The U.S. exports nearly half of the world’s weapons?

ICYMI: What’s keeping UK electricity bills stubbornly high?

As global tensions escalate, the arms trade is booming—and the world’s biggest powers are cashing in. From presidential phone calls to record-breaking defence budgets, the geopolitics of war are once again shaping markets.

Last week, a much-anticipated phone call between Donald Trump and Vladimir Putin was billed as a potential turning point in Europe’s bloodiest war since 1945. Both sides hailed the conversation as “historic”, but the results were far from groundbreaking. Putin agreed to pause strikes on Ukraine’s energy grid and to begin vague “technical negotiations” on the Black Sea. Meanwhile, the Kremlin demanded that the U.S. cut military support to Ukraine and that NATO retreat from Eastern Europe. Trump, on the other hand, framed the call as a step toward ending the war—without mentioning any of Putin’s conditions.

As American commitment wavers, Europe is rearming at speed. Germany has moved to loosen constitutional limits on defence spending. Britain and France are leading talks on a potential “reassurance force” for Ukraine. Even Poland and the Baltic states have announced plans to withdraw from the Ottawa Convention banning anti-personnel landmines.

🔫 Made in the USA: The World’s Biggest Weapons Dealer

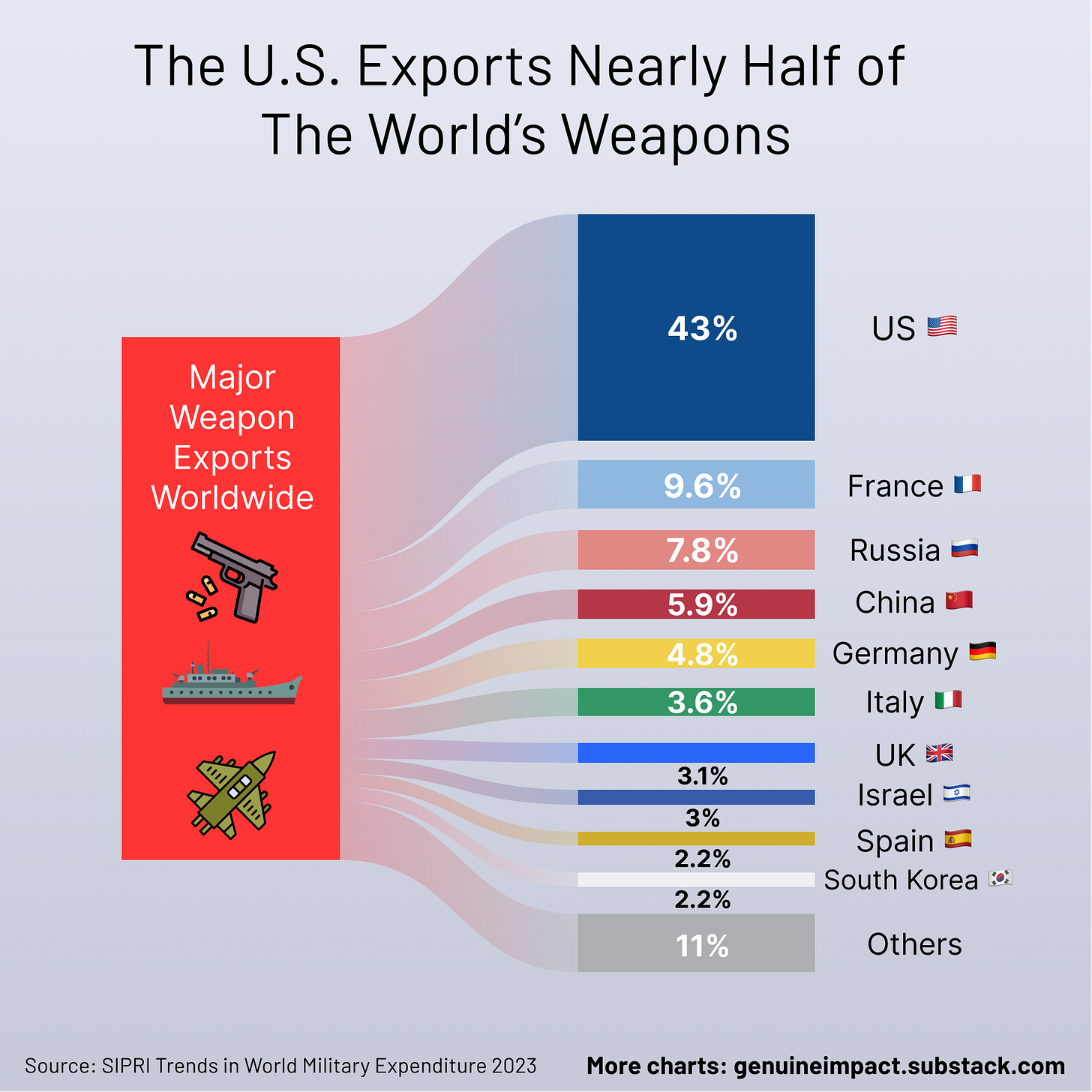

The arms race isn’t just political—it’s commercial. Between 2020 and 2024, the United States accounted for over 40% of all international arms exports, solidifying its role as the world’s top weapons supplier. France and Russia followed, contributing 9.6% and 7.8%, respectively. Together, these three nations were responsible for 60% of global arms exports during this period.

On the import side, Ukraine is the world’s largest buyer of major weapons, accounting for nearly 9% of all imports—a direct consequence of the Russian invasion. India, Qatar, and Saudi Arabia rounded out the top four.

Military Spending: Who’s Leading and Why

When it comes to defence spending as a share of GDP, Ukraine stands in a league of its own—dedicating a staggering 37% of its economy to military efforts in 2023. By comparison, countries like Algeria and Saudi Arabia followed at a distant second and third. Within NATO, member states are urged to spend at least 2% of GDP on defence—a benchmark that many are now racing to meet amid escalating global tensions.

