What a Trump Presidency Might Mean for Your Money

Following a recent rally attack, Trump's approval ratings have surged, leading to increased speculation about his possible return to the White House. This article examines the potential implications of Trump's policies on inflation, bond yields, the dollar, and the U.S. stock market, providing insight into what a Trump presidency might mean for your money.

Trump Victory Trades to Swell After Shooting

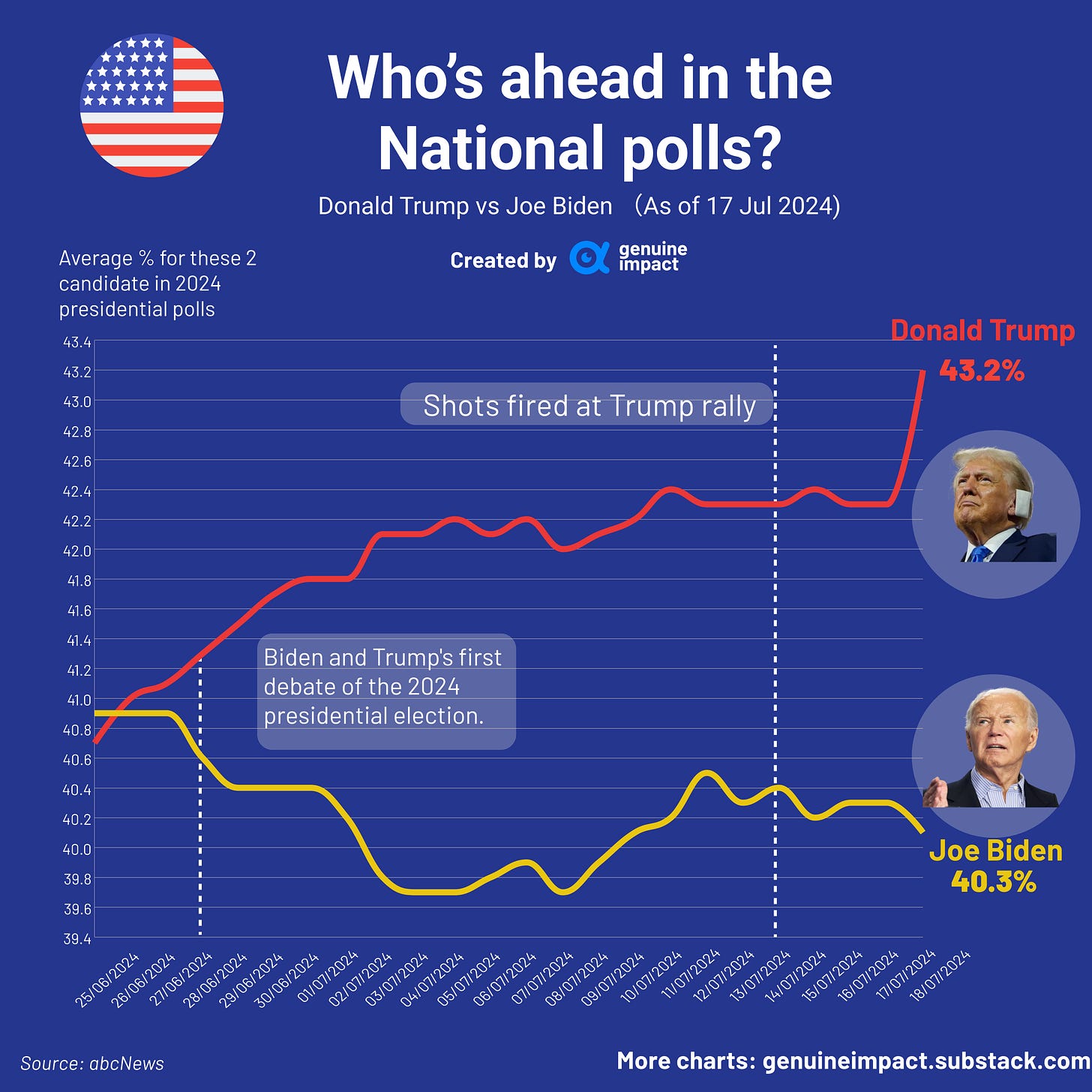

One shot later, Trump's approval rating reached its peak. This bullet did not kill Trump, but it might have killed Biden's political career. Saturday's shooting at former U.S. President Donald Trump's election rally has raised his odds of winning back the White House. The national poll indicated that Donald Trump is leading Joe Biden by almost 3 percentage points ahead of November's election after the rally attack.

