Christmas travel just around the corner, has global air travel bounced back?

Is Intel America’s last line of defence in the chip war?

How does inflation sneak into your daily life? 💸

✈️ Global Air Traffic and Airline Profit Trends: A Climb Back to the Skies

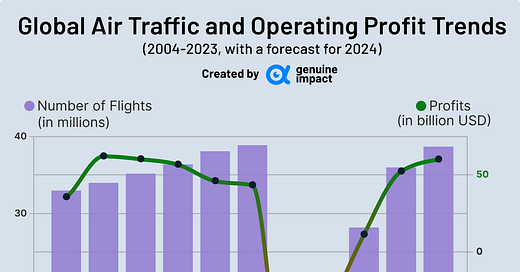

2020 was a nosedive for global air travel—passenger numbers plunged from 38.90 million in 2019 to just 18.30 million, resulting in a jaw-dropping USD $110.80 billion profit loss for airlines. Ouch!

Fast forward to 2024, and the industry is finally regaining altitude. Passenger numbers are expected to hit 38.70 million—a solid recovery, though still shy of the 2019 peak of 38.90 million. Meanwhile, airlines have not only weathered the storm but are thriving, with operating revenue projected to be USD $59.90 billion, soaring past the pre-pandemic USD $43.20 billion in 2019.

💼 World’s Most Expensive Business Travel Destinations 2024

And let’s not forget about business travel—the jet-setting elite are back in full force. In 2024, global expenditure by business tourists is set to reach USD $1.48 billion, comfortably surpassing the USD $1.43 billion spent in 2019. Looks like it’s not just the planes that are flying high again! 🚀

If you’re a business traveller, brace yourself—New York continues to reign as the priciest city for business tourism. In 2024, a business trip to the Big Apple set travellers back an average daily cost of USD $686.

And it’s not just New York—four of the top ten most expensive business travel cities this year are in the United States. Corporate budgets, take note!

✈️ Sky-High Competition: Which Airline Reigns Supreme?

In the fiercely competitive world of aviation, airlines are constantly battling for dominance. While finance experts lean heavily on metrics like brand value and revenue, passengers often judge airlines based on safety, affordability, and customer experience. So, how do the top contenders measure up in 2024?

According to Brand Directory, Delta leads the pack with a brand value of USD $10.77 billion, closely followed by American Airlines at USD $10.24 billion. United Airlines secures the third spot at USD $8.68 billion, while international favourites like Emirates Airlines and Qatar Airways are strong, emphasizing the aviation industry's global reach.

🗺️ If we split the list by regions:

North America dominates, with Delta, American Airlines, and United leading the charge.

Europe is represented by British Airways and Ryanair, which focus on premium and budget markets respectively.

Asia and the Middle East shine through Emirates, Qatar Airways, and China Southern Airlines, highlighting their influence on international travel routes.

But brand value is just one piece of the puzzle. Which airline would you crown the best? Is it all about luxury lounges, seamless check-ins, or unbeatable ticket prices? Let us know in the poll! 👇

Did you enjoy this week’s content? Please take just 2 minutes to tell us why you subscribe in our quick survey. 💬 We’d love to hear from you. Your feedback makes us better - so thank you!

Coming this Friday: We’ll dive deep into airline business models to uncover how these companies are making (and losing) money. Stay tuned! 💼

In Case You Missed It 📬

🛠️ Why the US Must Save Intel—Before It’s Too Late

Intel, once the crown jewel of the semiconductor world, is facing fierce competition and declining performance. In 2023, its revenue plunged 14% year-over-year, with its margin rate nosediving from a healthy 31% in 2001 to a razor-thin 3% today. The company, once a powerhouse, now teeters on the edge.

Meanwhile, semiconductors—the lifeblood of modern technology—power everything from your TikTok binge sessions to top-tier military defence systems. With global supply chains stretched thin and tensions with China escalating, the US simply cannot afford to rely on overseas giants like TSMC or Samsung. That’s where Intel comes in: a critical player in safeguarding national security and economic stability.

But this isn’t just about waving the American flag. Backed by the CHIPS Act, billions of dollars are being funnelled into revitalising domestic chip production. The goal? Keep cutting-edge innovation and high-tech jobs firmly on US soil. Losing Intel wouldn’t just be a corporate blow—it would hand over America’s tech leadership to a volatile geopolitical landscape, with Taiwan at its centre.