🌍 The Bigger Picture

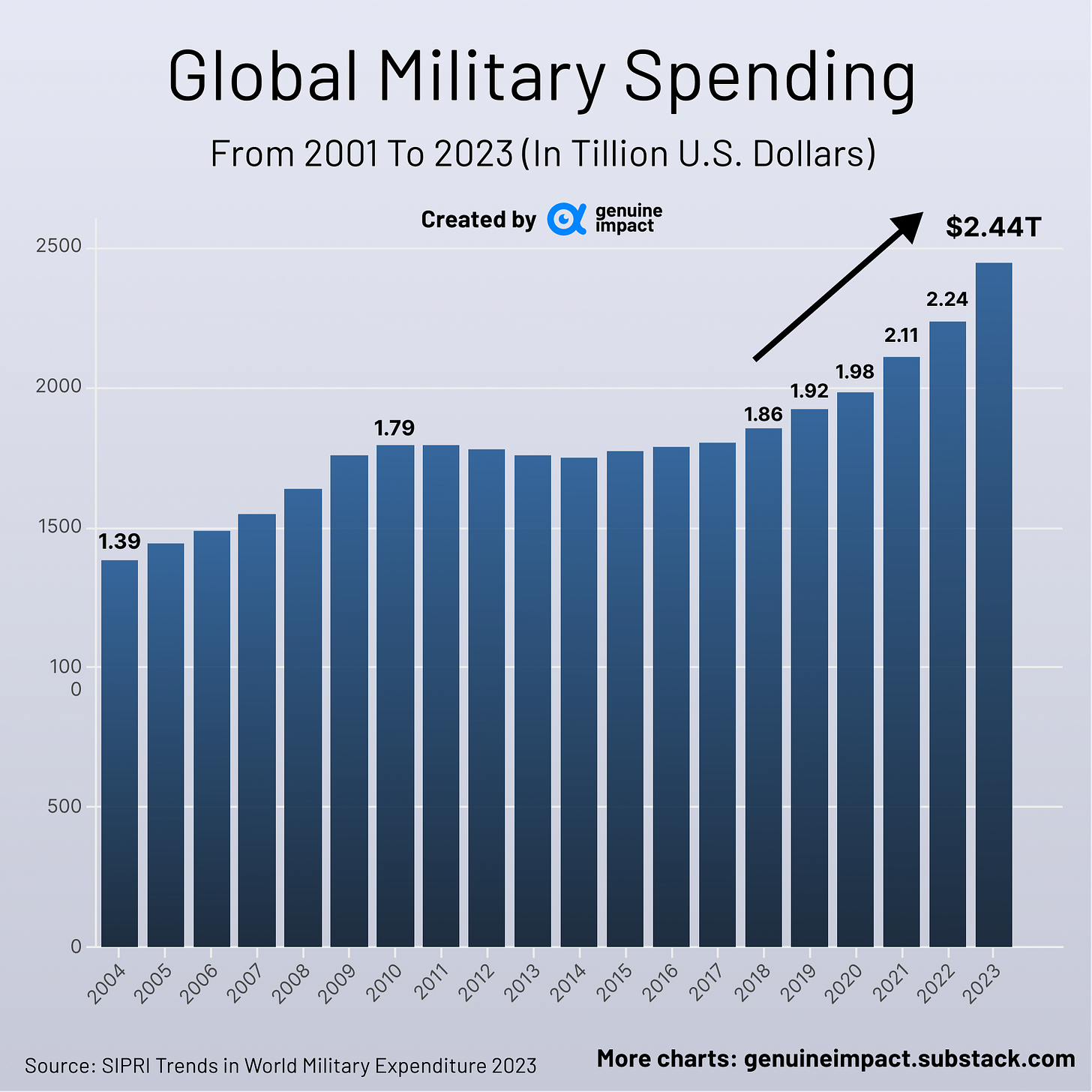

Global military spending has been on a steady upward trajectory over the past decade—not always due to active conflict, but driven by geopolitical uncertainty, regional power shifts, and deteriorating trust between nations. In 2023 alone, global defence expenditure hit a record $2.44 trillion, underscoring the scale of strategic realignment.

📈 What does this mean for investors?

Rising tensions have sent European defence stocks surging, and investor interest is picking up fast. We usually share the latest trends in our Monday Insider Newsletter, including a first look at our Insider Portfolio—a curated list of high-conviction investment plays.

📊 Curious about which stocks made the cut? Or how we’re positioning for ongoing geopolitical risk?

👉 Don’t miss this Friday’s premium edition, where we’ll break down our stock picks, portfolio allocations, and trade ideas — all for just $6/month (or £5/month).

Join 36,000+ savvy investors who believe: “Your money deserves better.”

In Case You Missed It 📬

🔍UK’s Clean Energy Push Fails to Cut Soaring Electricity Bills

Labour came to power with five flagship pledges, ranging from revitalising the economy to tackling violent crime. Progress has been patchy at best. However, on one front—turning the UK into a clean energy superpower—there’s finally a win. In 2024, for the first time ever, renewables (mainly wind and solar) overtook fossil fuels as the UK’s largest electricity source.

The government has championed this shift not just for its environmental impact but as a way to lower energy costs. With wind and solar significantly cheaper to produce than gas-fired electricity, Energy Secretary Ed Miliband reassured households that renewables would lead to "cheaper, more secure power."

🔌 So, have energy bills actually come down?