Maximize your productivity

Revolutionize your workflow with Notion - the all-in-one workspace for teams. From project management to note-taking, database organization to task tracking, Notion adapts to your unique workflow, fostering collaboration and efficiency. Experience the power of seamless integration, dynamic layouts, and customizable tools that elevate your productivity. Try Notion today and transform the way you work.

*This is sponsored advertising content.

Economic Impact of Trump’s policies

Trump's Economic Plans: From Immigration to Taxes

Trump has said he would seek to extend and expand his 2017 tax cuts, severely restrict illegal immigration while deporting millions of foreign-born residents, impose tariffs on all U.S. imports (especially from China), and roll back many of Biden’s initiatives to transition the nation to clean energy.

Investors are starting to evaluate the risks that could arise from Donald Trump winning November's US presidential election.

Inflation

Trump's policies, such as high tariffs and immigration restrictions, are expected to bring higher inflation. He has suggested imposing high tariffs on U.S. imports, especially 60% or higher on all Chinese goods, which will push inflation higher. High tariffs are typically seen as inflationary because they raise the cost of imported goods, enabling domestic producers to increase their prices, leaving consumers to pay more.

Moreover, severely constraining immigration, as Trump is proposing, would dampen economic growth as companies rely on fewer workers to make products and services. It also would reignite inflation as wages climb, forcing the Fed to raise interest rates again or wait longer before cutting rates. The Moody’s analysis estimated inflation would rise from the current 3.3% to 3.6% next year under a Trump administration, well above the 2.4% forecast under Biden.

What a Trump Presidency Might Mean for Your Money

Bond yield

Trump’s policies, like tax cuts and higher tariffs, will ignite inflation and would herald a spike in long-term U.S. Treasury yields. In the short term, rate-cut trades are more dominant, and the possibility of short-term Treasury yields rising is relatively low.

We need to focus on whether a new round of fiscal stimulus would prompt the Fed to take a more gradual approach to rate cuts next year…or even reverse course and begin hiking again if the central bank fears another inflationary spike.

Dollar💲

The "Trump Trade" refers to the market movements and investor behaviors that emerge in response to the economic policies and political actions associated with a Donald Trump presidency. If Trump gets elected, there might be a "Trump trade" that boosts the dollar in the short term, similar to what happened in November 2016. However, the future direction of the dollar will depend on the impact of his policies.

In 2016, Trump's unexpected victory caused significant asset price volatility. In the 1-2 months following the election, the market bet on the "Trump trade," which involved expectations of loose fiscal policy and tight trade policy. This led to higher U.S. inflation expectations and a widening gap between the U.S. and other economies. As a result, from November to December 2016, we saw high U.S. Treasury yields, a strong dollar, and strong U.S. stocks, with the Dow Jones leading the "Trump trade." This year, considering Trump's policies might also focus more on boosting economic growth and inflation, the dollar may stay stronger for longer.

On the other hand, Trump's proposed "weak dollar" policy aims to boost U.S. exports. It is important to monitor how future policies might affect the dollar.

US Stock Market📈

In recent days, under the influence of the "rate cut trade" and the "Trump trade," U.S. stocks have rebounded with volatility. Although a Trump win might lead to the dollar staying stronger for longer and bring potential headwinds for stock prices, many institutions believe the stock market would perform just fine, perhaps even incredibly well, because an AI hype bubble would outweigh all of those macro concerns.

