🐤 Aging Countries on a Tightrope

Shifts in Age Demographics are shaping Global Markets

The Global Fertility Freefall

Hold onto your hats—global fertility is dropping faster than the latest smartphone prices during a Black Friday sale! In 2023, the Total Fertility Rate (TFR) has tumbled to a mere 2.25 live births per woman, veering away from historical peaks like a savvy shopper dodging overpriced deals. According to the latest buzz from the United Nations, this isn’t just a quirky statistic; it’s a dramatic marker of changing times. Across the globe, nations are now scratching their heads over how to address their aging populations and make sense of shrinking workforces.

This stark decline in birth rates is part of a longer-term trend that has seen the average number of children per woman plummet from a peak of 5.31 in 1963 to today's figures. The drop became particularly pronounced after 2015, signaling a trend that might soon push individual countries’ TFRs below 2.1—the threshold necessary to maintain a stable population without significant reliance on immigration. This global average masks the variation across different countries, where those falling below this threshold increasingly depend on immigration to balance demographic shifts. Such a trend has profound implications for global economic stability and societal structures, as nations struggle to balance the needs of growing elderly populations with diminishing cohorts of new workers entering the workforce.

Population challenges are not unique to developed nations like Europe and Japan, which are familiar with aging demographics and low birth rates. Similarly, China, historically known as a population powerhouse, has recently come under the global spotlight with its own birth rate issues. This could be a major coup for some countries and a real concern for others, depending on its trade agreements.

As a major player in the global economy, China has leveraged its vast population to become a leader in manufacturing and exporting low-cost goods, significantly impacting international trade and market dynamics. We've previously explored related topics, such as its role in the semiconductor industry, its trade surplus, and the export dynamics of its burgeoning new energy vehicle sector.

However, the current population outlook appears less optimistic😢, especially when compared to nations like India.

India vs China: Heavyweight Population Match 🚨

Move over Mike Tyson vs Jake Paul, the real drama is the demographic face-off between historical heavyweight giants, China and India. They have the most people, but yet, are headed down two very different paths.