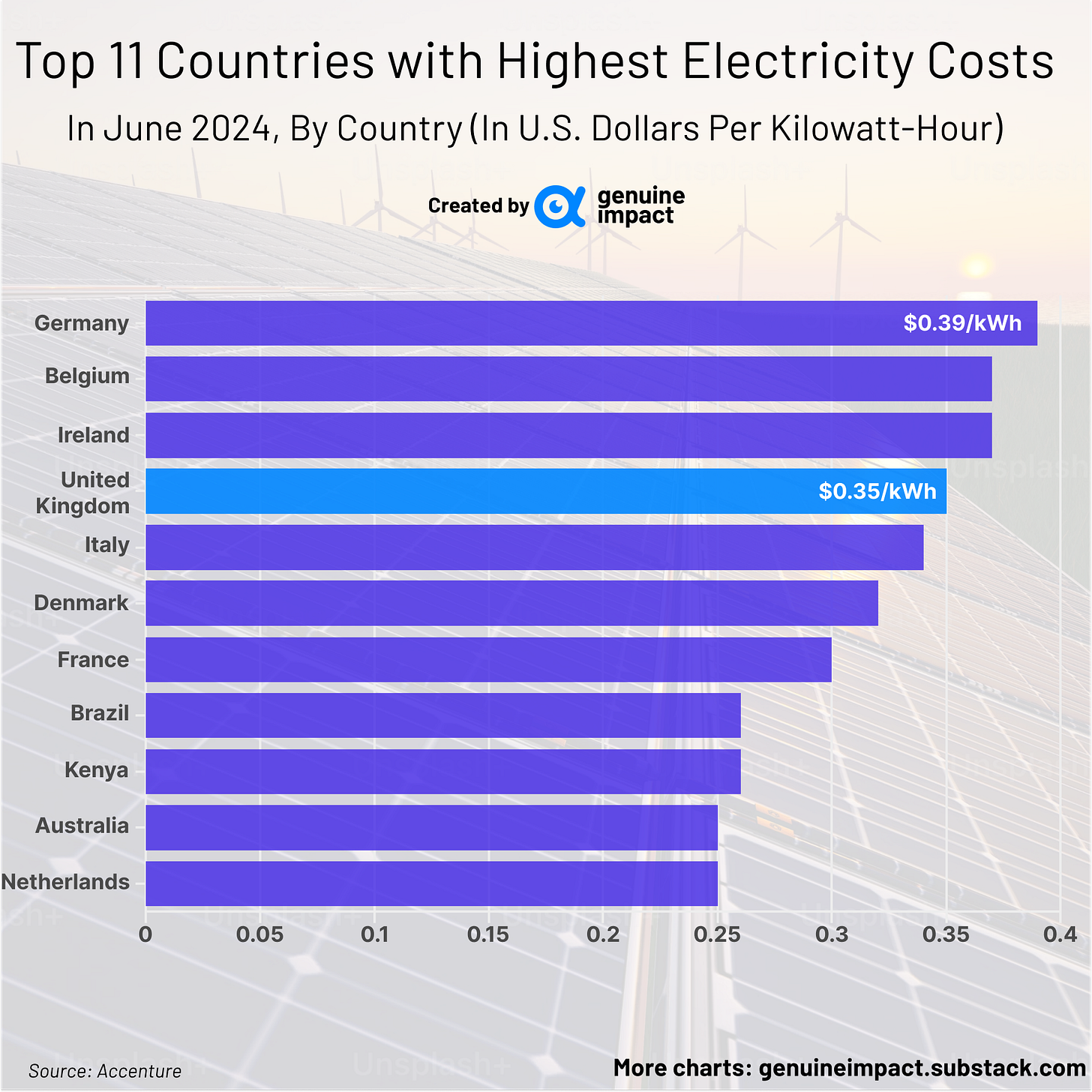

Not quite. Despite an expanding renewables sector, UK electricity prices remain among the highest in the world. According to recent data, British households pay $0.35 per kWh, more than consumers in France ($0.30), Denmark ($0.32), and even Italy ($0.34). Germany, topping the list, stands at $0.39 per kWh.

What’s keeping UK bills stubbornly high? Gas still dictates the price of electricity. Even with more wind and solar farms online, these sources aren’t available 24/7—turbines don’t spin without wind, and solar panels don’t work at night. As a result, the UK remains heavily reliant on gas-fired power stations, which set market prices high enough to ensure their continued operation.

📉 Why Clean Energy Isn’t Cutting Costs (Yet)

Gas still determines electricity prices 98% of the time in the UK, compared to just 58% in Europe.

High energy costs are squeezing businesses—UK steelmakers alone pay £37M more per year than their German rivals.

Households are feeling the pinch, with electricity now eating up 5% of disposable income, up from 3.5% in 2021.

💡 What Needs to Change?

The UK must reduce its dependence on gas by accelerating investment in wind, solar, and energy storage. The government has fast-tracked approvals for new solar farms and onshore wind projects, but large-scale expansions will take time.

The bigger challenge? Energy storage remains a major weak spot. Current battery technology can’t yet store enough surplus power to balance fluctuations in renewable output. Meanwhile, the UK lacks large-scale pumped storage facilities—a key solution used in other countries with mountainous landscapes to store excess energy.

Unless gas prices fall or energy storage technology catches up, UK electricity bills are unlikely to ease anytime soon—posing a major challenge for economic recovery and household budgets alike.

Keep in touch with Genuine Impact!

Instagram | X/Twitter | LinkedIn

Created by Arya