What happens when gold, US bond yields, and the US dollar rise together?

Gold has been on a tear recently, with multiple catalysts pushing prices close to historical highs.

⭐️In traditional pricing frameworks, gold possesses a triple nature as a currency, commodity, and financial asset, corresponding to its value as a currency, inflation hedge, and safe-haven asset, respectively. Therefore, it usually moves inversely with the US dollar and US bond yields. However, recently, this pricing rule seems to have "failed," as gold, interest rates, and the US dollar have all risen simultaneously. Is this phenomenon the result of new and more important pricing factors, or is it simply caused by short-term emotional excitement?

Gold prices are at an all-time high

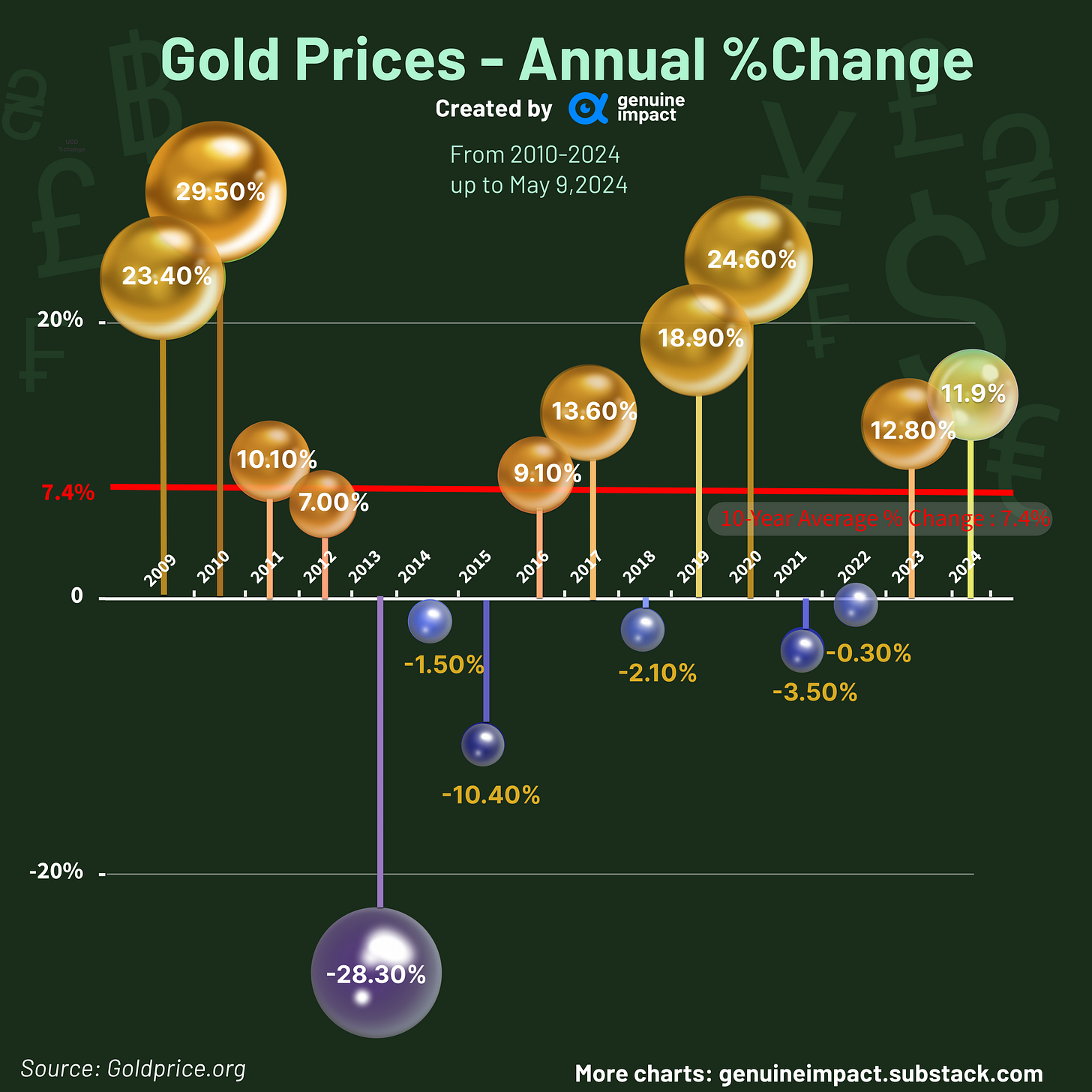

Since the beginning of the year, gold has surged, with its annual percentage change exceeding 16%, reaching a new all-time high above $2200. It has become one of the most prominent assets globally, second only to Bitcoin, which saw a 52.3% increase.

Simultaneously, the 10-year US Treasury yields are also steadily increasing. Typically, higher bond yields diminish the appeal of gold as they increase the opportunity cost of holding investments in the latter. However, this has not been the case in recent weeks.

Historically, gold has had a negative correlation with the U.S. dollar, but both are currently seeing flight-to-quality (or flight-to-safe) rise in price.

.

Maximize your productivity

Revolutionize your workflow with Notion - the all-in-one workspace for teams. From project management to note-taking, database organization to task tracking, Notion adapts to your unique workflow, fostering collaboration and efficiency. Experience the power of seamless integration, dynamic layouts, and customizable tools that elevate your productivity. Try Notion today and transform the way you work.

*This is sponsored advertising content.

The relationship between Gold, U.S. Bond Yields, U.S. Dollar

According to traditional pricing models, the price of gold has long had a close relationship with US bond yields and the US dollar: Lower US bond yields – which usually mean a weaker dollar – lead to higher gold prices, and vice versa. This scenario accounts for 43.8% of occurrences.

It's uncommon for gold prices to rise alongside US dollar & US bond yields historically.

Historically, what happens when gold, US bond yields, and the US dollar rise together?

During periods of sudden geopolitical tensions and heightened global economic uncertainty, both the US dollar and gold will go strong due to flight-to-safety sentiment.

While gold is traditionally considered a hedge against inflation, high US bond yields to tame rising prices can increase the opportunity cost of holding non-yielding bullion. However, when the majority of the risk requiring hedging originates from outside the United States and the US economy itself is not under significant downward pressure, all three – US Treasury yields, the US dollar, and gold – may rise simultaneously.

Historical events such as the 1998 Asian financial crisis, the 2005 outbreak of avian influenza and French riots, the 2008 global financial crisis, the 2014 Ukraine crisis, and recent geopolitical tensions in Ukraine and the Middle East have led to a sharp increase in global risk aversion, resulting in simultaneous increases in US bond yields, the US dollar, and gold.

Where are gold prices going?

With volatility around 15%, predictions about gold's future price movements vary. Gold's value is influenced by a complex interplay of macroeconomic indicators, geopolitical developments, and investor sentiment.

Created by Wendy