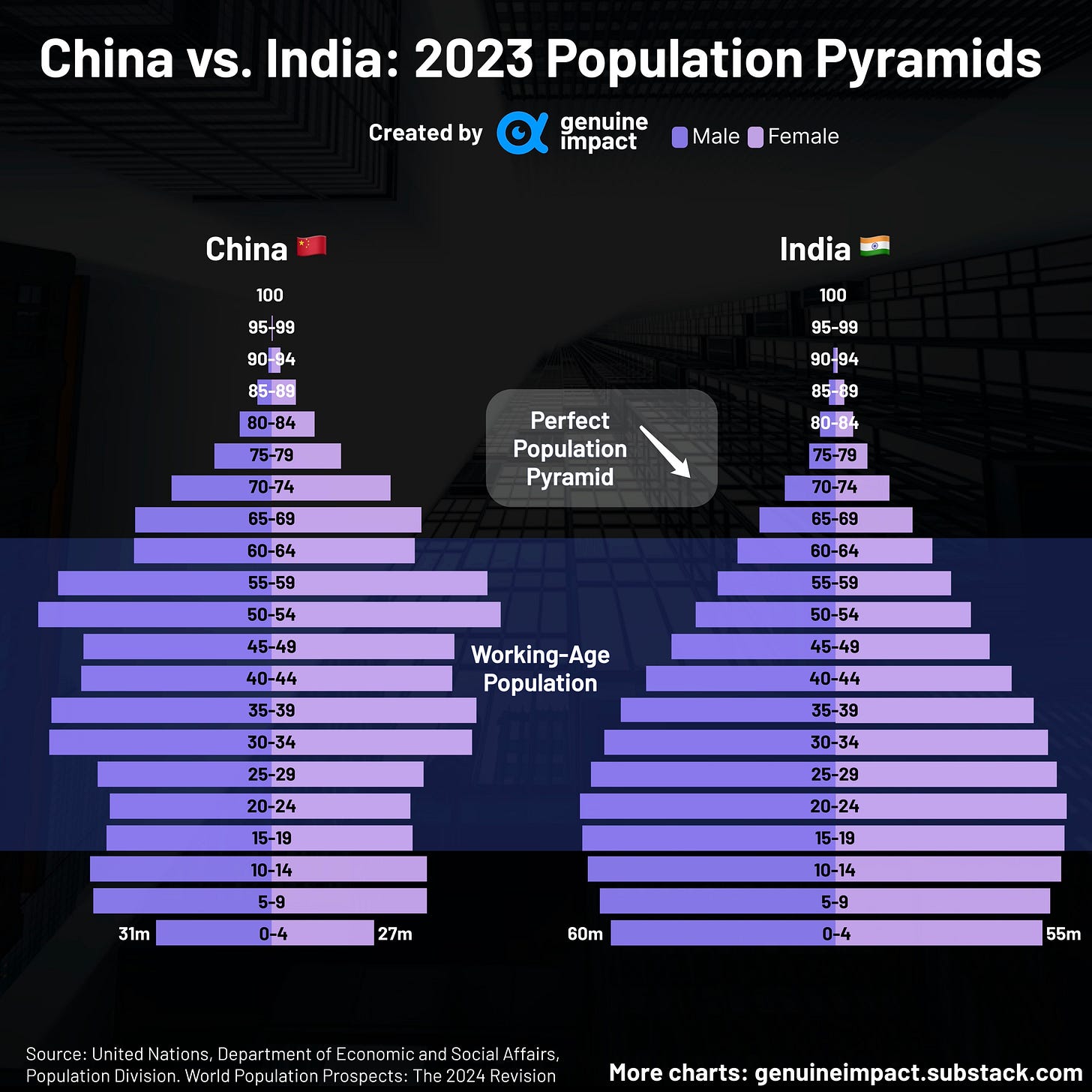

China’s youth numbers are dwindling, presenting a more lightweight figure with only 58 million toddlers (ages 0-4). In stark contrast, India's figure continues to be putting on the pounds with a booming 115 million tots, demonstrating a perfect population pyramid (characterized by a broad base of young people, indicates a healthy balance between age groups—ensuring a steady flow of new workers, taxpayers, and bearers of cultural heritage). It’s clear, when it comes to a match up, India looks to be winning that championship belt.

⚖️ Support Ratio Strain: The Balancing Act of 2065

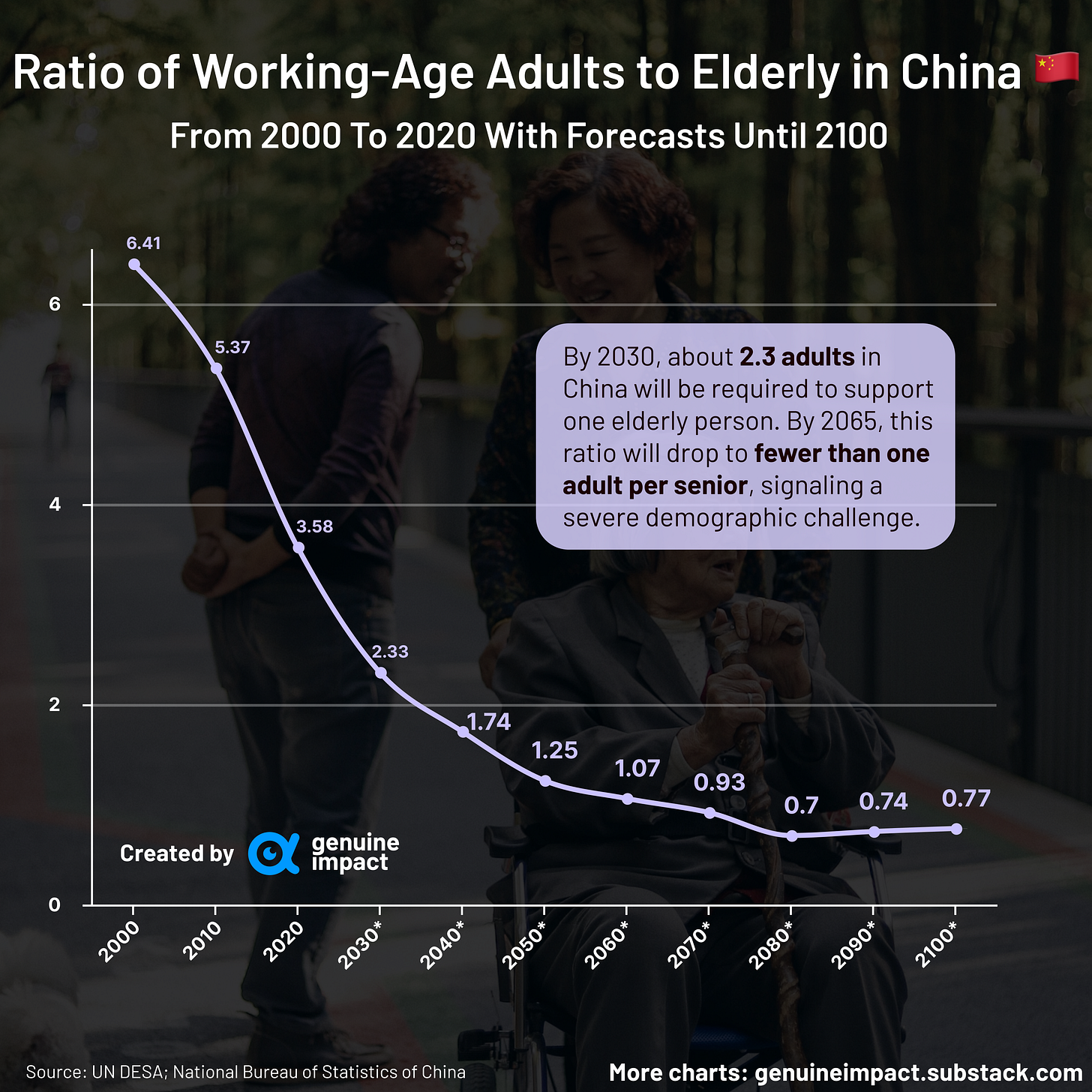

The generational tightrope in China could soon face a crowd control issue. Currently, the demographics show about 2.3 working-age adults to each senior. By 2065, there looks to be a dramatic decline, with the tempo set to less than one adult per elderly, which could disrupt China’s social and economic rhythm. This demographic imbalance could see China transition from the world’s production line to the front line of a new problem.