📊 Inflation Watch—US vs. UK Edition

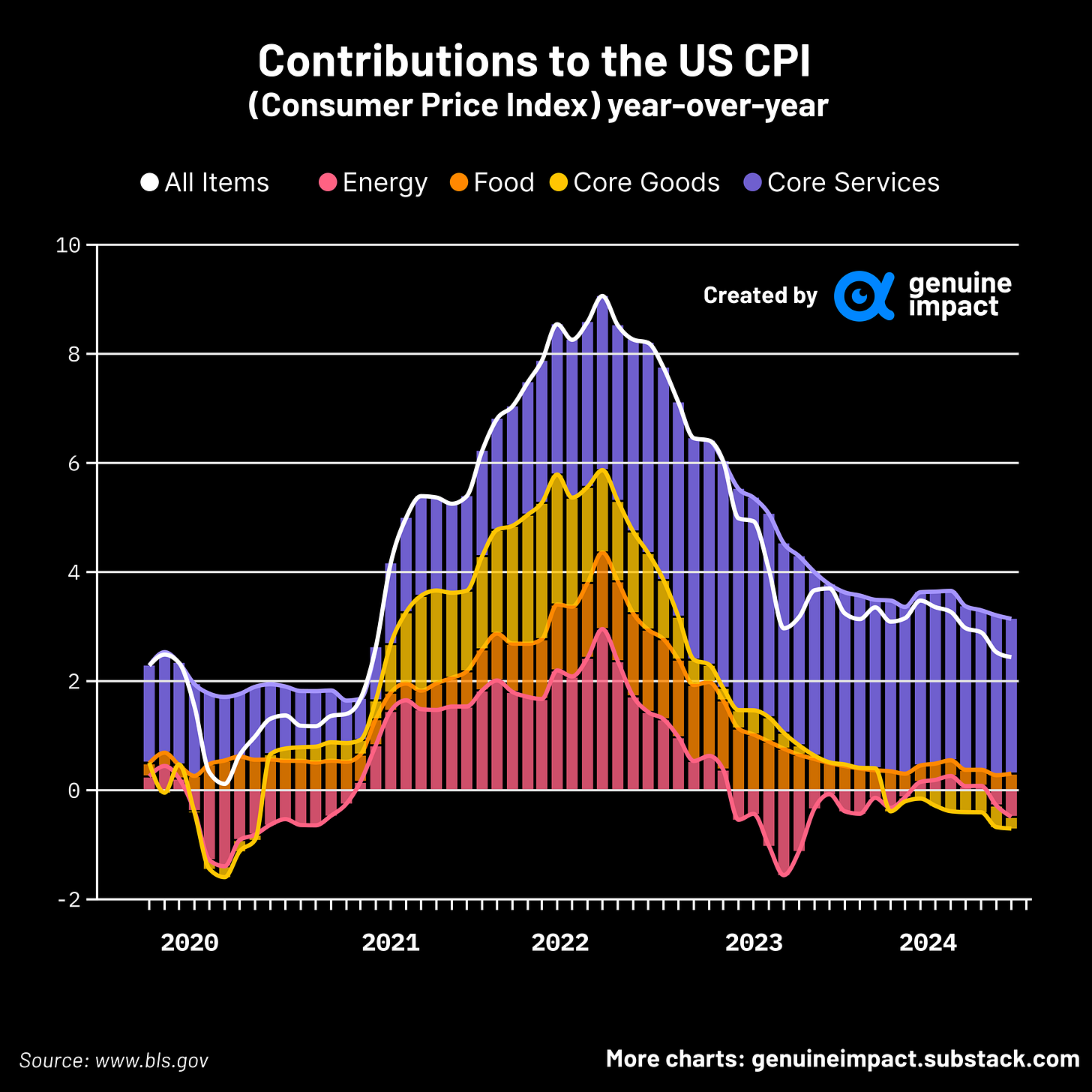

The latest inflation data is out, and it’s painting a fascinating picture across the pond. 🇺🇸 In the US, October’s Consumer Price Index (CPI) climbed to 2.6% year-over-year, slightly up from September’s 2.4%. Meanwhile, 🇬🇧 the UK saw its CPI cool to 1.7% in September, down from 2.2% in August.

Why should you care? Because inflation affects everything—from your grocery bill to your mortgage rate. Higher inflation erodes your purchasing power, while lower inflation signals cooling economies, which could impact jobs and wages. Whether you're saving, spending, or investing, keeping an eye on inflation helps you stay ahead of the curve. After all, your wallet feels every percentage point. 💸

Keep in touch with Genuine Impact!

Instagram | X/Twitter | LinkedIn

Created by Arya