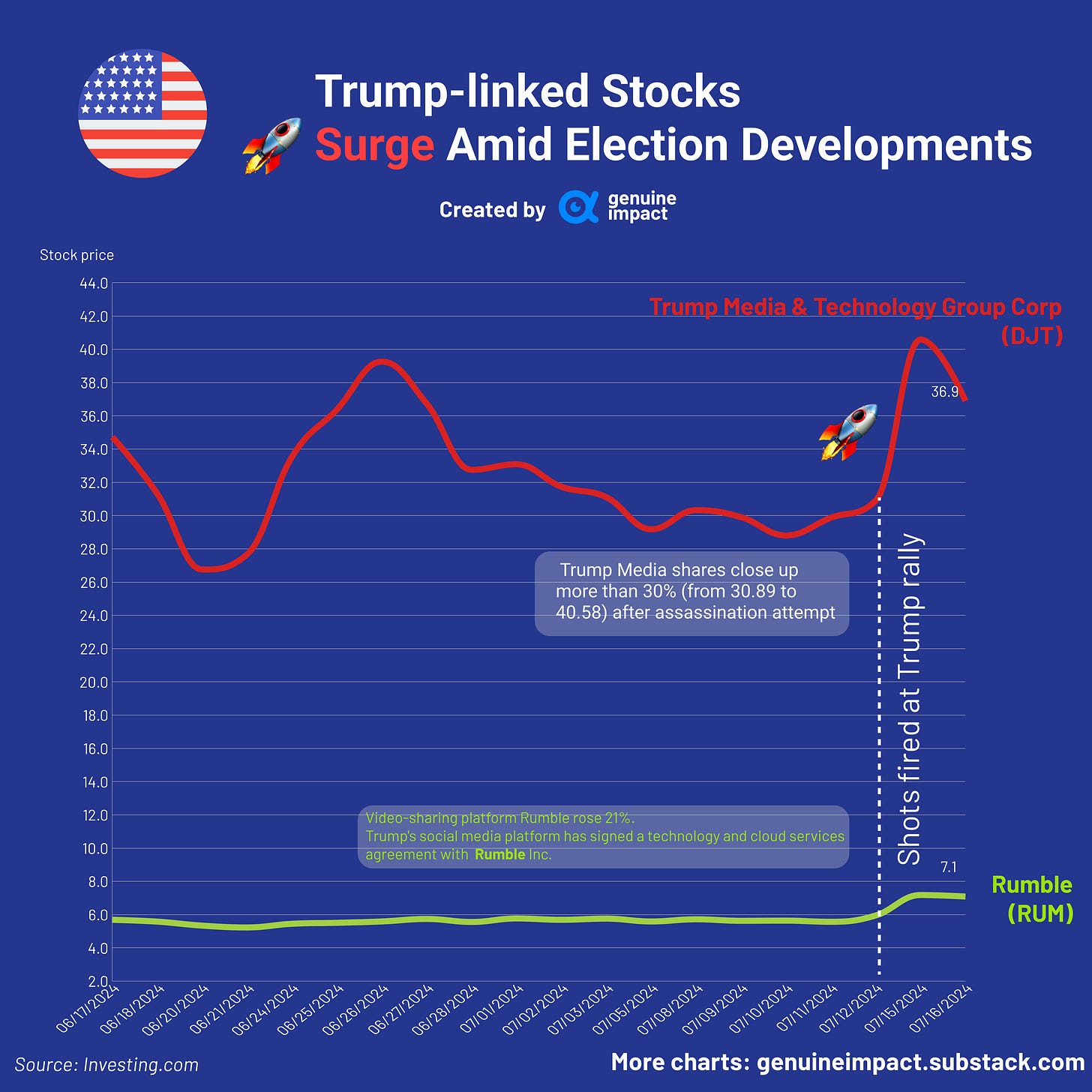

Some big beneficiaries of a Trump 2.0 presidency are expected to be healthcare, banks, cryptocurrency, and oil stocks. Recently, shares of companies linked to Trump soared in trading. On the first day of trading after the assassination attempt, Trump Media & Technology Group was one of the most actively traded stocks and rose as much as 31%, and video-sharing platform Rumble rose 21%.

Trump has emerged as a major supporter of Bitcoin in recent months, which is beneficial to cryptocurrency. After the Trump rally attack, crypto stocks also leapt as Bitcoin rose 8% to a two-week high, with exchange Coinbase Global up 11.39% and miners Marathon Digital Holdings and Riot Platforms rising more than 18% and 17% each.

As the election draws near, the potential economic impacts of a Trump presidency are becoming clearer. While high tariffs and strict immigration policies may drive inflation, there could be opportunities for growth in specific sectors such as healthcare, banking, cryptocurrency, and oil. Investors should stay informed and prepare for the possible market dynamics that a Trump win might bring.

Created by Wendy