Are traditional banks and digital banks colliding?

Santander Bank under plans to close nearly 1/4 of its high street branches?

ICYMI: Men in the US are paying more attention to their beauty ✨

The Evolution of Banking: Traditional Giants vs. Digital Disruptors

The UK’s banking landscape in 2024 continues to be shaped by both well-established financial institutions and rapidly growing digital challengers. While traditional banks still dominate in customer numbers and market value, online-only banks are redefining customer experience, satisfaction, and accessibility.

💸 Market Dominance and Financial Performance

Leading the charge among traditional banks, Barclays boasts the largest customer base, serving 48 million individuals worldwide, followed closely by HSBC with 41 million.

However, when it comes to market value, HSBC leads with a market capitalisation of $176.71 billion as of December 2024, solidifying its position as Europe’s largest bank. This financial strength is reflected in its impressive £65.9 billion in annual revenue, marking a strong rebound to pre-pandemic levels.

Yet, sheer size and financial dominance do not always translate to customer satisfaction. In a surprising trend, smaller online banks like Starling Bank, First Direct, and Monzo lead the way in customer contentment, proving that personalised digital services are increasingly valued by modern banking consumers.

📱 Digital Transformation and Customer Retention

As the shift toward digital banking accelerates, branch closures among the UK’s "Big Four" banks—Barclays, Lloyds, NatWest, and HSBC—have become widespread. Over 1,000 branches have shut down per bank between 2017 and 2024, leading to significant job losses but increased operational efficiency.

Santander has also joined this trend, announcing plans to close nearly a quarter of its high-street branches. Of its 444 UK branches, 95 will shut down, while 36 will reduce operating hours and 18 will transition to "counter-free" service. Only 290 Santander branches will continue offering full services. The bank cited a 61% decline in branch-based transactions since 2019, alongside a rise in online banking activity.

Despite this transition, some traditional banks have successfully retained and even expanded their customer base. Nationwide Building Society, for instance, emerged as the top performer in net current account gains in Q3 2024, attracting 22,000 new customers through the Current Account Switch Service.

