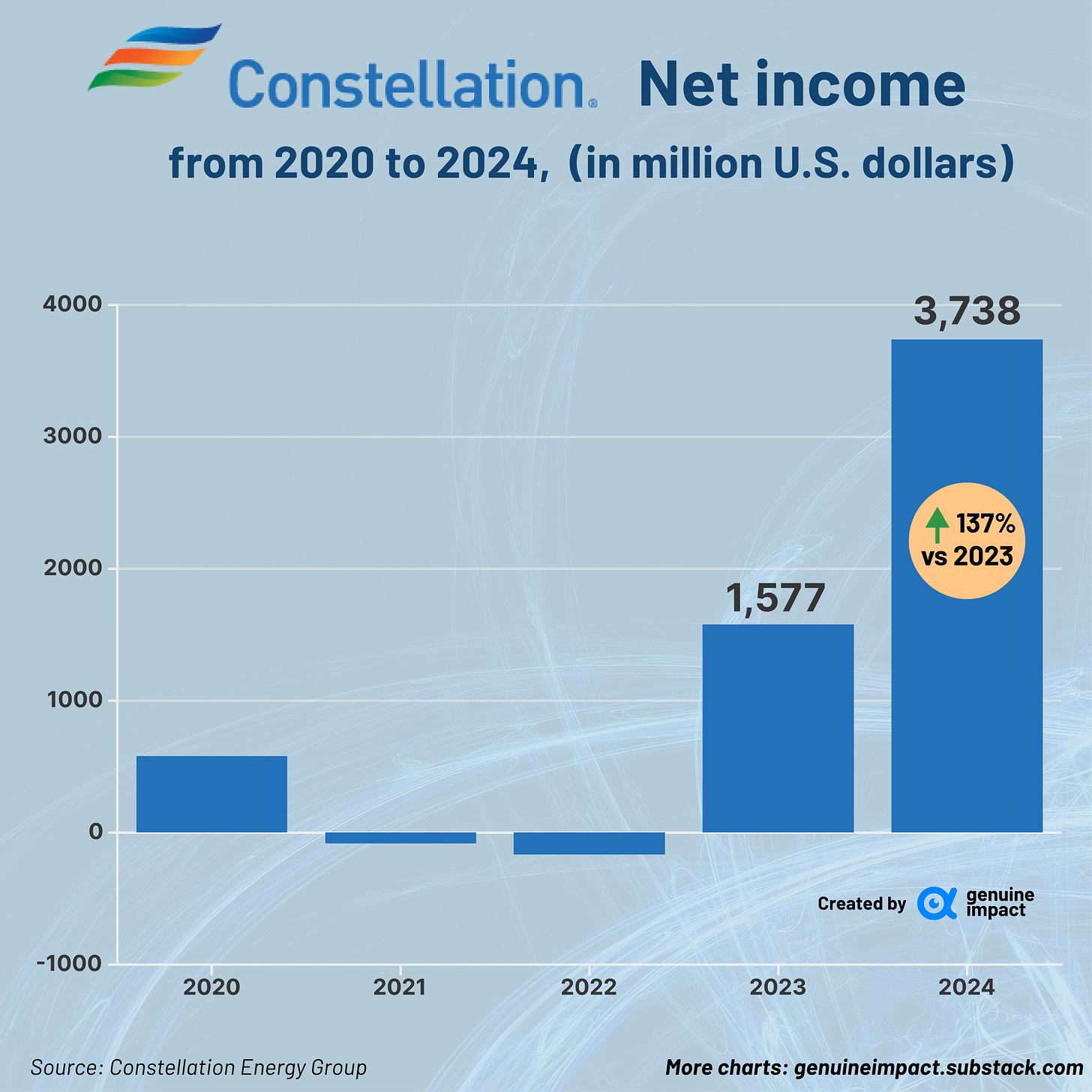

Constellation Energy (CEG)

A blue-chip player with strong performance: Q1 adjusted earnings of $2.14/share (up from $1.82 YoY).

Calpine acquisition strengthens its generation base.

Q1 highlights: 94.1% nuclear uptime; 99.2% gas dispatch match rate.

Positioned as a power supplier to AI-driven workloads, CEG emphasises grid reliability and clean baseload energy.

Oklo (OKLO)

A high-growth Small Modular Reactor (SMR) startup. Shares have surged around 550% YoY.

Regulatory milestones: progressing toward COLA (a license that companies must obtain from a regulatory authority) application and fuel manufacturing licenses.

Selected for the U.S. Department of Defense's advanced microreactor programme.

Financials: 162% revenue growth, $9.77B market cap, 78% gross margin.

Engie (ENGI.PA)

Diversified European energy giant with a strong nuclear and renewables portfolio.

Poised to benefit from EU-wide focus on decarbonisation and energy independence.

Notably, Engie finalised a landmark nuclear agreement in Belgium, transferring €12 billion worth of nuclear waste storage liabilities—reducing financial overhang and boosting investor confidence.

☣ Proliferation Watch: Who Goes Nuclear Next?

As U.S. security guarantees erode, countries like Japan, South Korea, Poland, Saudi Arabia, and Turkey may reconsider nuclear weapons. The UK is doubling down: 22–23% of its defence budget now goes to nuclear deterrence, and it is researching non-U.S. missile delivery options.

Nuclear energy is no longer a legacy sector—it's a frontline solution to national security, energy transition, and digital infrastructure. We’ll continue tracking this intersection for long-term opportunities.

🕵️ Black Swan Risks to Monitor

U.S. institutional decay and governance erosion.

North Korean escalation.

Failure of U.S.-Iran diplomacy triggering regional war.

Stay with us as we navigate the nuclear renaissance and its implications for global markets and security.

Stay tuned for our Friday premium edition where we’ll break down portfolio moves, sector rotations, and our next trade idea — all for just $6/month (or £5/month).

Join 36,000+ savvy investors who believe: “Your money deserves better.”

Keep in touch with Genuine Impact!

Instagram | X/Twitter | LinkedIn

Created by Arya