China's Workforce Woes

Given such severe population issues, it's no wonder the Chinese are again shocking the world with their frenzied work ethic! After delving into their demographic shifts, another major concern pops up like an unwelcome notification: 🚨 the intense workload shouldered by the nation's workforce. Reports from the National Bureau of Statistics reveal Chinese workers are clocking in an average of 48.6 hours per week—hinting at a growing labour strain. For comparison, in 2023, average weekly working hours stood at 36.4 hours in the UK and 34.4 hours in the U.S. 🥲, highlighting the particularly strenuous conditions faced by workers in China.

This recent increase in working hours, the most significant in over two decades, suggests more than just heightened job demands; it reflects substantial societal changes. The widely discussed "996" culture—working from 9 AM to 9 PM, six days a week without overtime pay—underscores this shift. While this intense schedule is often praised for its rigour, it also raises concerns about 'neijuan' or 'involution,' a phenomenon where increased effort does not necessarily yield better outcomes. As China's population continues to decline, the pressure to maintain economic productivity could lead to even more intensified work conditions. This could exacerbate the challenges of balancing work and family life, potentially further discouraging family formation among young workers.

A diminishing and stressed out workforce could spell trouble for China within the global market. Other countries may look to take advantage and knock China off its manufacturing and trade pedestal. Combined with threats from the U.S. President-Elect Donald Trump to impose high trade tariffs on China, it will be worth keeping an eye on the situation.

What does this mean for the world and my wallet?💰

The crunch in China’s workforce doesn’t just redraw its economic map; it sends shockwaves across the globe 🌏. As China pants to keep up its productivity with fewer, overtired hands, global supply chains that lean heavily on its outputs, the country might find themselves SOL.

This could spell erratic prices and shaky availability of goods, from gadgets to garments, that are typically stamped 'Made in China'. Grasping these shifts is vital as they ripple through our daily expenses and long-term financial blueprints — highlighting how intertwined our global economy is, and how demographic and labour changes even as far as China can tug on everyone’s purse strings.

🇨🇳 Moreover, China's government has historically implemented policies swiftly and decisively, a capability not unnoticed in global discussions. Many developed nations have faced challenges related to labour shortages, and it's compelling to ponder what measures China might take in response. Will China innovate in policy making to mitigate these demographic and labour market challenges? Stay tuned for our future articles, where we may delve deeper into the potential policy directions the Chinese government could adopt in response to these pressing issues!

In Case You Missed It 📬

💹 Facebook Dominates as Social Media's Billionaire Factory Skyrockets

As the digital landscape expands, so does the financial clout of its pioneers. Market leader Facebook not only was the first social network to surpass one billion registered accounts but now boasts approximately 2.9 billion monthly active users, maintaining its status as the most popular social network worldwide. In June 2023, Facebook continued to dominate app rankings alongside messaging giants WhatsApp and Telegram Messenger. Forbes highlights the significant wealth generated in this sector, with four of the top ten social media billionaires, including Facebook's founder Mark Zuckerberg, whose net worth reached an astounding USD $118 billion. In 2023, Meta's revenue nearly hit USD $135 billion, underscoring the vast economic impact of social networks. 🌐

Bank of America Sees Bright Days Ahead, with a Twist! 📈

Bank of America's 2025 economic forecast offers a generally optimistic view, with a few twists to keep things interesting. They’re calling for steady U.S. GDP growth at about 2.3%, driven by significant productivity gains. Yet, there’s a hitch—persistent inflation is likely to muddy the financial waters, prompting the Federal Reserve to tweak interest rates throughout the year.

The expected interest rate cuts, aiming to stabilise between 3.75% and 4%, are designed to keep inflation in check while fostering economic growth. This could perk up consumer spending and buoy business investments, giving various sectors a little economic espresso shot.

Furthermore, the forecast points out the influence of policy shifts, including tariffs and fiscal measures, which could notably impact both U.S. and global economies. Especially significant are potential trade policy changes with China, which might jostle global supply chains and affect everything from commodity prices to everyday consumer goods. These factors combined suggest a year where economic conditions could shift as often as the wind—so it might be wise to keep an umbrella handy!

Keep in touch with Genuine Impact!

Instagram | X/Twitter | LinkedIn

Created by Arya