🤳 The Rise of Digital-Only Banks

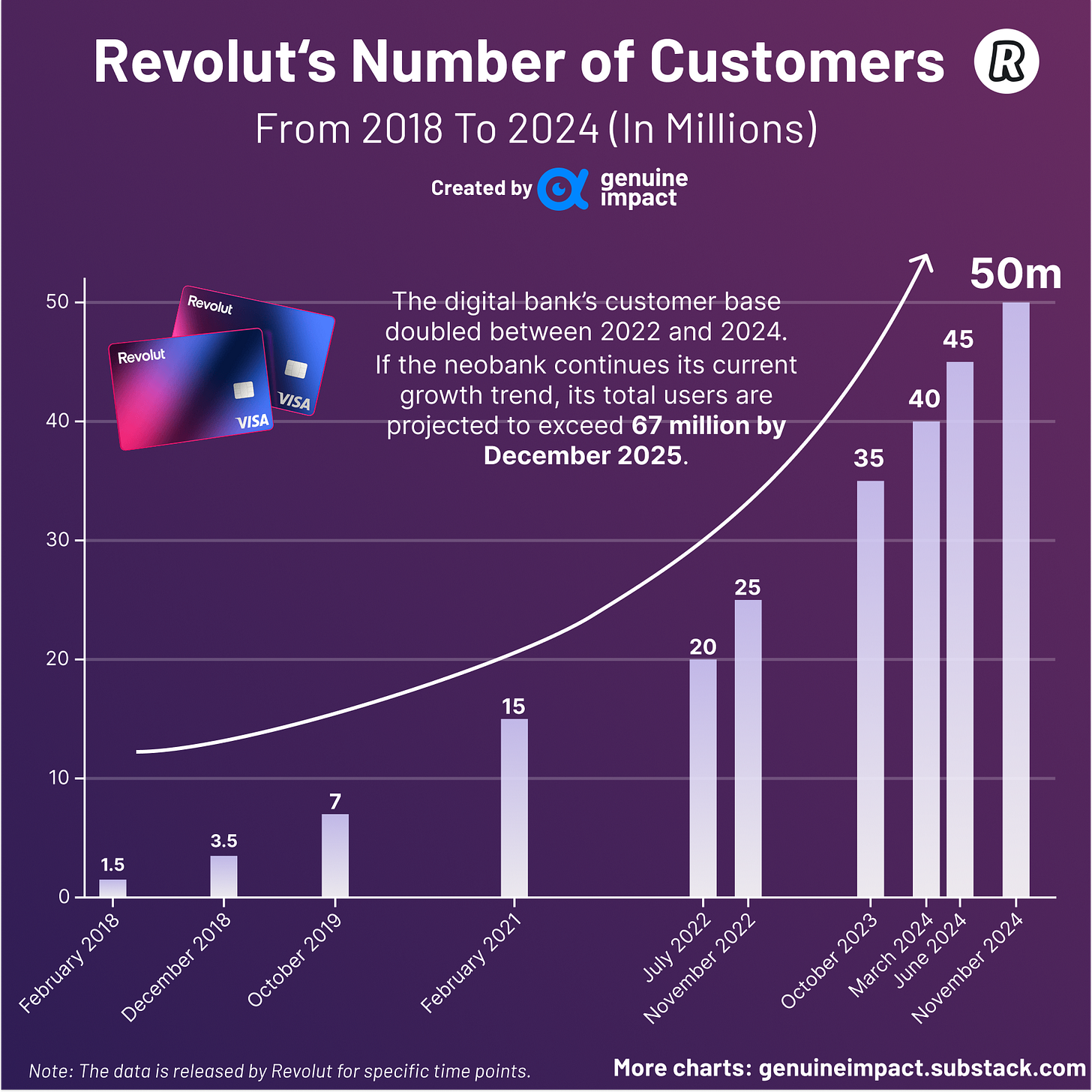

Neobanks like Revolut, Monzo, and Starling Bank are reshaping the financial sector by offering mobile-first banking with lower fees, higher interest rates, and cashback rewards—a stark contrast to the traditional high-cost structure of legacy banks. Revolut’s rapid expansion is particularly striking, with its customer base doubling between 2022 and 2024. It reported over 50 million global customers by November 2024—a milestone highlighting the rising demand for digital-first banking solutions. If this growth continues, Revolut is projected to surpass 67 million customers by December 2025.

The competition among digital banks is intense, and their ability to attract funding has been aggressive. As of January 2025, Monzo led all European digital banks with a total funding amount of $1.8 billion, closely followed by Revolut, N26, and Wise, each securing $1.7 billion in funding. Other players like Starling Bank and OakNorth have also raised over $1 billion, underscoring the financial industry's belief in the neobank model.

🤔 What’s Next for Banking?

Banking has come a long way—from queuing at a branch to managing everything with a few taps on your phone. So, where do you stand? Are you sticking with the old guard or embracing the fintech revolution?

Digital innovation and emerging technologies are reshaping jobs, incomes, and investment landscapes. This Friday, we turn our focus back to Nvidia and its highly anticipated GPU Technology Conference (GTC), exploring how AI chips, robotics, and autonomous driving will shape the future of business and investing.

📢 Get all the insights in our Friday premium edition for just $6/month (or £5/month)!

Join 36,000+ savvy investors who believe: "Your money deserves better."

In Case You Missed It 📬

Men in the US Are Paying More Attention to Their Beauty ✨

The beauty industry is undergoing a profound transformation, with men emerging as a rapidly growing consumer base. In 2024, the global beauty market reached around $650 billion, with the United States leading at over $100 billion in revenue. By 2030, total revenue is expected to rise consistently, with the Personal Care segment alone reaching $339.51 billion—the highest among all categories.

🔹Once considered a niche sector, the men’s beauty market is now expanding rapidly, with projections indicating steady growth across all segments. Shifting attitudes are fueling this evolution. Compared with the past five years:

56% of U.S. men now buy more skincare products.

Over 70% feel comfortable using skincare.

37% would even adjust their budget to prioritise beauty products.

Key trends driving this growth include a move toward inclusivity and digital influence. The industry has seen an 8% rise in gender-neutral skincare products, reflecting a broader acceptance of beauty as a universal concept. Meanwhile, younger consumers, especially Gen Z men, have driven a 20% surge in facial skincare purchases over the past two years. Social media is playing a crucial role in shaping buying behaviours, with influencers and trending hashtags guiding product choices.

Keep in touch with Genuine Impact!

Instagram | X/Twitter | LinkedIn

Created by Arya

You should check out Backbase. They’ve been making waves in digital banking for years! https://www.linkedin.com/company/backbase/