Welcome to the latest edition of our newsletter! Today we update the portfolios of three very popular investors: Warren Buffett, Cathie Wood, and Bill Ackman. How similar is your portfolio to their’s?

Warren Buffett (Berkshire Hathaway)

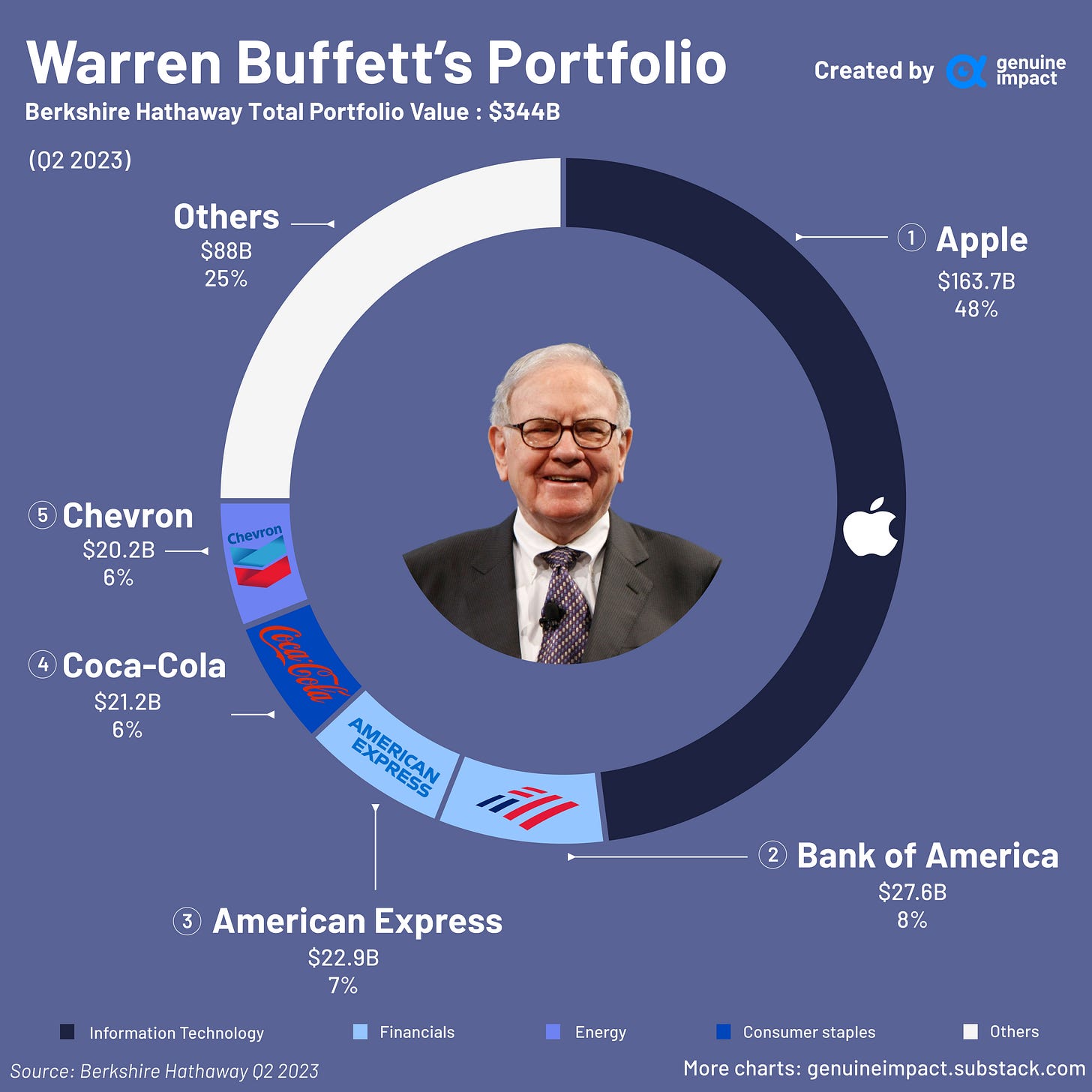

Almost half of Warren Buffett’s portfolio is made up of Apple at 48%, and valued at $163.7B. His other significant investments are in financial companies (Bank of America, American Express), consumer staples (Coca Cola), and energy (Chevron). His top five investments account for approximately 75% of his total portfolio, that is valued at $344B as of Q2 2023. This is an almost 15% increase since last year where it was $300B.

Maximize your productivity

Revolutionize your workflow with Notion - the all-in-one workspace for teams. From project management to note-taking, database organization to task tracking, Notion adapts to your unique workflow, fostering collaboration and efficiency. Experience the power of seamless integration, dynamic layouts, and customizable tools that elevate your productivity. Try Notion today and transform the way you work.

*This is sponsored advertising content.

Cathie Wood (ARK Innovation)

Now we move on to Cathie Wood and her flagship ETF: ARK Invest. This ETF has had many ups and downs and as of October 2023, it is valued at $6.6B. The ARK Innovation ETF focuses on companies that are deemed ‘innovators’ and ‘disruptors’, however the sectors are fairly diverse including: health care, information technology, consumer discretionary, and financials.

Bill Ackman (Pershing Square Capital Management)

Unlike the diversity in sectors present in the ARK Innovation ETF, Bill Ackman invests primarily in consumer discretionary companies. In fact, the top four holdings are all in this sector: Chipotle ($2B), Restaurant Brands International ($1.8B), Lowe’s ($1.7B), Hilton ($1.4B). These make up almost 70% of the total portfolio!

Created by Amara